Consolidation has enabled broadcast companies to lower costs through automation and economies of scale.

Key takeaways

But growth through consolidation is hitting a wall.

Meanwhile, revenue sources have shifted substantially over the last 15 years.

Following multiple waves of consolidation over the last 25 years, future growth in local TV broadcasting revenue will rely on quality content and cutting-edge technology.

The U.S. Federal Communications Commission, which regulates broadcasting, has gradually loosened TV station ownership rules since 1996. That has allowed for a higher concentration of ownership in designated market areas across the United States, says Matthew Goldstein, senior manager of audit services at RSM, who specializes in the broadcast TV industry. That consolidation has accelerated over the last five years.

Consolidation has enabled broadcast companies to lower costs through automation and realization of efficiencies from economies of scale.

“Using today’s technology, TV stations can be managed remotely,” Goldstein says. “Overhead and support services, including master control room operations, can be centralized, which reduces costs on a per-station basis.” Consolidation has also meant companies could raise their ad rates, because they now reach more viewers, giving them greater negotiating power with major TV networks and cable companies.

But growth through consolidation is hitting a wall. “I expect consolidation amongst the largest players to slow because of the current FCC limitations in place,” says Goldstein. “The total percent of U.S. households a single company is allowed to broadcast to is 39%. Some of the majors are now approaching that limit.”

New revenue approaches

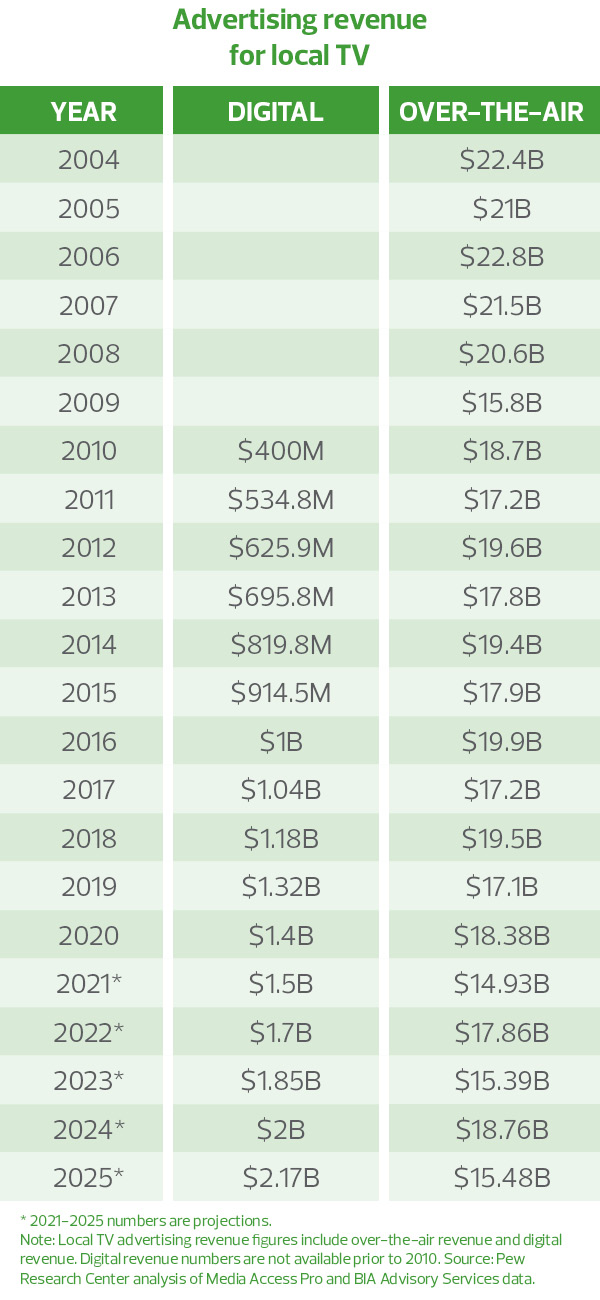

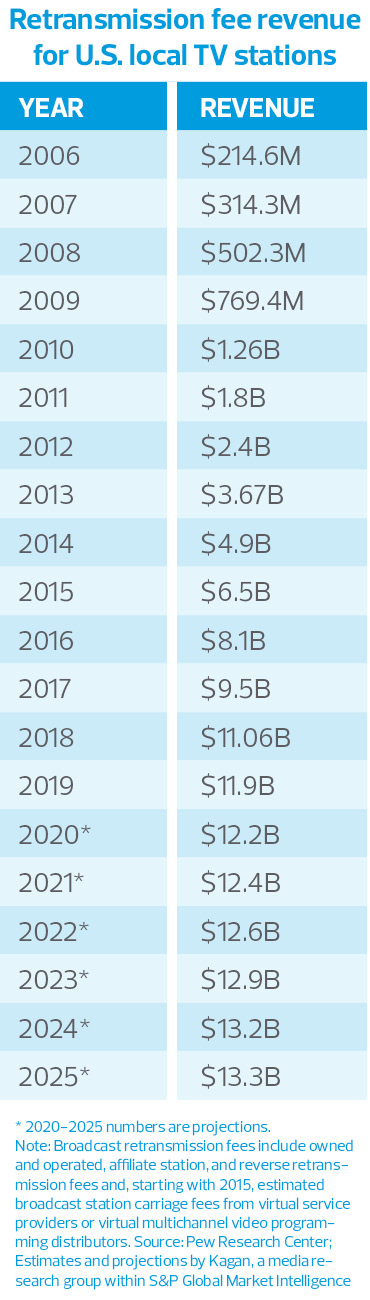

Meanwhile, revenue sources have shifted substantially over the last 15 years as stations began charging cable and satellite services licensing fees to retransmit local news broadcasts. Those fees have grown from $214.6 million in 2006 to a projected $12.6 billion this year.

At the same time, traditional ad revenues have fallen from $22.8 billion in 2006 to a projected $17.8 billion today as more and more people turn to other sources of news, including the internet and social media. And as more and more people cut the cord and drop their cable subscriptions, growth in retransmission revenue is slowing.

“Although consolidation has been a major factor in this industry, driven by the desire to increase revenues and decrease redundant costs, the industry’s future lies in its ability to compete with social media and streaming,” says Goldstein. That means investing in quality content, innovating using new technologies, and embracing newer methods of distribution, such as digital and over-the-top media, which uses the internet to carry broadcast streams, explains Goldstein.

Broadcasters are already developing their own content, including operating production studios and investing in digital and production companies, he says.

In terms of technology, a new protocol approved by the international nonprofit Advanced Television Systems Committee could enable new revenue streams for broadcasters. ATSC 3.0, also known as NextGen TV, comprises a raft of new technologies to improve the television viewing experience. It produces higher audio and video quality, improves compression efficiency, enables robust reception on mobile devices, and includes capabilities for interactivity, such as data casting, as well as personalization.

Essentially, the new protocol will enable broadcasters to go hyperlocal and collect data just as websites and apps do today. Broadcast stations in at least 40 markets are already transmitting using the new protocol.

So far, digital advertising makes up only 7% of total TV broadcasting ad revenue, according to Pew Research Center. Presumably, this new standard could help grow that.

“There are lots of things broadcasters can do with this new protocol to enhance their offerings,” says Goldstein. “ATSC 3.0 not only offers a more interactive experience for the viewer, but will enable advertisers to target different ads to different demographics in a market.”