Significant amounts of money have flooded the EV and battery space over the last 18 to 24 months.

Key takeaways

Leadership teams should examine how to factor the current fiscal environment and inflation into their R&D investment plans.

Domestic investments in battery plants will be crucial for companies to gain more autonomy from foreign-sourced batteries.

Auto suppliers should ensure alignment with OEMs’ growing commitment to electric vehicles.

RSM US LLP sponsors the Original Equipment Suppliers Association’s Automotive Supplier Barometer, a quarterly survey of the top executives of OESA’s regular member companies. The survey provides insight into the commercial issues and business environment the industry faces. Each quarter’s survey focuses on a different topic, from planning to production. The following article offers Q1 2022 insights on electric vehicles and research and development.

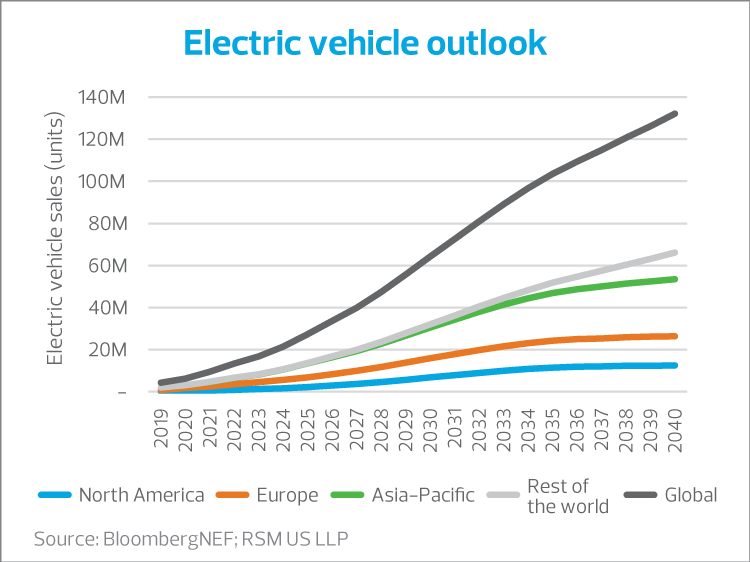

Original equipment manufacturers are accelerating their investment in electric vehicles just as the supply of critical inputs such as rare earth metals are coming under pressure. To succeed in this environment, auto suppliers are having to make high-risk strategic decisions to determine which market segments to compete in and how best to stretch scarce resources to maximize returns not only today, but into the future as well. Companies would do well to evaluate their overall research and development approach to ensure alignment with OEMs’ accelerating commitment to an EV future.

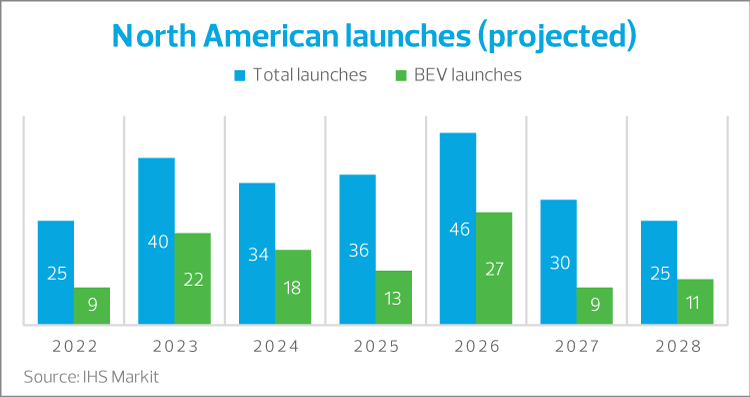

Significant amounts of money have flooded the EV and battery space over the last 18 to 24 months; GM, Ford and Toyota have announced U.S. investments of approximately $20 billion in coming years to establish battery plants that will be critical to the future of the industry. More than 100 battery EV launches—accounting for 3.8 million units—are planned from 2022 to 2028, according to IHS Markit, and 97 of those will be for new BEVs. Domestic investments in battery plants will be crucial for companies to gain greater autonomy from foreign-sourced batteries while reducing geographic supply risk in the future.

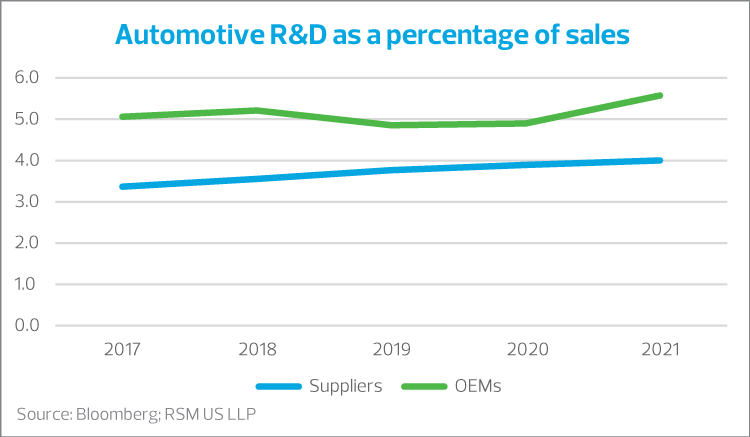

From the automotive supplier perspective, leadership teams assessing their R&D outlook in the context of these shifts should zero in on how to factor the current fiscal environment and inflation into their R&D investment plans. With R&D spending already increasing, costs are compounding as material and commodity prices are expected to continue rising. While OEMs will likely pass such costs off to their customers, or cover increases with reduced vehicle incentives, suppliers will need to remain aware of movement in material costs and proactively seek relief from their customers to the extent possible.

R&D investments

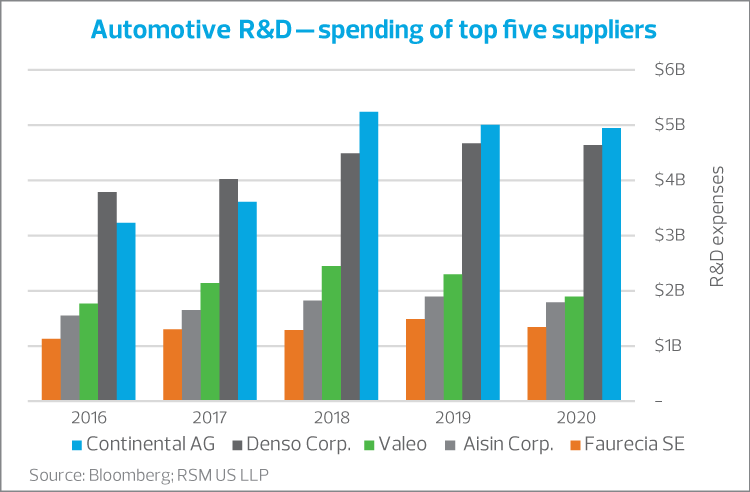

Looking at the top companies investing in R&D can provide some insight into where such investments are being made. Continental AG has invested an astonishing $22 billion over the past five years. As reported by Bloomberg, the company’s “Transform 2019−2029” restructuring plan will proactively address the demise of diesel and accelerate its transition to EVs and autonomous technologies. Denso Corp. has spent nearly $22 billion over the same period and is in the process of restructuring its business to be a leader in connected, autonomous, shared and electrified (CASE) technology. Aisin, the world’s fifth-largest auto parts supplier, is expanding its new business related to vehicle electrification, advanced safety, autonomous driving and connected cars. The company has also committed to CASE technologies, with plans to invest nearly $2.5 billion over the next five years to establish a global supply structure for electric driving units and cooperative regenerative brake systems, according to Bloomberg.

Other examples of R&D investment include Faurecia SE’s new electronics division, which is focusing on infotainment and continued development around how humans and machines interface in the context of connected vehicles. The company believes smart, in-car electronics will be the chief differentiators between vehicle brands in the future.

Automotive suppliers and other investors are spending billions to strategically position themselves as dominant players in the future of EVs. Companies rethinking their R&D investments should understand the competitive landscape, as many suppliers have been investing heavily to prepare for an EV world for years.

Over the past 12 months, companies have initiated more than 35 EV-focused transactions—including acquisitions, strategic investments and joint ventures—and those disclosed publicly represent billions in investment. BorgWarner is currently working on a transaction valued at more than $220 million to acquire Santroll Automotive Components, a carve-out of the electric motor business of Tianjin Santroll Electric Automobile Technology Co. Ltd. One of the largest European acquisitions closed in February 2022, as Faurecia acquired a 79.5% stake in Hella through a $5.95 billion deal aimed at electrification and autonomous technology. Aptiv has also recently completed a $4.3 billion acquisition of software company Wind River, a sign of the software-centric future of the auto industry.

These examples show that the automotive industry is rapidly transitioning to the electrification of vehicles and embracing a more connected and autonomous future.

Financing the future

With the strength of the industry over the past decade, many companies had built up a cash surplus in anticipation of the ripe investing opportunities we see today. Those that didn’t will need to develop different acquisition and investment strategies. The industry should continue to see a variety of joint ventures and other strategic alliances among companies, but such deals will be optional for some and essentially required for others.

The current low interest rate environment might provide auto suppliers with a timely opportunity to make strategic investments, but companies also need to consider what significant inflation will mean in the future if they borrow now.

RSM contributors

-

Bart HuthwaitePrincipal

Bart HuthwaitePrincipal -