Peaking of the federal funds rate in the first half of 2023 could lead to a gradual easing of headwinds.

Life sciences services industry outlook key takeaways

Risk aversion has led to headwinds not only for clinical research proposals but also for new technologies, such as those supporting decentralized research.

Labor demand could ease beginning in the second half of 2023, but companies should not expect an immediate decline in wage pressure.

Coming out of a period of staggering growth during the pandemic, life sciences services companies, particularly in the clinical research space, have maintained strong growth despite the economic headwinds of 2022. Looking toward 2023 and 2024, we see a potential easing of these headwinds as the federal funds rate hikes potentially peak in the first half of 2023. Key considerations include the following:

Macroeconomic

Funding:

- Depressed valuations may have hit bottom.

- Public funding may open back up in summer 2023, after the final federal funds rate hike.

- Private funding remains strong as investors remain open to the “right investment.”

Interest rates:

- The federal funds rate may peak in the first half of 2023.

- Look for some correlation between the final federal funds rate hike and a funding rebound (barring unforeseen market events).

- Continued rate hikes could push the U.S. economy into a recession in 2023.

Labor:

- Life sciences labor demand has historically outpaced labor supply.

- Recession will lead to a tempering rather than a lack of labor demand, which may not fully work its way through the system until 2024.

Industry

Clinical trial volume:

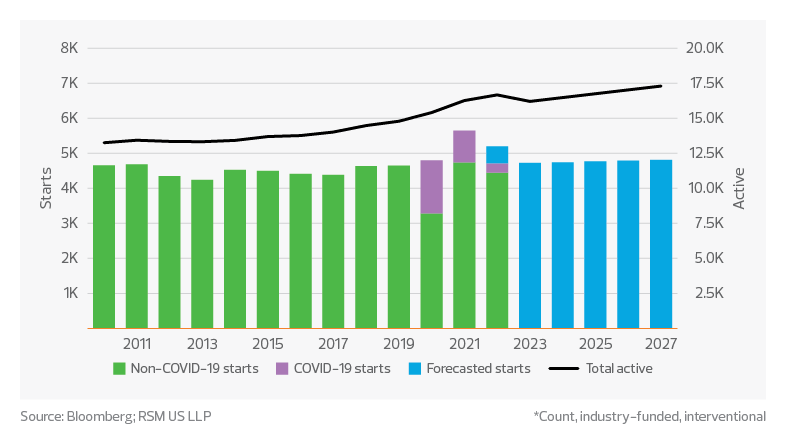

- Approximately 5,200 clinical trials started in 2022.

- Over 16,000 clinical trials are currently active.

- Approximately 30% of phase 2/3 clinical trials have experienced delayed start dates, but there is ample volume to maintain strong growth.

Clinical trial duration:

- Phase 3 clinical trial durations increased from two years in 2010 to 3.5 years in 2022, with no signs of abating in the near term.

Clinical trial cost:

- Cost will be emphasized over timeliness in the near term. Uncertainty around technology investment will lead sponsors toward legacy clinical trial models versus virtual options.

Small to midsize biotech RFP headwinds may ease with public funding rebound in summer 2023

From 2017 to 2021, according to data from Bloomberg and RSM US LLP, biotechs averaged approximately $45 billion annually in private equity and venture capital investment. Through 2022, we did not see a significant PE and VC investment shortfall; however, the public funding environment has faced significant challenges. From 2017 to 2021, biotechs averaged approximately $15 billion annually in funding from initial public offerings. Through 2022, we saw around $2 billion in funding from IPOs, a decline of approximately 85%.

Amid rising rates from the Federal Reserve, biotechs are experiencing depressed valuations. It costs around $350 million to bring a new drug to market, excluding the cost of the many failures along the way. Many biotechs raise around $100 million in private markets before turning to public markets to secure remaining funding. Therefore, public markets serve as a major funding source in a biotech’s life cycle. Recent inflation challenges and the corresponding federal funds rate hikes have effectively lowered available public funding of US biotechs through depressed valuations.

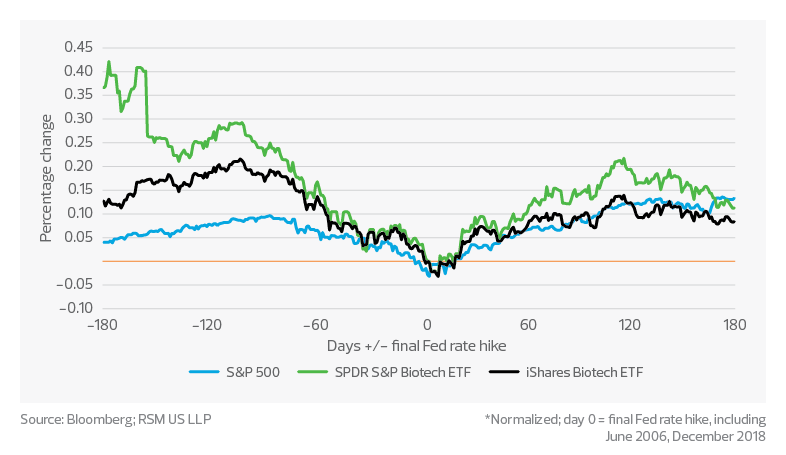

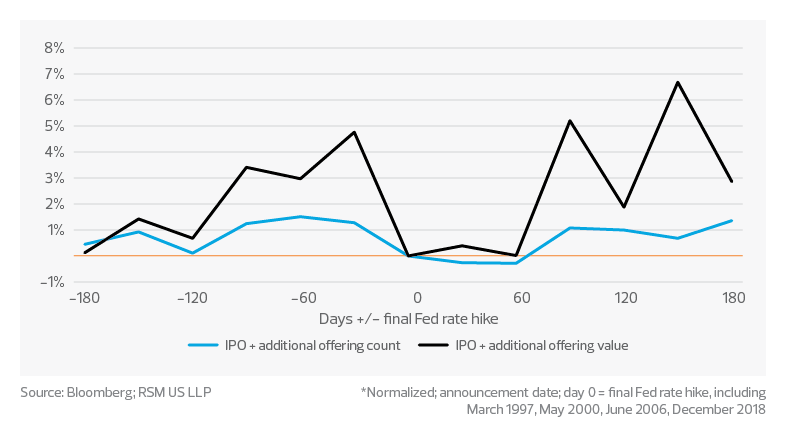

That said, history has shown some correlation between the final federal funds rate hike, market performance, and funding through IPOs and additional offerings. We currently anticipate the final hike in the federal funds rate in the first half of 2023. Barring any unforeseen shocks to the U.S. economy, this could mean a rebound of public funding as early as summer 2023.

Biotechs are increasingly focusing on cost as extending their cash runways takes on growing importance. This means that clinical research organizations with a high concentration of small to midsize biotech sponsors are under increasing pressure to meet sponsor cost demands while maintaining profitability in a period of rising labor costs. An easing of the public funding markets should mean an easing of this trend for CROs, increasing the volume of requests for proposals and granting CROs more bargaining power to bake in much-needed fee increases to offset rising labor costs.

Average return pre- and post-final Fed rate hike*

IPO and additional offering funding; pre- and post-final Fed rate hike*

Look for labor demand to ease as U.S. economic growth slows through 2024

U.S. labor demand, including life sciences services, remains unhampered coming out of the pandemic. Through 2022, based on analysis on the clinicaltrials.gov database, we expect approximately 5,200 new clinical trials to start. While this is less than the approximately 5,650 starts in 2021, strong starts and increasing clinical trial duration mean labor demand remains strong. The industry’s demand for labor, which includes a highly skilled and specialized workforce, has historically outpaced supply. The federal funds rate hikes, expected to peak in the first half of 2023, will lead to a tempering of demand, which we see as moving more in line with supply levels versus falling short of supply. Therefore, companies should not expect an immediate decline in wage pressure. It could take until well into 2024 for this demand realignment to work its way through the system.

As a side note, we found that approximately 30% of phase 2/3 trials scheduled to start in the first half of 2022 delayed their start date. The delays averaged approximately 130 days or 4.3 months. We believe these delays, influenced by small to midsize biotech funding challenges and by availability of labor, are the primary reason we did not see record levels of clinical trial starts in 2022.

Clinical trial study starts and active forecast*

Subscribe to Life Sciences Insights

Knowledge is power. Stay up to date with key life sciences trends and timely insights, delivered straight to your inbox.

The Real Economy

Monthly economic report

A monthly economic report for middle market business leaders.

Industry outlooks

Industry-specific quarterly insights for the middle market.