Expect record levels of clinical trial study activity heading into the fall, with oncology continuing as the leading therapy area.

Key takeaways

While virtual technologies are gaining traction, study durations are not highlighting their success.

Only 46% of phase 3 studies from the past five years report having met enrollment requirements.

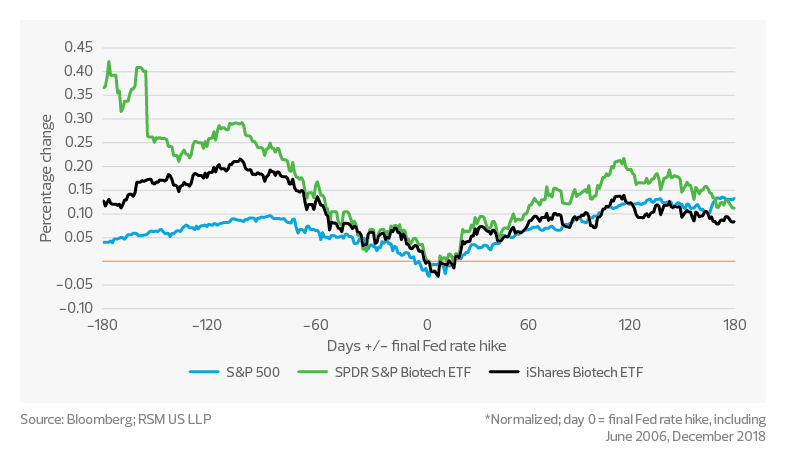

Macroeconomic overview

Demonstrating that the life sciences industry is not immune to the challenges facing the U.S. economy, the S&P 500 life sciences tools and services index dropped by 15% to 25% from January through mid-August and continues to fluctuate; however, the index maintained an approximately 19% CAGR over the prior five years.

As a service industry, life sciences is experiencing pressure on earnings due to inflation and limited skilled labor. While many contract research organizations have intended to pass cost increases on to sponsors as new business is awarded, a funding slowdown for middle market biotechs means that CROs may experience increased pushback from sponsors as companies plan to maximize their limited liquid assets.

We note that large CROs maintained healthy cash positions, with strong free cash flow, through the second quarter. Large CROs continue to report strong request for proposal volume and new business awards. While some middle market CRO constituents have indicated a perceived negative impact on new business awards due to the funding slowdown, there have been limited reported reductions year over year.

With reasonable short-term obligations and positive working capital, we see no immediate concern for the long-term health of the industry. In addition, and while it is no silver bullet quite yet, labor demand has eased over recent months, and we now see 1.81 job openings per unemployed worker in the United States, down from a peak of 2.0. To be clear, this labor demand metric still sits well ahead of the pre-pandemic rate of 1.2 job openings per unemployed worker. But we expect this downward trend to provide some much-needed relief in the industry.

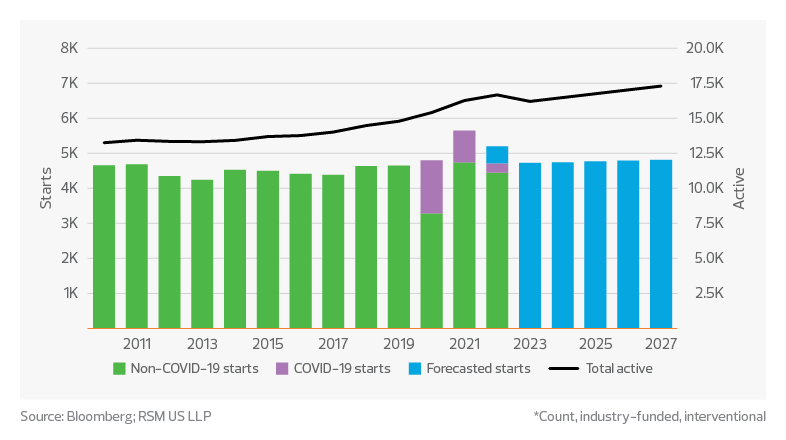

Active studies and study starts

There are over 16,000 active, industry-funded and interventional clinical trial studies, with no signs of this count dropping significantly in the near term. Study starts through August are on pace to exceed 5,500 non-COVID study starts during 2022 compared to approximately 4,700 in 2021, which would represent an increase of more than 17% year over year. According to IQVIA’s Global Trends in R&D 2022, oncology continues to be the leading therapy area, comprising at least 33% of all study starts.

Next-generation treatments also continue to gain momentum, while still making up a relatively small portion of the overall study population. Over 800 next-generation biotherapeutics were in development in 2021—encompassing CAR T-cell therapy to fight cancer, cell therapy, gene therapy and RNA therapeutics. The next-generation pipeline has seen a CAGR of 27% since 2016.

Clinical trial study starts*

Study duration

Through August, completed-study duration for non-COVID studies averaged approximately 3.5 years, slightly up from the 2021 average of 3.4 years and retaining the significant upward trend of the prior 10 years. Given that some virtual study providers are targeting a one-to-two-year trial timeline and some large CROs are incorporating virtual components into 50% of their new studies, we’ve been optimistic that virtualization might lead to reduced study duration. Individual service providers are reporting successes, but we have yet to see an overall reduction.

We noted that studies completed in 2022 are on pace for only 75% to 85% of prior-year completions. We see two potential causes of this reduction:

- The reduction in 2020 and 2021 non-COVID study starts may be flowing through the study completion population. This trend could continue for the next 24 to 36 months, which is when we expect the current study starts to work their way through their life cycle.

- Labor shortages may be impeding study completions. In a first-quarter site survey performed by WCG Clinical Inc., over 50% of sites cited staffing as the top issue currently affecting them. As labor challenges persist, site enrollment timelines and capacity to perform testing will suffer.

In addition, while enrollment trends remain challenging, identifying investigators to oversee study sites is equally so—45% of investigators participate in only one trial at a time.

Average years to phase 3 study completion*

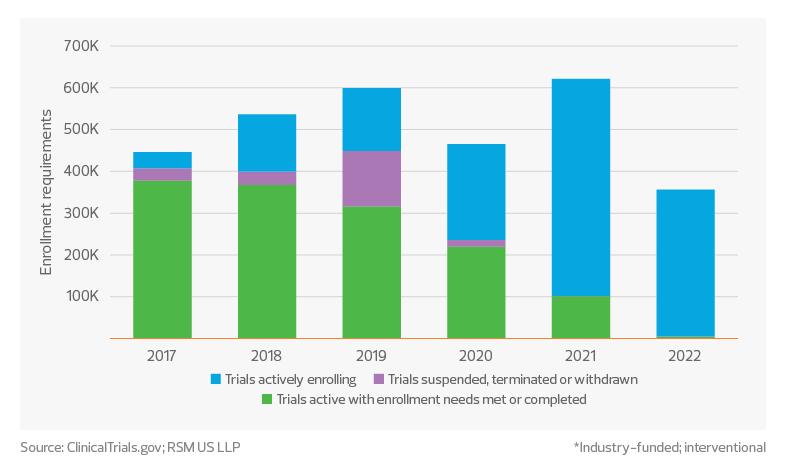

Enrollment challenges

1.4 million: This is the number of participants needed to meet enrollment requirements across phase 3 studies that are still actively enrolling. Only 46% of phase 3 studies started over the past five years reported having met enrollment requirements.

CVS and, most recently, Walgreens represent two pharmacies entering the clinical trial business and hoping to leverage their networks of thousands of locations to improve study recruitment and diversity. In addition, decentralized clinical trials continue to gain traction and provide flexibility in study locations, which widens the available participant population. Coupled with other solutions, such as providers using algorithms to parse electronic health records to identify potential study participants, we expect to see a trend of shortening recruitment timelines and improved diversity across studies.

Gap in phase 3 clinical trial enrollments*

Subscribe to Life Sciences Insights

Knowledge is power. Stay up to date with key life sciences trends and timely insights, delivered straight to your inbox.

The Real Economy

Monthly economic report

A monthly economic report for middle market business leaders.

Industry outlooks

Industry-specific quarterly insights for the middle market.