Many leading insurers are taking interest in blockchain technology.

Key takeaways

Blockchain can help companies reduce security risks and mitigate fraud in a scalable way.

Blockchain technologies, partnerships and road maps should be part of insurers’ growth strategy.

While many insurers continue to face rising operational costs, outdated legacy technology systems and increased competition in the market, blockchain is a potential game changer that could revolutionize how they operate. In a risk-averse industry, blockchain can create an environment of trust by providing a network with controlled access and a method to share valuable data in a secure, tamper-proof way.

Blockchain is a decentralized digital database or ledger that records transactions and tracks assets across numerous computers, or nodes, which continuously and collectively agree to the current state of the ledger. Blockchain nodes can encompass several computers or electronic devices that maintain the chain of records that keeps the network functioning, ensuring no single entity can own or manipulate the information. When new blocks are formed, the data in the current block is linked to the previously added block. This forms a chain of data with enhanced accuracy and traceability, and prevents manipulation of the prior data.

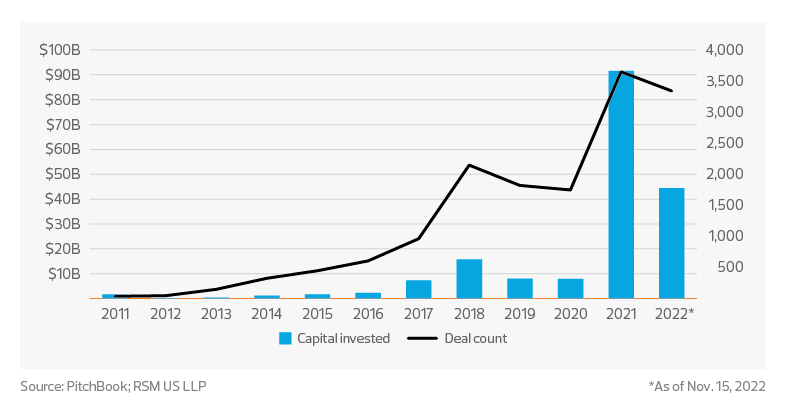

Twelve years ago, when blockchain was introduced to the global market, the emerging technology was mainly associated with cryptocurrency. In 2021, capital investments in blockchain grew from $7.9 billion to an astounding $91.6 billion, according to PitchBook data. Since March 2022, while capital investments in the space have decreased significantly, deal counts have maintained the pace of the prior year. This trend may reflect current economic challenges and inflationary pressures. While capital may be strained, blockchain may still provide significant business value for companies looking to expand their networks and economies of scale.

While capital may be strained, blockchain may still provide significant business value for companies looking to expand their networks and economies of scale.

Blockchain capital investment and deal count

Insurance sector applications

Many leading insurers are taking interest in blockchain technology as they seek to leverage verified, real-time data to provide products and services faster and cheaper. Blockchain can help companies reduce security risks, comply with regulatory requirements more efficiently, guarantee payments and mitigate fraud in a scalable way.

For instance, when claims are moved to a blockchain-based ledger shared among insurance companies within the peer-to-peer network, the claims cannot be modified. Ultimately, insurance companies share a trusted, single source of truth that can eventually reduce fraud and make managing claims much easier. With access to the same shared and secure blockchain ledger, insurers within the linked network can immediately know the status of a specific claim and obtain historical claims information that is more accurate and available much faster than most information collected today.

With access to the same shared and secure blockchain ledger, insurers within the linked network can immediately know the status of a specific claim and obtain historical claims information that is more accurate and available much faster than most information collected today.

Like claims management, the blockchain ledger can help insurers accurately rate risks. Sharing a blockchain ledger among linked insurers and reinsurers provides access to data relating to policies, premiums and loss history to simplify or even eliminate the reconciliation process, and thus simplify the underwriting process overall.

The insurance industry is slow to adopt blockchain technology due to risks related to data and asset custody, cyber hacks or a lack of interoperability between various blockchains, for example. Still, in such a competitive market, insurance and insurtech companies should continue to engage firms to help incorporate blockchain technologies, partnerships and road maps as part of their growth strategy.