2024 was a transformative year for the Small Business Investment Company program.

Key takeaways

Recent regulatory reforms have made the program more attractive to equity-focused investors.

Accrual and reinvestor licenses contributed to a surge in license applications in 2024.

The Small Business Administration (SBA) has reformed and expanded the Small Business Investment Company (SBIC) program in recent years; 2024, in particular, was a transformative year. The program debuted two new types of SBIC licenses, launched funds under the new critical technology program and released additional financial reporting that provides greater context for how SBIC financial performance compares to traditional private equity and private credit funds.

While the new presidential administration and the seating of a new Congress in 2025 add some uncertainty to the near-term future of the program, it seems likely that it will continue to grow and evolve. The program has strong bipartisan appeal and SBA data demonstrates a significant interest from potential SBIC fund managers.

Background

The SBA created the SBIC program in 1958 to encourage investment in American small businesses. The program has led to the investment of more than $130 billion into almost 200,000 small American companies, helping to fill a capital availability gap for small enterprises. The modern form of the program focuses on SBIC-licensed private fund managers raising capital from limited partners and then leveraging that capital at favorable terms with SBA-guaranteed debentures available through the program. The program operates under a zero-taxpayer subsidy model with minimal debenture defaults. In fact, the program generates a surplus for the federal government, with a net $1.5 billion inflow transferred to the U.S. Treasury over the past 24 years.

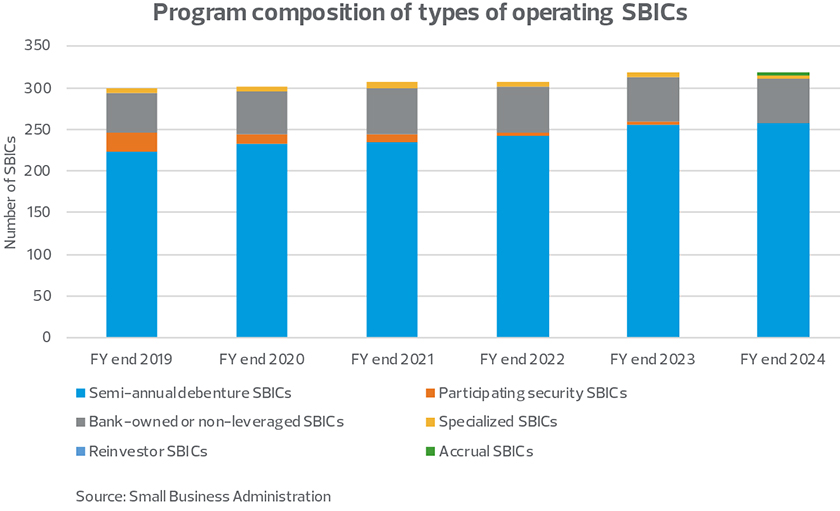

There are 319 licensed SBIC funds with approximately 100 additional license applicants in the pipeline as of Sept. 30, 2024. The current portfolio of licensed SBIC funds is on track to provide financing to over 1,100 small businesses throughout 2025, which will have created or sustained an estimated 112,000 jobs.

While private credit-focused investment managers have typically made up a large portion of the licensed funds, the program supports a variety of investment strategies and recent regulatory reforms have made it more attractive to equity-focused investors like venture capital, growth equity and buyout firms.

The program issued over $3.9 billion of debenture commitments in the SBA’s fiscal year ending Sept. 30, 2024, and it had almost $47 billion of collective debenture and private capital outstanding.

2024 activity

Accrual SBIC

One of the most significant changes to the existing SBIC program in recent years was the creation of a new form of license, the accrual license, in 2023, which provides accrual debentures. In contrast to traditional debentures, accrual debentures do not have a current interest-paying component but accrue interest over a debenture’s 10-year term. The leverage is non-amortizing and prepayable without penalty after a short lock-up period. Repayment of principal, interest and fees are made pursuant to a proscribed distribution agreement, or “waterfall”, that allocates proceeds between the SBA and private limited partners. Interest rates are favorable to alternative sources of financing available to private funds with the accrual debenture carrying a 5.505% coupon as of Jan. 16, 2025, an approximate 0.9% spread above 10-year U.S. Treasury bond rates.

SBICs need to indicate if they intend to use traditional or accrual debentures at the time of licensing, and SBA approval is subject to the same licensing process. Accrual SBICs may borrow up to 1.25 times their private regulatory capital, and a maximum amount of leverage will be determined by aggregating the total expected principal and interest over the life of the debenture.

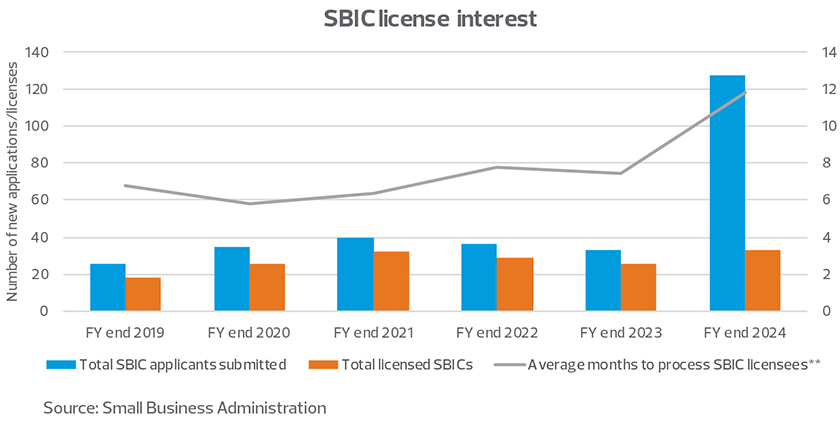

There has been significant interest in the accrual debenture program, much of it from venture capital, growth equity and buyout investors. More than 55 accrual license applications were submitted in 2024 alone, compared to the SBIC program receiving an average total of 35 license applications per year before 2024. The program issued three accrual licenses in fiscal year 2024, with an additional eight in a later phase of the licensing process as of Sept. 30, 2024.

Critical Technology Initiative

The Department of Defense and the SBA announced the SBIC Critical Technology (SBICCT) Initiative in December 2022 to increase private investment in critical technologies, including component-level technologies and production processes vital to U.S. economic and national security interests. There are 14 critical technology industries identified by the DoD, including biotechnology, advanced materials, quantum science and space technology.

Critical technology funds will use the accrual debenture to make up a meaningful portion of the new SBIC fund applicants. Licensed funds can access support from the DoD, including access to technical experts and cooperative research and development agreements.

The DOD announced in early January 2025 that 18 critical technology funds had been given at least the “green light” approval, with seven of those licensed. According to a DoD press release, “This first cohort is projected to invest over $4 billion into over 1,700 portfolio companies focused on all 14 critical technology areas.”

Reinvestor (fund-of-funds) SBIC

Historically, SBIC funds were broadly prohibited from investing into relenders or reinvestors, businesses whose primary business activity involves—directly or indirectly—providing funds to others, purchasing debt obligations, factoring or long-term equipment leasing. That changed in 2023 with the introduction of the Reinvestor SBIC license.

Reinvestor SBICs are allowed to invest in other investment funds, whether the investees are SBICs or non-SBICs; however, if the investee is an SBIC, it must be non-leveraged. Investee funds must have an investment strategy that aligns with current SBIC requirements, including investing in companies that meet portfolio company size standards, have at least half of their employees in the United States and are controlled by entities or individuals in the United States. Reinvestor SBICs may also make co-investments into portfolio companies alongside investee funds, subject to certain conditions. Reinvestor SBICs utilize the accrual debenture and are eligible to borrow debentures up to twice their private regulatory capital.

While interest in the reinvestor license has been lower than the general accrual debenture, there were still eight license applications submitted in FY 2024 and one reinvestor fund was licensed in December 2024.

Increase in license applications

The introduction of the accrual and reinvestor licenses contributed to a surge in license applications in 2024. A total of 127 applications were submitted in fiscal year 2024 compared to an average of 35 per year in the prior five years, more than a 3.5x increase. Additionally, a large portion—84—were first-time applicants for an SBIC license.

To reduce the financial burden for new applicants, diversify the pool of fund managers and make the program more accessible overall, the SBA has modified licensing fees and broadened eligibility requirements for fund managers.

While the regulatory reforms designed to grow the SBIC program appear off to a good start, challenges remain. In particular, the SBA, like most government agencies, faces resource constraints and can’t easily scale its licensing capacity to meet applicant demand. Before 2024, processing an SBIC application took an average of just under seven months. In fiscal year 2024, the timeframe increased to nearly 12 months. While applications rose by 285% compared to the previous year, the number of licenses issued only grew by 27%. Applicants and their limited partners should be prepared for the time involved in the licensing process.

SBIC fund performance reporting

Although the SBIC community has long believed that SBIC funds offer the potential for superior returns compared to non-SBIC funds, quantifying and evaluating these comparisons from an academic perspective has been challenging. The challenge is due to factors such as differences in accounting standards, limitations on SBA data collection and a stronger emphasis on assessing the economic impact of the program on company financing and employment. However, new reporting in 2024 aimed to make this comparison clearer.

First, a June 2024 paper from the Institute for Private Capital found that SBICs outperform comparable non-SBIC peers by an average of about 4% in terms of internal rate of return (IRR). Second, the SBA’s first SBIC performance report—published Jan. 17, 2025—indicated the opportunity for superior SBIC program returns compared to private equity/private credit benchmarks. For eight of the 10 vintage years beginning 2013, the SBIC program portfolio overall produced net IRRs higher than the SBA-selected benchmarks, net total value to paid-in capital (TVPI) higher than median benchmarks for nine out of 10 vintage years, and net distributions to paid-in capital (DPI) higher than median benchmarks for five out of 10 vintage years.

What’s next

Ongoing efforts continue to increase the amount of debenture capital available to SBIC funds and fund families, broaden the pool of limited partners that are investing in SBICs and increase the limits on how much bank limited partners can invest in SBICs. Though there will be challenges and obstacles along the way, it is apparent the SBIC program has a bright future.

RSM contributors

-

Jordyn KuhnManager

Jordyn KuhnManager -

Katie SchuhowPartner

Katie SchuhowPartner -