Historically low interest rates are providing a rare opportunity for many businesses in the pandemic-depressed economy to access low-cost capital and make long-term strategic investments in technology and other improvements, such as upgrades to their facilities, writes RSM US Chief Economist Joe Brusuelas. Consumer products businesses are no exception.

Opportunities

The consumer products industry is significantly transforming due to the pandemic. Businesses in this sector cannot afford to sit by on the investment sidelines, even as many organizations face margin pressures and reduced cash flows and liquidity. The prospect of tapping into pent-up demand and $1.65 trillion of U.S. household savings accumulated during the pandemic—combined with inexpensive capital—affords consumer-facing businesses the chance to put the digital tools in place to compete in a dynamic, hyper-competitive post-pandemic consumer environment.

Customer-facing technology

The COVID-19 pandemic accelerated the shift toward e-commerce, so digital channels became the primary means of interacting with customers for many consumer companies. The technology investments made to create personalized shopping experiences and high-touch transactions in a virtual environment set successful consumer products companies apart during lockdowns—and are quickly becoming consumer-expectation strategies rather than differentiators. With the promise of widely distributed vaccines on the horizon, shopping patterns will evolve as consumers establish newfound comfort with shopping online through increasingly mobile lifestyles. Consumer businesses’ investments in customer-focused technology will need to integrate with reimagined physical footprints to create convenient, seamless customer experiences.

Data analytics

The shift to e-commerce has also created a growing ability to collect and analyze consumer data for actionable insights, particularly for consumer businesses that invest in the right tools. The ability to aggregate data from digital touchpoints with customers will be imperative to understanding changes in what, where and how consumers are making purchases. A nimble, data-driven approach to forecasting will allow consumer businesses to adopt demand-focused business models, control inventory levels and maximize profitability in an increasingly dynamic consumer ecosystem.

Why invest now?

In recent years, middle market firms have lagged behind their larger industry counterparts in capital outlays, a trend that has been documented in the RSM US Middle Market Business Index. In an encouraging sign, the December 2020 MMBI survey showed that more than half of respondents (52%) said they expect to boost investment in productivity-enhancing capital expenditures such as software, equipment and intellectual property over the next six months.

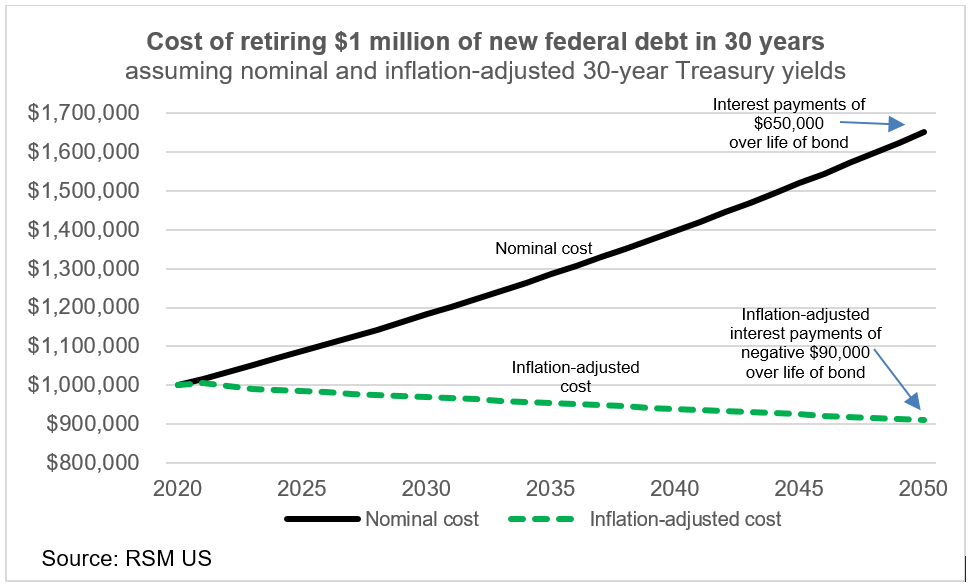

Due to the unique confluence of events that is upon us, firms will actually make money by borrowing because we are operating at near-zero nominal interest rates that become negative when adjusted for inflation.