A series of cross currents in public health, public policy and economics will shape growth conditions across the American economy during the year ahead. The juxtaposition of an intensifying pandemic and the encouraging developments in the race to find a vaccine is the perfect metaphor for growth over the next year. We are all waiting for a vaccine, yet we must still gauge the probabilities of recovery and figure out how to reimagine our firms during a time of changing technology, telework and automation.

The grim data around the coronavirus point to downside risk on our forecast of 2.75% growth in the fourth quarter gross domestic product and a 2.2% increase in the first quarter next year. Yet the possibility of 500 million vaccine doses produced domestically for distribution in 2021 carries the potential that close to $4 trillion in impaired economic activity could be unlocked in the second half of next year.

It provides the possibility of significant upside to our forecast of 4.3% growth in second quarter next year and 3.9% in the second half of the year, along with an easing of the unemployment rate to 5.5% by the end of the year.

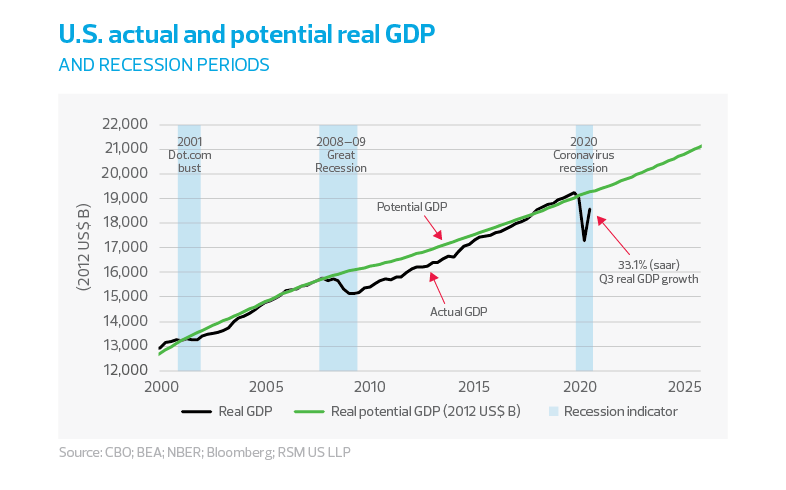

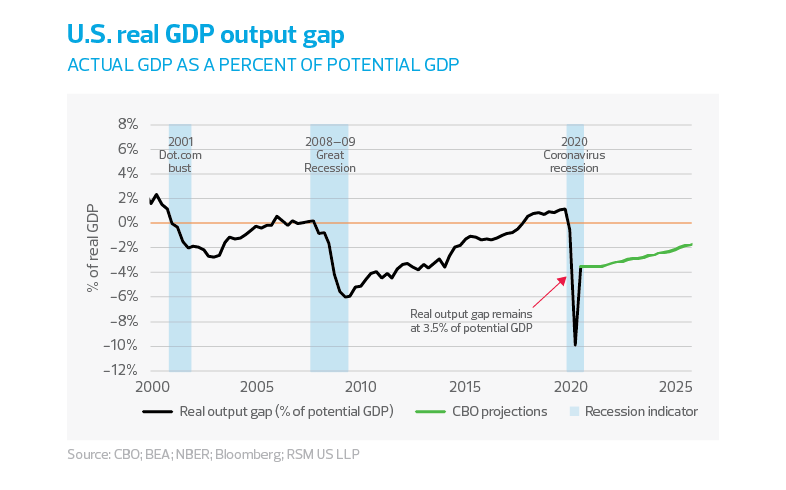

Although we expect the economy to be back to potential output by the end of 2021, it will be some time before policymakers can begin discussing full employment, wage pressures and inflationary risks. In short, despite current risks around the pandemic, next year promises to be one of recovery and above-trend growth in the United States.

While our core baseline forecast is predicated on a recovery, the long shadow of the economic shock unleashed across the real economy this past spring will require a year of reactivation and reimagination of America’s commercial community. The economy will recover, but it will not return to the way it was.

The pandemic unleashed a once-in-a-century economic shock while simultaneously providing an opportunity to reassess operations, talent and strategy. The pulling forward of many long-term trends in technology and automation will cause firms to increasingly look to substitute technology for labor and to reduce outlays on commercial real estate and traditional business travel.

Moreover, the pandemic stimulated a real-time experiment for businesses on what tasks could be done remotely and who could thrive under such conditions, all while providing a stress test on growth strategies. In that experiment’s aftermath, expectations around outlays on capital expenditures, commercial real estate, talent acquisition and retention, as well as corporate culture, are going to change. Despite the prospect of strong growth, the imperative for many firms next year will be reimagining their operations and technological transformation — a difficult proposition under any circumstances.

Growth

We are forecasting a year of strong growth in 2021 — near 4% — with the possibility of a much stronger pace of economic activity in the second half of the year linked to the production and distribution of a vaccine.

Should the vaccine be pulled forward into the first half of the year, we anticipate that individuals and firms will begin normalizing social and economic interactions more quickly than anticipated. During both waves of the pandemic, the public pulled back in advance of the state and federal governments’ acting to mitigate the disease. Once public confidence in the management of the disease is reestablished, we would anticipate that economic activity will quickly improve.

We see two major catalysts propelling economic growth next year:

- The unleashing of household spending. We anticipate a 3.1% increase in household spending in 2021. Given that spending by the two upper quintiles of income earners remains roughly 9.5% below where it was in January 2020, and that the national savings rate stands at 14.1%, there is sufficient ammunition to push that much higher should growing expectations around a vaccine be realized. One should expect a sustained increase in household spending near 5% for the year.

- Another round of fiscal aid. If Congress approves $1 trillion in fiscal aid early in the year, that will probably not be felt in the economy until the second quarter. With the Federal Reserve guaranteeing a zero policy rate until 2023 and yields along the maturity spectrum rising, improved financial conditions will support greater federal spending that will boost overall output without stoking the risk of higher interest rates or rising inflation. Conditions are ripe for a multitrillion-dollar, multi-decade infrastructure project.

While we would expect growth to continue to be driven by the manufacturing and housing recoveries that are already underway, we would expect the damaged areas of the economy to join the party later in 2021. By midsummer, we expect travel, leisure, hospitality, energy and retail all to experience robust increases in demand driven by the unleashing of the 14% household savings rate and business activity moving toward a solid, albeit changed, status quo.

Alternatives to the baseline forecast

The alternatives to our baseline forecast for 2021 can be seen in two scenarios, one positive and one negative:

- Public confidence in a vaccine rises dramatically. This would usher in a reopening of the economy and the resumption of normal social activities much more quickly than the market has priced in. That, in turn, would create conditions for closer to 6% growth in 2021 and a reduction in the unemployment rate to 4.9% by the end of the year. Under this scenario, the need for more than one round of fiscal aid in 2021 fades and the virtuous cycle of improved financial conditions, rising risk appetite in the lending community and robust domestic and global demand as international trade returns all support much stronger growth than our baseline forecast implies.

- The political polarization in Washington proves too much to overcome. This would limit any aid to the unemployed, states and local governments, while early hopes for a vaccine are dashed. Both create the conditions in which dampened economic activity linked to a difficult winter proves sufficiently large to keep growth well below the long-term trend of 2%. Under this scenario, the risk of a double dip, or W-shaped, recovery remains quite real.

Risks to the outlook

Risks to the outlook primarily revolve around three areas:

- The need for aid to states and municipalities. Federal aid would avoid rounds of layoffs to well-paid public employees such as teachers, police officers and firefighters. If there is little or no fiscal aid, along with dashed hopes for a vaccine, then unemployment may rise and aggregate demand will sag in the first half of 2021.

- The likelihood of a difficult winter. Should nothing be done to cushion the blow to beleaguered consumers and small firms, that may somewhat offset growth in the areas of the economy that have done well during the pandemic. This remains the major wild card in determining the 2021 growth path despite our optimistic outlook.

- The overhang from the trade war. This challenge comes in addition to contentious talks about how to get vaccines to emerging markets, which could reduce the benefits from reopening the trade channel in 2021. The unique logic of the pandemic is that until there is a vaccine that is available to all, we will simply not get back to the pre-pandemic levels. This will likely require a global conference to establish collaboration and coordination on the production and distribution of a vaccine. Given the current U.S.-Chinese tensions that are not going to abate anytime soon, this may be an under-the-radar challenge next year.

MIDDLE MARKET INSIGHT: By midsummer, we expect travel, leisure, hospitality, energy and retail all to experience robust increases in demand driven by the unleashing of the 14% household savings rate and business activity moving toward a solid, albeit changed, status quo.

Central bank policy and interest rates

We would not be surprised before year’s end to see the Federal Reserve increase the pace of its Treasury purchases from $80 billion a month (and $120 billion overall) and shift the composition of those purchases out along the yield curve to dampen long-term rates. This would be in response to any bout of premature enthusiasm from bond purchasers to bid up yields on the back of a much stronger recovery than is priced in. The modest recent increase in yields actually creates policy space for the Fed to act at its December meeting. That is the major reason for our target on the U.S. 10-year yield of 1.26% at the end of 2021.

We have made the case that interest rates will remain low for a long time. The combination of the large output gap and monetary policy out of the Fed has created the conditions that provide considerable fiscal space to address the current crisis and rebuild the nation’s crumbling infrastructure. Although we anticipate a modest steepening of the yield curve next year that will bolster financial conditions, risk appetite, lending and overall growth, it will not derail the issuance of debt by the federal government nor crowd out investment by the corporate community.

In the coming years, economic historians and policymakers will look back on the decisive actions taken by the Fed during the peak of the pandemic and note how they prevented much greater long-term damage to the economy. For these reasons, we do not expect the Biden administration to replace Jerome Powell when his position as chairperson of the Fed comes up in February 2022 – a prospect that will affect financial markets starting at the end of next year.

The Biden administration

In a recent note, we made the case that next year the Biden administration will pursue a policy agenda organized around the following:

- Science. The pandemic and health care are going to be the administration’s first priority. From what we can ascertain, President-elect Joe Biden’s team believes its political fortunes revolve around getting the disease under control and managing the production and distribution of the vaccine.

- The economy. The economy needs an additional round of fiscal aid and we do expect something above $1 trillion to be approved in the new year.

- Trade. The administration has signaled that it intends to mend fences with the major trade partners of the United States excluding China. This means that there will be a policy imperative to get commerce moving across North America, which should reinvigorate manufacturing in the Western Hemisphere, while simultaneously jump-starting trade with England, the European Union, Japan and South Korea. While we do not expect tensions with China to abate anytime soon, there is space to quietly begin talks on agricultural exports. For this reason, we expect the protracted trade conflict that characterized 2018-20 to be quietly brought to an end next year. It is natural and legitimate that the trade channel be a component of the recovery that we anticipate to expand in 2021 and 2022.

- Infrastructure. We anticipate a major policy initiative out of the administration early in 2021 to create an infrastructure bank to support the modernization of the nation’s crumbling infrastructure. The focus will revolve around what we call I2E, or the rebuilding of the roads, bridges, transit, ports and waterways (big I); the expansion of digital broadband and the establishment of 5G (little i); and the integration into all of the above smart and renewable resource use (E). Given that real interest rates out along the curve are negative, this implies that the time is ripe to engage in a multidecade, multitrillion-dollar reinvigoration of the domestic economy through the infrastructure channel. It’s long overdue and much needed.

- Employment. While the economy will return to realizing its potential output over the next 12 to 24 months, it may be some time before the economy moves back to full employment, which is closer to a 3.5% unemployment rate than the current 6.9%. We expect that the gain in monthly payrolls will average roughly 320,000 per month in 2021. From our vantage point, the risk to the forecast is clearly toward a faster pace of payroll growth and a lower year-end target on the unemployment rate than our current 5.5%.

Our major concern on employment is in the destruction among small firms within the service sector. Revenues in that sector are down 26% from January 2020, and more than one in four firms that were open at the outset of 2020 remain closed. Ultimately, many of those firms will not reopen and their displaced workers will either turn to self-employment — which we think is occurring given the increase in business formation — or they will face long bouts of unemployment. Given that more than 21 million people were on some form of unemployment insurance in mid-November and that millions more have exhausted government assistance, the bifurcation in the economy between the haves and the have-nots is going to widen during a year of recovery.

- Inflation. The disinflation caused by the once-in-a-century economic shock has not yet completely worked its way through the economy. While it is almost certain that the economy has entered recovery, the gap between actual and potential output implies that the economy is only two-thirds back to where it was at the beginning of 2020 – and where it was at the bottom of the financial crisis. And that strongly suggests that there is not much inflation risk. While the Consumer Price Index will certainly jump to near 2.5% in mid-2021 on a year-ago basis, that will be nothing more than a transitory deviation in pricing, and the yearly average in inflation will remain below 2%. This does not denote any material upside risk to an early termination of the Fed’s lower-for-longer policy or an interest-rate spike in 2021.

MIDDLE MARKET INSIGHT: Although we anticipate a modest steepening of the yield curve next year that will bolster financial conditions, risk appetite, lending and overall growth, it will not derail the issuance of debt by the federal government nor crowd out investment by the corporate community.

The takeaway

We expect the economy to return to its potential output by the end of 2021, though risks remain, including the need for more aid to state and local governments, the possibility of a difficult winter as infections rise and the overhang from the trade war. Still, there is also the real chance of a significant upside to our forecast if a vaccine can be produced and widely distributed to a population that is sorely in need of relief from the pandemic.