We can learn from the PPP and MSLP to be better prepared for the next crisis.

Key takeaways

The PPP was put in place with remarkable speed, but it was not without problems.

The Main Street Lending Program took more time to launch, which limited its reach.

Three years after the start of the pandemic, the experience of the American and European employee support programs offers lessons for how to get ready for the next health or financial crisis.

While the remarkable speed at which the Paycheck Protection Program was set up resulted in direct assistance to needy firms, the program was not without problems.

The haste in which the facility was created also most likely resulted in a leaky program prone to disbursing scarce resources to those that did not need them or those that gamed the system to get help at the expense of those that did.

In contrast, the delay in standing up the Main Street Lending Program was one of the major challenges in plugging the hole blown in the commercial sector because of government-mandated shutdowns.

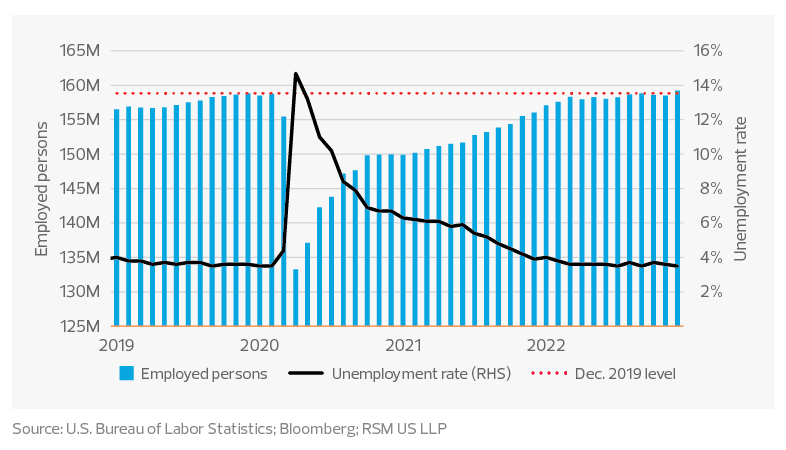

Retention of employees during the pandemic and the unemployment rate

While the scope of the program was commendable, demand was muted in part because of the lengthy delays in getting the program off the ground despite the impressive disbursement of more than $17 billion to small and middle market firms.

In light of the recent experience with federally operated programs during large, exogenous shocks, how should the policymaking community consider proceeding in the future?

Rethink the PPP

First, we would recommend separating the functions of the PPP into two programs: one for maintaining employee income streams, and one for issuing loans to small businesses that will not have access to the bond market.

The PPP was a well-intended compromise for employee and proprietor assistance. Only one-fourth of the benefits accrued to workers for whom it was intended, with the bulk going to the proprietors, landlords and suppliers.

And because of the shared risk between the government and private lenders—no matter how small—the PPP benefited businesses with larger revenue streams that were more attractive for lenders.

While we applaud the novel efforts to provide timely bridge financing and direct forgivable aid to small and midsize firms, it would be wise to have plans on the books to provide that aid to smaller firms at the outset.

The most efficient method of wage support would be through direct payments by the Social Security Administration.

Although aid to individual workers understandably is going to receive the primary attention, it is critical that the political authority not neglect the commercial community. The commercial community and the American workforce are complements of, not substitutes for, each other.

Loans to businesses would be through the Small Business Administration. Loans to suppliers would be through the SBA or the successor to the Main Street Lending Program at the Federal Reserve.

Improve data collection

Second, policymakers at the Fed and Treasury need to invest in the collection of information that could easily be converted into a program term sheet and scaled for thousands of businesses.

Like the work done at the Pentagon, CIA and State Department, the Fed and Treasury should be provided funds on an annual basis to conduct exercises in crisis management.

Focus on labor

Third, if the purpose of the PPP was employee retention and preserving the skill level of the workforce, European and U.K. models may offer better solutions.

A recent paper by the International Monetary Fund concludes that Europe’s more aggressive use of job retention schemes kept around 4 million workers in their jobs. The report noted that during 2020, U.S. employment fell by 6.2% and the unemployment rate increased by 4.4 percentage points.

That compares to an employment decline of only 1.4% in the European Union and a minimal increase in the unemployment rate of 0.4 percentage points.

In contrast to Europe, the United States experienced a plunge in employment that took two years to recover from. U.S. payrolls have only recently topped the December 2019 peak despite a quick rebound in the economy.

This lag was compounded by voluntary displacements from the labor force and the lingering effects of the health crisis, all of which contributed to the tightening of the labor market and higher wages.

The case for government aid

Finally, the pandemic experience offers arguments for the efficacy of aid to businesses and the efficiency of direct aid to households during times of economic distress and market failure.

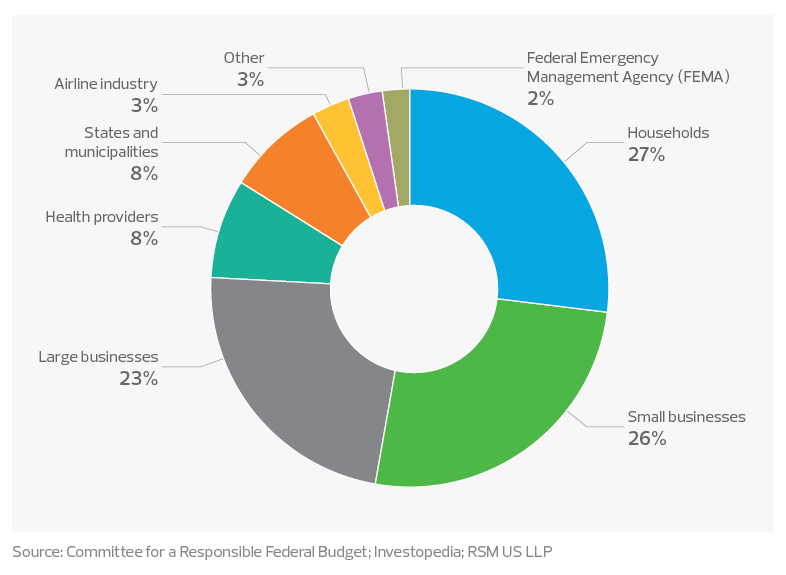

Fearing an economic collapse, Congress passed the $2.3 trillion Coronavirus Aid, Relief and Economic Security Act in March 2020. Led by Majority Leader Mitch McConnell and signed by President Donald Trump, households, small businesses and large businesses received roughly three-quarters of the funds, with the last quarter allocated to health providers, states and municipalities, the airline industry, and others.

Recipients of the $2.3 trillion funding of the 2020 CARES Act

The entirety of the CARES Act and subsequent aid programs dwarfed the PPP and Main Street outlays.

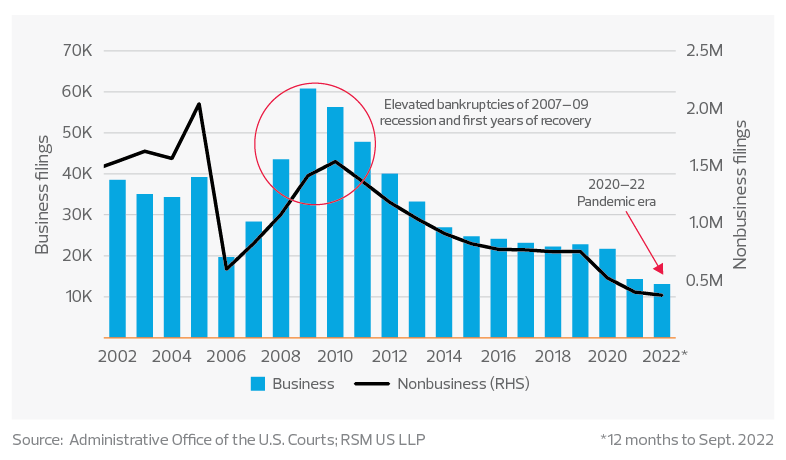

Economic growth rebounded quickly after vaccines became available. And bankruptcies, both business and personal, dropped during the pandemic.

Business and nonbusiness bankruptcy filings

The takeaway

There have been legitimate arguments over the size of the CARES Act and subsequent aid packages, and as we noted, the PPP program was leaky. And there are arguments over the role that such aid played in contributing to excessive demand and the high level of inflation.

But these arguments must also consider that the economy has closed the output gap, poverty has retreated and wage inequality has narrowed. All of this is because of the resurgence of the private sector after a rather large fiscal and monetary boost from the federal government.

Without that action, an economic catastrophe would have been at the American doorstep. The U.S. political authority would be wise to take the lessons learned during the pandemic and translate them into policy and planning ahead of the next crisis.

RSM contributors

Q2 2024 Middle Market Business Index (MMBI)

Sentiment improves as firms look to invest

Key findings:

- The MMBI rose to 132.0 in the second quarter from 130.7 in the prior period.

- Forty percent of senior executives indicated that the economy had improved.

- A majority of executives intend to boost capital expenditures over the next six months.