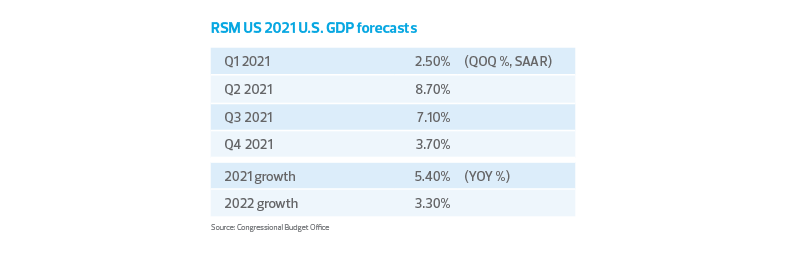

Recent events have set the stage for a significant increase in fiscal outlays this year that will boost growth in the American economy to 5.4% for the year, with risk to the upside.

The upward revision comes after the Democrats captured control of the Senate by winning two runoff elections in Georgia, which has increased the freedom of the Biden administration to pursue its ambitious spending plans. That will result in a much quicker pace of growth than previously forecast.

We are now anticipating as much as $2 trillion in fiscal aid in early February that will boost growth by 1.9 percentage points in 2021 and 1.1 percentage points in 2022. This will close a sizeable output gap in the domestic economy and pull forward to the final quarter when the U.S. economy will return to using its full capacity to produce goods and provide services.

Because of the reconfiguration of power in Washington, the Biden administration will have as many as three opportunities to use reconciliation, a legislative maneuver that allows budget-related matters to be passed with a simple majority and avoid the filibuster. Such a use of reconciliation will most likely result in not only a near-term boost to growth but will also set the stage for a much more ambitious array of spending programs.

The next round of fiscal aid will almost certainly contain a one-time, $1,400 direct transfer to eligible individuals. When that is added to the $600 payments approved in December as part of the $900 billion coronavirus relief package, American households stand to receive $465 billion in direct aid.

Given that households are sitting on roughly $1.5 trillion in excess savings compared to the 20-year average of before the pandemic, we will most likely observe one of the more robust and sustained increases in household consumption since the late 1990s.

The coming boom in overall consumer spending will significantly bolster the opportunity of middle market businesses to facilitate their recovery and re-imagination in the aftermath of the pandemic.

We anticipate that a fiscal package will include direct aid to state and local governments that will preclude debilitating losses to essential services and prevent what we think would be a loss of close to 1.5 million jobs because of the need to balance budgets on the state and local level.

Finally, there will be funding for vaccines and their distribution, as well as more support for small businesses that continue to bear the brunt of the pandemic. And it is almost certain that there will be an extension through the end of the year of pandemic-related unemployment programs.

Coming attractions

We are now confident that a double-dip recession can be ruled out and that there is slightly less than a 20% chance of recession over the next 12 months. The significant increase in fiscal transfers to households amid a robust increase in federal spending will turbocharge growth during the middle of 2021 to the point where we expect an average growth rate of 7.9% between April and September.

In addition, we have not included an increase in fiscal outlays directed toward Biden administration priorities such as infrastructure, automatic stabilizers and other social investments. The passage of those programs later this year would result in an impact of between $2 trillion and $4 trillion to the economy, and would significantly alter the growth forecast for this year and next. Additionally, there will most likely be action on extending health care and climate change programs that will alter the growth equation in 2022 and 2023.

Unemployment and policy considerations

Given the significant boost to growth prospects from the coming change in fiscal policy, we expect that the unemployment rate, which stands at 6.75%, will fall to 4.9% by the end of 2021 and 4% in 2022.

While this will support an increase in core inflation back toward 2%, it will not lead to full employment, which we think is 3%, or create the kind of high-pressure economy that results in inflation above 2% that would lead the Fed to change its accommodative monetary policy. For this reason, we do not expect an increase in the policy rate until 2024.

We have made the case for some time that changes in the underlying structure of the economy permit it to run above the long-term trend growth rate of 1.8% for several quarters without generating significant inflation. Our forecast is predicated on that analytical framework, and given the Fed’s shift in its policy regime last year, we are certain that will set the stage for a year of robust growth.

Multipliers and upside risk

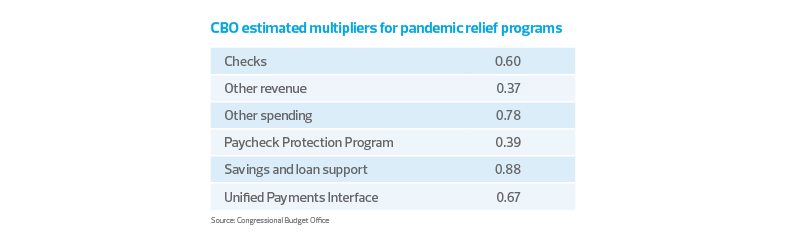

To transform increases to fiscal outlays into growth forecasts, we use the fiscal multipliers estimated by the Congressional Budget Office, which themselves are based on the most relevant academic literature.

Following passage of the CARES Act last March, the CBO found that initial estimates of fiscal multipliers were somewhat lower than compared to recent experience. That was almost certainly because of the following:

- Higher household savings: The savings of direct aid by households linked to uncertainty around fiscal aid programs turned out to be quite rational and well-founded, given the months-long delay in renewing that aid by the political authority.

- Reduced spending: The understandable pullback of outlays by upper-income households early in the pandemic is an almost perfect fit to what is known as the Keynesian paradox of thrift.

- Inability to spend: This was because of the necessity of engaging in social distancing and varying degrees of lockdowns across the economy.

We expect those headwinds to abate as the distribution of vaccines accelerates across the country in the coming months, which will likely result in stronger multipliers. In addition, as the economy reopens, the normalization of demand for services will be a large part of the economic narrative this year and next, which will result in stronger multipliers and present some upside risk to our forecast.

With the Federal Reserve committed to keeping its policy rate effectively at zero through 2023 and its purchase of $120 billion in assets each month, we are confident that there will be no crowding out of private investment this year.