What we learned at RSM’s Domestic and Global tax forum

Our Domestic and Global Tax Forum featured eight sessions that examined issues ranging from global tax reforms to the evolving state tax landscape. Here’s what we learned:

Tuesday, June 14, 2022

On-demand webcast

Chief financial officers, tax executives, finance and tax professionals

Two day event: June 14 and June 16

Complimentary

Our Domestic and Global Tax Forum featured eight sessions that examined issues ranging from global tax reforms to the evolving state tax landscape. Here’s what we learned:

Although fiscal year 22 was the best on record for state revenues, the forecast for fiscal 23 is relatively dubious because of inflation, supply chain disruptions and other economic factors. That uncertainty increases the likelihood that state departments of revenue will be more aggressive with audits and regulation in order to fund commitments that state governments are making now.

RSM’s panel of state and local tax specialists identified a list of potential targets for state departments of revenue:

“We’re seeing activity across the board in all of these areas,” said Charles Britt, a partner in RSM’s state and local tax practice. “We’re seeing statutory frameworks and interpretations where it’s becoming more routine for taxpayers to find themselves in that situation where different states are taking inconsistent approaches, and it’s subjecting them to double tax.”

We’re seeing statutory frameworks and interpretations where it’s becoming more routine for taxpayers to find themselves in that situation where different states are taking inconsistent approaches, and it’s subjecting them to double tax.

Other targets for opportunistic state taxing authorities include the income tax safe harbor statute known as Public Law 86-272; clawing back credits or incentives for which a company did not meet the requirements; and filings completed shortly after the Tax Cuts and Jobs Act or CARES Act were enacted.

“We had all this chaos going on for a couple years,” Britt said, referencing consecutive disruptions of tax reform and pandemic relief. “Some statutory changes were being retroactively applied. Last-minute changes were made to legislation. There may be some risks there. Besides that, there are some legitimate areas where states and taxpayers just interpret the law differently.

“Because a lot of these rules were passed last-minute, they were ambiguous. Some of them included mistakes that states had to go back and fix. There are going to be areas for argument there. We’re going to see these issues showing up from an audit perspective.”

As nexus standards continue to evolve—including those involving economic nexus, bright line thresholds and updates to P.L. 86-272—states are becoming more aggressive in asserting nexus for not only sales tax, but income tax as well. Companies cannot assume they are in the clear just because they don’t have physical presence in most jurisdictions.

“Everywhere you’re doing business, you may be triggering nexus,” said Anna Cronic, state and local tax manager in RSM’s Washington National Tax practice.

Everywhere you’re doing business, you may be triggering nexus.

There are great differences among the states when it comes to determining tax liabilities, said Mark Siegel, RSM state and local tax partner. With the economic nexus environment creating nexus risk for companies in more jurisdictions, it is important to understand the differences in state law that may create tax planning opportunities and risks. Companies also need to understand the nuances of taxability, apportionment planning, credits and incentives, return filing methodologies and other factors that can affect their tax burden.

“Because companies are filing in so many states now, the potential for them to run into problems is growing,” said RSM State and Local Tax Manager Brooke Nelson.

Companies should be proactive when addressing nexus concerns and objectively measure the risk level of their businesses. That is just the first step, however, and organizations must embrace and adopt best practices regarding state tax compliance and audit defense. Companies that do so will greatly increase the odds that they are in compliance or actively managing the risks of non-compliance in all the states where they have established nexus.

Debt planning for an acquisition is one way for a company to create tax efficiencies following a transaction. However, it involves numerous considerations, many of them complex.

“Globally, it’s well established that multinationals use debt planning as a way to manage worldwide tax and repatriate profits across borders at lower effective withholding rates,” said Stephen Rupnarain, national leader of RSM Canada’s M&A tax services practice. “We’re seeing a shift from a Canadian tax perspective to align with more restrictive financing regimes that currently exist in other countries. These rules are complex and supplement the existing thin capitalization regime to further protect the Canadian tax base.”

With the increased complexity, modeling will become even more critical to M&A planning to aid in understanding the benefits associated with a particular cross-border finance structure, Rupnarain said.

Jim Davenport, West region leader for RSM US’ state and local M&A tax practice, emphasized the importance of analyzing the organizational structure and state tax profile before financing to ensure debt is placed at an entity that can properly obtain the benefit of interest expense deductions in certain jurisdictions.

“We frequently see combined groups simply pushing down interest expense to operating companies, and there hasn’t been a lot of consideration or work done around debt placement and interest within the corporate structure, which can result in significant adverse state tax consequences,” Davenport said. “When you turn around and try to sell the target, these consequences materialize and can cause a lot of issues.”

Among numerous tax considerations for M&A, the panel also discussed mitigation strategies, including representations and warranties insurance and tax clearances.

Davenport said RSM is seeing representations and warranties insurance more frequently than in the past given market trends. Historically, buyers and sellers may have waived state bulk sale notifications or declined to pursue tax clearances because of the potential to create a delay in closing.

“We are seeing more tax clearances, as it’s often a really effective way in the right type of transactions to get comfortable and get that assurance that there are no outstanding, historical issues out there,” Davenport said.

The new attribution requirement for foreign tax credits limits what taxes are creditable, a seismic change that has far-reaching implications for international business.

Multinationals continue to adjust to the final regulations the IRS published in January. Impacted areas include certain corporate income tax regimes, such as Brazil; withholding taxes from countries that do not have an income tax treaty with the United States; capital gain taxes on the sale of property; and controlled foreign corporations.

“We’ve got to start looking at the business model for your company and the ways to plan around this potential loss of foreign tax credits—because otherwise you’re going to be double-taxed on all this foreign income,” said Mathew Hopfer, foreign tax credits specialist in RSM’s global tax practice.

To understand the effects from a Brazilian tax perspective, Flávia Mariotto, head of international tax at RSM Brasil, discussed the Brazilian transfer pricing regime and its differences from U.S. tax rules. She assessed the potential changes in Brazilian law in response to these regulations, as well as other planning opportunities taxpayers may have when doing business in Brazil.

Hopfer described planning opportunities that involve the tax and commercial components of a business. They include examining transaction flow and any relevant classification methodologies, revisiting the company’s business model, assessing transfer pricing and analyzing permanent establishment.

The digital economy represents potential for significant tax-base growth in every state within the United States.

“The last few years, we haven’t seen much legislative expansion into digital goods, products and services,” said RSM Senior Director Mo Bell-Jacobs. “But if states need money—and it’s looking like they may by the end of fiscal years 23 or 24—we could see states refocusing on activities generating revenue and generating transactions that are currently escaping taxation in the digital economy.”

What might that look like? Bell-Jacobs, a state tax specialist in RSM’s Washington National Tax Practice, offered a list: expanding the sales tax base; adding digital goods, products and services to statutory language governing different types of taxes; a digital advertising tax similar to one Maryland has pioneered; and taxes on personal information and data storage.

States might choose not to legislate these items and instead work them out through informal policy, or even audit positions, Bell-Jacobs said.

In the meantime, ambiguity clouds the tax treatment of digital assets in many cases. Take, for example, an NFT that is a sporting event ticket designed by an artist. It’s an event ticket and a piece of art. The price of admission is fixed, but the art could appreciate.

Amol Jain, RSM senior manager and state tax specialist, reiterated the importance of a two-step process. Start with characterizing the asset and then identify the applicable tax laws for each state involved.

“We’re going to use the same framework as before,” Jain said, “but there needs to be flexibility in defining it.”

If states need money—and it’s looking like they may by the end of fiscal years 23 or 24—we could see states refocusing on activities generating revenue and generating transactions that are currently escaping taxation in the digital economy.

Over the last five years or so, state revenue authorities have become more aggressive in auditing companies’ transfer pricing rules and methods, RSM Senior Director David Brunori explained.

There have been more audits, and the states have added personnel, particularly lawyers, because many of those audits end up in litigation. The states are also using talented outside consultants more than ever.

“A state transfer pricing audit is miserable,” said Brunori, who specializes in state and local tax as a member of RSM’s Washington National Tax practice. “While taxpayers have a pretty good record winning these in court, they spend an inordinate amount of money doing so. A transfer pricing audit seemingly never ends, and they sap the life out of you.”

Companies can mitigate the likelihood they will have to endure one by knowing the risk factors.

A transfer pricing assessment conducted by specialists can help determine whether the volume and dollar amount of a company’s intercompany transactions reach the threshold that tend to attract state auditors. Other factors include whether a company operates in a so-called separate accounting state or does a lot of work in states known for transfer pricing audits, such as Louisiana.

“The best way to mitigate risk at the state level is via a contemporaneous transfer pricing study,” said Brunori, meaning a study performed before or at the time of the transactions, as opposed to one in the face of an audit. “We have seen states drop audits when you have a good transfer pricing study. They’ll come in, look at it, and say, ‘OK,’ and move on.

Incompatibilities remain between the Organisation for Economic Co-operation and Development’s Pillar 2 regime and the United States’ global intangible low-taxed income (GILTI) regime in the absence of legislation to address them.

“Assuming we have no legislation passed to get GILTI to conform by 2024, U.S. corporations have some real issues,” said Ayana Martinez, a partner in RSM’s Washington National Tax practice who specializes in global tax.

The biggest disconnect, Martinez said, is the difference between the GILTI rate (between 10.5% and 13.125%) and Pillar 2 tax rate (15%). Also, Pillar 2’s effective tax rate is determined on a country-by-country basis, and GILTI is currently being calculated on a blended basis. Pillar 2 has a threshold of 750 million euros while GILTI has no threshold.

Provisions to help marry Pillar 2 and GILTI exist in the version of the Build Back Better Act that the U.S. House of Representatives approved in November 2021, but the bill is languishing in the Senate amid doubts it will ever move forward.

Without legislation to reconcile differences, Martinez said, a company could potentially have to pay taxes in foreign jurisdictions even if it is in a loss position overall or by jurisdiction. She also noted a risk of double taxation because of a lack of offsetting foreign tax credits.

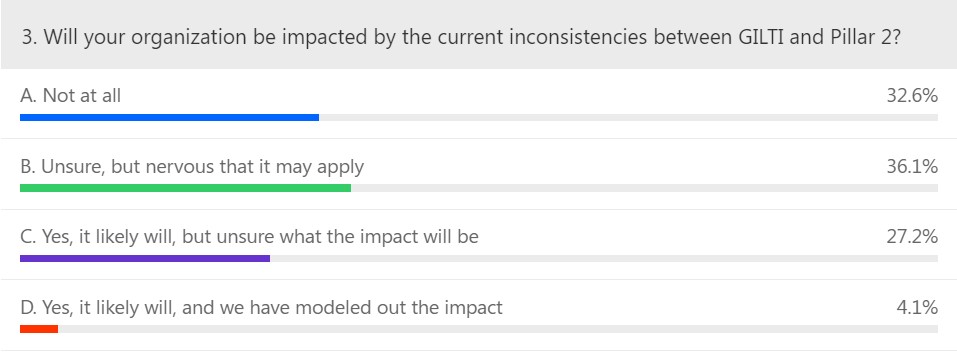

In response to a polling question about whether session attendees’ organizations would be affected by the inconsistencies between Pillar 2 and GILTI, a total of 63.3% of respondents indicated they were either uncertain or nervous theirs would be.

“We are seeing a lot of our clients start to get on top of this and model out what the impact is,” Martinez said, “particularly for the purposes of their financial statements.”

Businesses are seeking alternatives to reduce their exposure to Asian suppliers amid pandemic-related supply delays, a panel of RSM supply chain specialists said.

“Wal-Mart and Target are starting to get the inventory they ordered two years ago,” said Bart Huthwaite, a principal in the firm’s management consulting practice. “Given that demand has shifted significantly over the past several months, we’re seeing disconnects between supply and demand”.

Meanwhile, new trade rules designed to dissuade the use of forced labor in China take effect on June 22; they require additional transparency and put more responsibility on businesses, said Mark Ludwig, national leader of the firm's trade advisory practice.

To mitigate risk and build resiliency, some midsize businesses are seeking alternative suppliers in diverse regions of the world. Many are exploring sourcing alternatives in Eastern Europe and Mexico, panelists said. In addition, U.S. companies are exploring reshoring production into the United States, a move that comes with challenges, such as the high cost of raw materials amid rising U.S. inflation, a tight labor market and tax implications for setting up new facilities, said State and Local Tax Partner Sherri York.

While the Russia-Ukraine war has led to oil shortages and higher domestic prices at the pump, it has not resulted in broad-based supply disruptions, panelists said. Instead, it has been tough on select industries, including some food companies reliant on wheat and automotive suppliers that source palladium.

Businesses that take advantage of technology to manage demand for their products in the volatile supply environment will have better control over inventory, Huthwaite said, noting: “Good, clean data is going to allow companies to make good, informed business decisions and do agile planning.”

Watch all eight sessions from the 2022 domestic and global tax forum

Tuesday, June 14, 2022

On-demand webcast

Chief financial officers, tax executives, finance and tax professionals

Two day event: June 14 and June 16

Complimentary