Media companies’ top-line revenue is decreasing as consumer habits shift.

Key takeaways

Inflation means consumers have less to spend on entertainment.

Companies should assess ways to reduce churn and diversify their content.

The last several years have been a rollercoaster for the media industry. The 2020 pandemic lockdowns led consumers to shift from spending on experiences outside of their houses to spending money predominantly on at-home entertainment. That said, the trend quickly reversed when the economy reopened, as consumers started spending less time at home and began consuming media and entertainment at theaters and live venues again. Some believe that we are now in another recessionary period for the media sector, given that inflation levels are at record highs and consumers have reduced their discretionary spending.

In 2022, the media industry as a whole has performed significantly worse than the overall market; as of Aug. 31, 2022, the S&P 500 Media & Entertainment Index was down 33.87% compared to the S&P 500, which itself was down 17.02% on a year-to-date basis, according to Bloomberg.

The top challenge for the media industry in a slowing economy is revenue

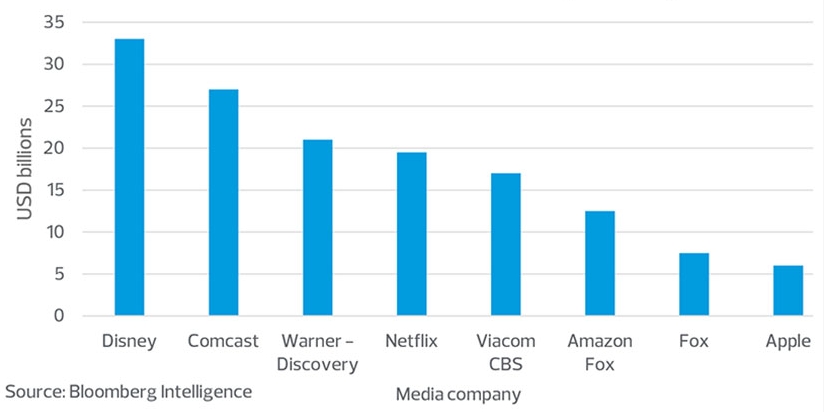

Media companies’ top-line revenue is decreasing as consumer habits shift, while bottom-line costs are increasing based on content costs.

Companies are dependent on advertising for a substantial portion of their revenue. For example, large TV conglomerates depend on ads for 30% to 40% of their revenues, making them highly vulnerable in an economic recession. Typically, advertising spending is one of the first things that companies reduce during downturns; however, this year may still have some increase in ad spend due to the upcoming political campaigns for the midterm elections. That said, media companies are battling a content war, with high competition and the continuous need for new, high-quality entertainment which is accompanied by significant costs.

Estimated 2022 content spending

From a consumer angle, inflation is hurting discretionary spending; consumers have less to spend on entertainment since the cost of necessities is increasing. As people assess their budgets, some consumers are reducing the number of services they are subscribed to, causing higher churn for the companies.

Other media industry challenges include saturation and customer churn

Saturation in the media industry is making it harder for companies to grow user counts, especially in the streaming sector which is also being affected by inflation. As consumer spending gets squeezed by inflation, streaming subscribers are becoming more and more fickle. Consumers are faced with more platform choices than ever and are making more deliberate decisions to cancel existing subscriptions when they start new ones. This means subscription platforms need to plan for increased customer churn and lower retention.

How media companies are mitigating these challenges

Raising service costs will help counterbalance some of the increased content production costs and losses from advertisement cuts.

Streaming companies can find innovative new ways to reduce churn. Some brands are creating ad-based products aimed at customer retention. The plan is to reduce the price of their services by introducing advertisements, but if consumers want an ad-free experience, their price will increase.

Media companies can begin to analyze their customer base and crack down on account sharing to avoid lost revenues. Roughly two in five adults share passwords to online accounts, according to the Pew Center for Internet and Technology. That figure is even higher among millennials, 56% of whom have shared passwords.

Media companies are focusing on investing in the future by diversifying their library of content. As an example, most streaming providers are making large leaps by investing in sports media rights.

RSM contributors

Industry inflation snapshots

Hampered by rising inflation, geopolitical uncertainty and supply chain disruptions tied to the COVID-19 pandemic, the U.S. economy contracted in each of the first two quarters of 2022.

RSM economists peg the chance of a full-blown recession over the next 12 months at about 65% (as of October 2022); an economic slowdown of any measure creates significant challenges for middle market companies. We took a look at the potential impact on several industries.