Demand for durable goods has remained positive in recent months—a positive sign.

Key takeaways

Still, accurately forecasting mid- to long-term future demand will prove to be a challenge.

Manufacturers who prioritize data-driven decision making will be best positioned to adapt.

Demand for durable goods has remained positive in recent months amid soaring inflation and pessimism in the outlook. This is a positive sign for the manufacturing sector, even as the U.S. economy as a whole faces headwinds. Forward-looking data indicates such goods orders moved into positive territory in August after two months of contraction, according to the latest purchasing managers index survey from the Institute for Supply Management. If that metric remains in growth territory, however small that growth may be, it will signal that the sector is not headed into a recession in the near term.

Though peaks in inventory levels were consistent with annual trends in preparation for fourth-quarter demand, manufacturing companies should take appropriate measures to ensure inventory levels are tightly managed to balance the ability to meet consumer demand while controlling costs.

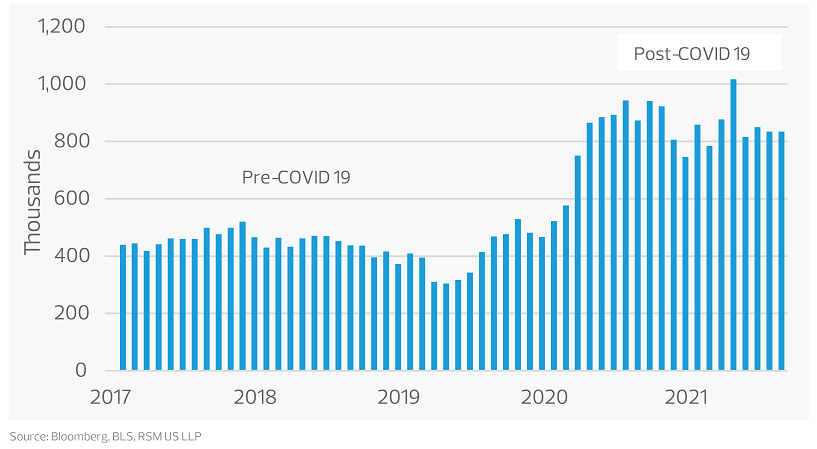

Durable goods new orders: Month-over-month, seasonally adjusted

The broad-based Bloomberg commodity spot index is showing a downward trend from its all-time high in May of this year, signaling a slight easing on both pricing and margin pressure in the coming months. Still, commodity prices continue to remain above the 10-year historical average and have room to fall before normalizing. It remains to be seen at what rate prices will respond to the Federal Reserve’s interest rate increases before prices begin to calibrate.

Commodity prices falling but remain above historical averages

Open manufacturing jobs remain elevated and will largely go unfilled

Supply chain pressures have eased back into a more neutral territory since July, according to RSM’s Supply Chain Index. If this trend continues, it would signal goods disinflation may be ahead. This would be welcomed news against inflationary increases driven by supply shortages, which are outside of the Fed’s control.

The top challenge for manufacturers in a slowing economy is demand forecasting

Accurately forecasting mid- to long-term future demand will prove to be a challenge. On one hand, manufacturing orders are holding steady. On the other hand, the Fed is seeking to dampen demand without tipping the country into a recession. Manufacturers will need to plan for a pullback in orders. The Fed will not stop raising rates until it sees signs inflation is trending toward its target rate of 2% from its 8.5% rate today. Predicting how much and when sales will contract as a result of the Fed’s actions will be a challenge.

Labor is another major challenge

The labor shortage continues to crunch manufacturing companies. Manufacturing hiring has slowed but still added 22,000 jobs in August. The sector’s labor market will continue to be tight, with 834,000 unfilled jobs—nearly twice the pre-pandemic level. Total labor force participation returned to its high-water mark of 62.4% per the August 2022 jobs report—not seen since March of this year. This milestone remains below 63.4% in February 2020 before the pandemic.

Workers in the prime ages of 25-44 added to the total labor force, while those aged 55-64 have been declining since June of this year. Eased concerns over COVID-19 have likely drawn some workers back to work, and inflationary increases that eat away household budgets and savings may draw additional workers into the workforce in the coming months.

For many manufacturers, labor attraction and retention is an issue in terms of both factory-floor workers and white-collar engineers who operate or oversee complex processes and equipment. As economic headwinds mount, companies will need to develop a workforce plan that avoids the loss of highly sought-after talent. Locking in the appropriate talent with the necessary skillset is imperative to not only current production capacity but to navigating an ever-evolving digital environment.

How the sector is mitigating these challenges

Manufacturers who continue to prioritize data-driven decision making will be best positioned to quickly adapt to evolving market demand. Data-driven decision making will unlock opportunities to gain efficiency in the supply chain and ensure appropriate workforce resources to meet production needs. Leveraging technology to support the workforce will continue to be a priority to streamline processes and provide talent support.

To best position a company over the next 12 to 18 months, management teams might consider performing an analysis using recent demand trends and inflation data to enhance their projections.

RSM contributors

Subscribe to Manufacturing Insights

Sign up to receive our monthly tax, accounting and operational information, ranging from tips for addressing daily challenges to strategic and long-term planning initiatives.

Industry inflation snapshots

Hampered by rising inflation, geopolitical uncertainty and supply chain disruptions tied to the COVID-19 pandemic, the U.S. economy contracted in each of the first two quarters of 2022.

RSM economists peg the chance of a full-blown recession over the next 12 months at about 65% (as of October 2022); an economic slowdown of any measure creates significant challenges for middle market companies. We took a look at the potential impact on several industries.