Technology advancements and supply chain disruptions are putting more pressure on costs

Key takeaways

The talent/skills gap has caused delays in the claim settlement process

Insurers should have thoughtful approaches to data, technology and talent

While claim inflation—combined with social inflation—certainly poses a unique challenge for insurers, insurance carriers are generally faring better than the overall economy now. Inflation isn't a new risk for insurance carriers; over the last decade, there has been a steady increase in claim costs, particularly related to advances in automotive technology. This poses some concerns for auto insurers who are feeling the impact to their margins due to auto repair costs, global supply chain issues, and a labor and skills gap.

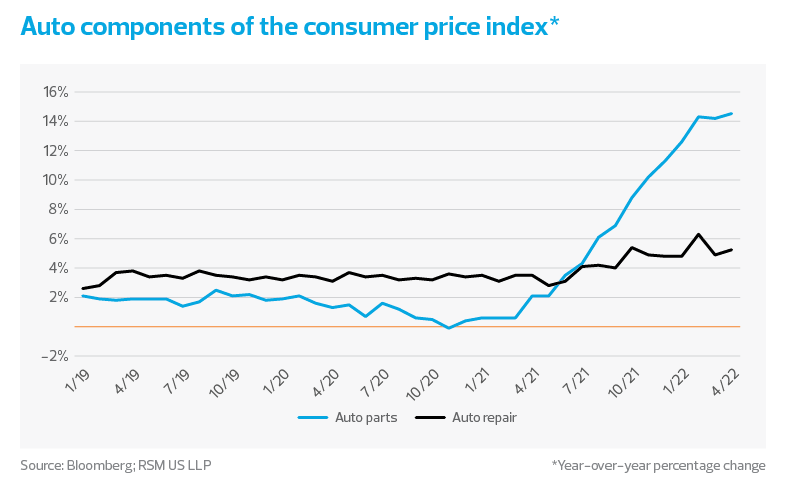

While there are some indications that claim cost inflation is leveling, and we are seeing a slight decline in auto parts costs, the price to repair autos continue to rise. Auto repair costs are at 4.9% as of March 2022, twice as high as the 2.3% 2016–2019 average, according to Bloomberg.

By the numbers

Supply-side shocks such as price volatility and commodity shortages affect the productive capacity of the economy. Raw material and commodity prices can directly contribute to rising claim costs and, as we show below, the auto parts component of the consumer price index has spiked since early 2021. In April, auto part prices were up about 14% compared to the same time in 2021.

A top challenge for the insurance industry in a slowing economy is parts prices

Traditional private passenger vehicles are transforming at a rapid pace into connected cars, equipped with technologies such as RADAR (radio detection and ranging), LiDAR (light detection and ranging), advanced sensors, cameras and advanced driver assistance capabilities to meet the needs of consumers. A recent Fortune Business Insights study found that the connected car market in North America will exceed $60 billion in 2022. These new, tech-enabled automotive parts are more expensive to replace in the event of an insurance claim, and the repairs rely on highly skilled and costly labor.

Enter the pandemic and the exacerbated effects on claims inflation. Supply chain constraints have led to further increases in claim costs related to parts and intermediate materials, recent wage pressures and increased demand for used vehicles. Bottlenecks have also caused delays in the claim settlement process, resulting in higher costs for insurers as they provide their customers with rental vehicles and temporary housing.

Technology such as advanced driver assistance systems in newer vehicles is also becoming more commonplace. For the near term, this means that these tech-enabled automotive parts will be more expensive to repair or replace in the event of an insurance claim. For instance, the traditional private passenger windshield claim typically costs less than $500. However, many of the tech-enabled capabilities and sensors designed to protect you are located right behind and/or within the windshield. Estimates to recalibrate this technology can cost between $1000–$1500 on top of the typical replacement cost depending on the manufacturer.

Alongside parts prices, labor is another major challenge insurers are navigating. The Bureau of Labor Statistics projects a 4% decline in employment in the overall auto technician field through 2029, according to CCC’s 2022 Crash Course Report. With the rapid advancement of tech-enabled vehicles entering the market, the lack of skilled technicians can pose additional costs for the insurer such as longer repair cycle times, supplements and rental vehicle costs. It’s not just a gap on the repair facility side; insurers experience similar skills challenges among their appraisers too. Unfortunately, even with paying higher wages, offering increased benefits and providing more work flexibility, mining the technical gap will be an issue for the foreseeable future.

How insurers are mitigating the impacts

To mitigate these risks, insurers need to leverage technology to estimate auto vehicular damage and upskill resources. Three estimation methods, while they may not address supply chain issues, can improve claim efficiency, accuracy and the customer experience:

- Appraisals using photo-estimation capabilities that provide a 360-view of damages

- Guided estimations using artificial intelligence (AI) and augmented reality (AR) to deliver information that recognizes damage to vehicle components and makes recommendations for repair operations

- Automated estimations leveraging computer vision and algorithms for repair/replace decisions, and parts availability for pricing decisions

Insurers should also be intentional with talent acquisition and retention strategies that go well beyond wage considerations. Companies need discipline and consistency in creating clearly defined and achievable career pathways through mentoring, upskilling and training to address skill and knowledge gaps. This will be especially crucial as more tech-enabled vehicles become the standard and employees need to undergo technical training programs or acquire certifications.

Other top considerations to offset the impact of headwinds facing the insurance industry

Accelerating digital transformation in all business functions, including distribution, underwriting, policy servicing, billing, claims and more

Expanding the insurance ecosystem connecting everything insurance to the internet

Enabling a flexible workforce that can work virtually

Providing a customer experience that automates the ordinary and humanizes the extraordinary

RSM contributors

Industry inflation snapshots

Hampered by rising inflation, geopolitical uncertainty and supply chain disruptions tied to the COVID-19 pandemic, the U.S. economy contracted in each of the first two quarters of 2022.

RSM economists peg the chance of a full-blown recession over the next 12 months at about 65% (as of October 2022); an economic slowdown of any measure creates significant challenges for middle market companies. We took a look at the potential impact on several industries.