U.S. private equity deal activity is expected to remain muted into the first quarter of 2023.

Key takeaways

PE managers may face difficulty with securing debt financing and around planned exits.

Various strategies can be employed to continue executing deals even if conditions worsen.

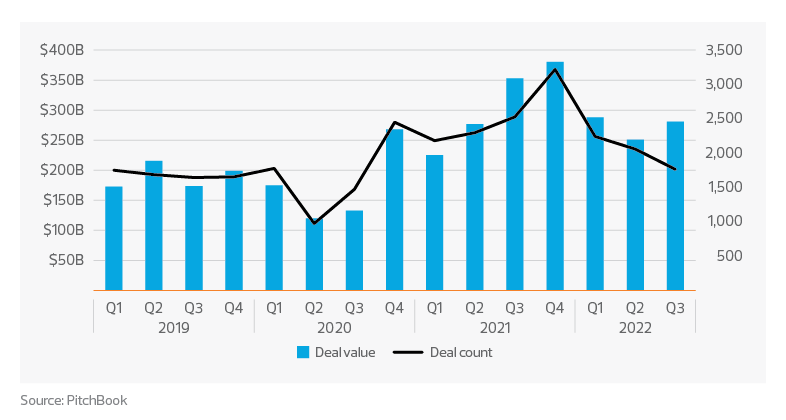

U.S. private equity deal activity through the third quarter of 2022 did not maintain the breakneck pace of 2021, but still held up remarkably well considering the various headwinds that caused the public equity markets to collapse through the end of the third quarter. PitchBook data through the end of September shows U.S. PE deal activity totaled $819 billion from 6,062 deals compared to $854 billion from 7,003 deals over the same period in 2021. That represents declines of 4.1% and 13.4% in deal value and deal count, respectively.

U.S. private equity quarterly deal activity

Unlike 2021, which ended with a flurry of deals that sustained momentum into the first quarter of 2022, the final quarter of this year and first quarter of 2023 are likely to be more muted.

Panicked equity and debt markets have resulted in weakened financial conditions. This has made securing debt financing for PE buyout deals much more difficult as lenders take a more cautious approach or demand higher yields in the current rising interest rate and high inflation environment.

The public exit market is also not cooperating, with the number of initial public offerings of PE-backed companies at its lowest level since 2008. Unwillingness by sellers to sell at depressed prices will force a delay in some planned PE exits.

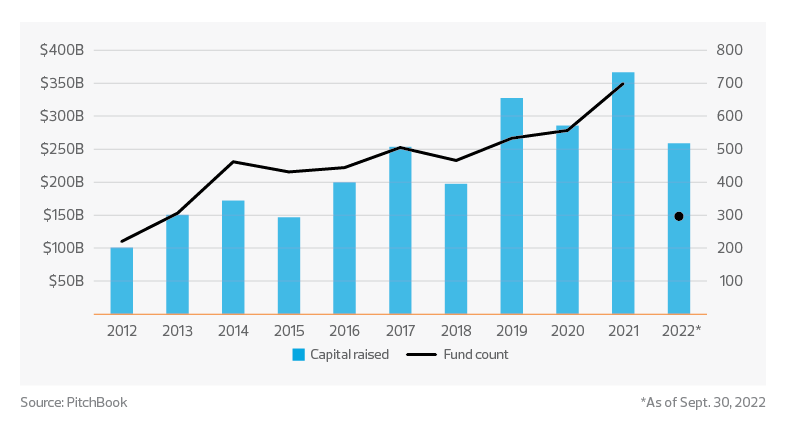

Despite this backdrop, we do not expect deal activity to capitulate. A steady flow of deals should continue, as PE managers still have plenty of dry powder. Given prevailing headwinds, PE managers enjoyed a relatively strong fundraising year. Large, established managers fared particularly well in a much more selective fundraising environment that favored the safety of size and tenure.

U.S. private equity fundraising activity

PE managers can also employ various strategies to continue executing deals even if conditions worsen and the deal-making environment slows. Those strategies include:

- Add-on investments: Acquisition of a new platform company in the current climate may be a challenge for a PE fund given the size of the commitment required for such an addition. Risk tolerance thresholds may simply not be high enough to take on larger deals. On the other hand, investment in add-ons to existing platforms will continue to present opportunities to close deals. Companies can still execute a roll-up strategy to expand established platform companies, even in a slow environment.

- Carve-out deals: Public companies that need cash or want to shore up cash reserves but face an unreceptive public market may find that now is the time to spin off units that are not part of their core strategy. Such carve-outs can form the base of a platform strategy for a PE group, feed an add-on strategy for an established platform, or appeal to a strategic buyer in an adjacent industry. In the current environment of smaller deal sizes, carve-outs may be the ideal-size transactions that cautious deal-makers are willing to open their checkbooks for.

- Contingent sale proceeds: Contingent sale proceeds have long been used by PE firms when selling companies that have the potential to grow significantly post-sale. These provisions can be an option in the current environment where sellers may feel they are leaving money on the table by selling at valuations that fully price in current economic downside risk without accounting for the strong rebound that may ensue when conditions improve. Use of contingent sale provisions may help to incentivize both buyers and sellers and break deadlocks by factoring in opposing views on current and potential future pricing.

- Take-private deals: Several public companies that went public during the IPO frenzy of 2020 and 2021 have struggled to maintain their valuation of the boom period. Tapping the public markets at the current valuations could result in significant dilution for existing shareholders and would be undesirable. Some of these companies need capital injections—the reason they may have rushed to go public during those boom years. For such companies, their only hope of fresh capital may be to return to private hands and offer themselves up to willing PE buyers. We expect such “private to public and back to private” deals to materialize in greater number over the coming quarters should public markets show no respite.

- Private investment in public equities (PIPEs): At the height of the market panic in March and April 2020, before the Federal Reserve’s lending programs made their way into the system to ease funding pressure, public companies were turning to private equity for capital in the form of PIPE deals. PIPEs were also popularized by the special purpose acquisition company boom of 2020 as a key aspect of financing the reverse merger transaction. Private equity firms may find opportunities to deploy capital through this medium should public companies continue to find public markets unwelcoming.

Companies looking to explore these various strategies would do well to assess how such investment and deal options align with their broader business strategy. A third-party advisor can also play a crucial role in performing due diligence for these scenarios.