Before the coronavirus pandemic, Americans might have been more reluctant to try video appointments with their doctors, perhaps uncertain of the quality of care that telehealth would allow. But now, five months into the crisis, necessity has spurred rapid, widespread adoption of telehealth in the United States. If physicians or patients thought video health care appointments were simply a fledgling trend before 2020, plenty of them almost certainly have a different perspective now.

Earlier in the pandemic, news outlets reported that telehealth appointments were soaring. According to research from Fair Health, telehealth claim lines increased by 4,347% nationally, from 0.17% of medical claim lines in March 2019 to 7.52% in March 2020. The Providence Medical Group reported that it experienced an increase from 700 visits a month to 70,000 visits a week after ramping up their telehealth platform in March, as we noted in our health care industry outlook in July. Medicare figures point to skyrocketing use as well: “At least 10 million Medicare beneficiaries have used telehealth since early March,” according to a CNBC article from mid-August.

The rapid expansion of virtual health in the wake of COVID-19 is not contained to the United States. Canadian company WELL Health Technologies reported a 1,200% increase in digital services revenue year-over-year for the second quarter, according to a report from Desjardins Capital Markets. This segment of the company 's health care business grew to 22% of total revenue from just 2% the prior year, per that report.

Even if the telehealth boom is leveling off now compared to March and April, we do not expect telehealth use and investments ever to go back to pre-pandemic levels. Increased capital from investors and pressure on the U.S. Centers for Medicare and Medicaid Services to change its reimbursement rules for telehealth are two indicators that widespread adoption of this service is here to stay.

Investment and regulatory landscape

The adoption of telehealth has long been constrained by the regulatory and reimbursement environment. Physicians, for example, cannot practice across state lines (e.g., a doctor in Minnesota generally cannot treat a patient in New York), and that limit historically has applied to virtual care as well. Health care providers have also criticized the reimbursement framework; a physician cannot be reimbursed for a virtual visit with a patient covered by Medicare unless that physician has previously seen that patient in person.

The pandemic temporarily relaxed such regulatory rules, and we expect, as do others, that some of these rules will be permanently relaxed or revised. Whatever changes may happen with Medicare reimbursement, payors will likely follow suit. Industry stakeholders, including tech investors, are watching closely to see how these regulatory decisions shake out.

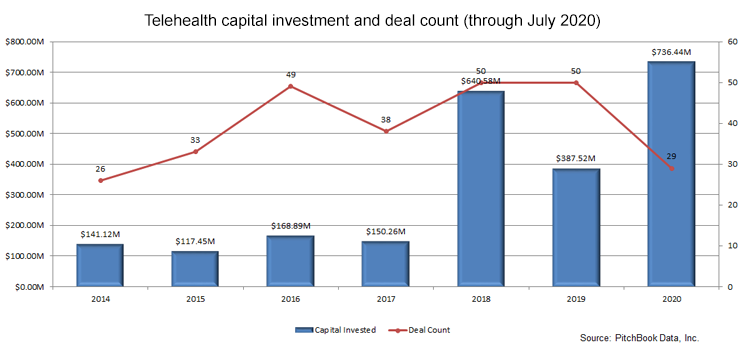

Meanwhile, telehealth is on pace for a record-setting year in terms of both the number of venture capital deals and the capital raised in those deals, according to data from PitchBook. We don 't expect anything in the second half of 2020 that will slow down telehealth deal-making.