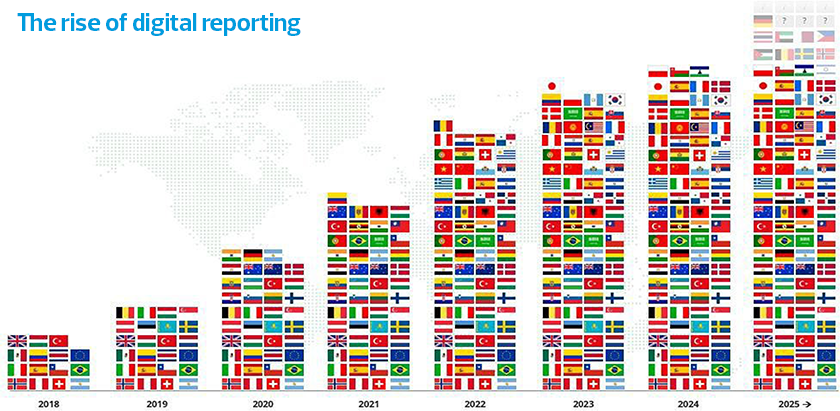

The transition from traditional paper-based invoicing to electronic invoicing (e-invoicing) is reshaping business operations on a global scale. As e-invoicing becomes a regulatory mandate across business-to-government (B2G), business-to-business (B2B), and soon, business-to-consumer (B2C) transactions, business leaders must understand and address the strategic challenges that accompany this shift. Mastering these challenges not only strengthens compliance but also positions organizations for operational excellence and a competitive advantage.

Strategic awareness of system nuances

Understanding the nuances of different e-invoicing systems is crucial. Each country has specific requirements for managing data elements, which can be either hard-coded or dynamic. For example:

- Brazil: The Nota Fiscal Eletrônica (NF-e) system requires adherence to fixed fields and adaptable data elements, such as transaction-specific currencies.

- Poland: The Krajowy System e-Faktur (KSeF) mandates the use of structured XML formats and precise compliance with specific fields, including value-added tax (VAT) identification numbers and invoice dates.

Strategically, leaders must invest in flexible e-invoicing solutions capable of adapting to these varying requirements. Understanding these nuances helps organizations avoid compliance errors and streamline operations across multiple markets.

Strategic error management

Error management in e-invoicing involves more than just correction; it requires a strategic approach to prevent and address mistakes efficiently. For instance:

- Mexico: The Comprobante Fiscal Digital por Internet (CFDI) system requires generating credit notes to correct errors and issue new invoices.

- Poland: The KSeF system supports real-time reporting and validation, necessitating prompt error resolution to avoid operational disruptions.

Investing in advanced error detection and correction technologies ensures that mistakes are quickly addressed without compromising compliance or efficiency. A strategic approach to error management enhances overall operational effectiveness and maintains regulatory adherence.

Supporting diverse transaction types strategically

E-invoicing systems must handle a variety of transaction types to support comprehensive financial management. For example:

- Italy: The Sistema di Interscambio (SDI) platform accommodates standard invoices, credit notes, debit notes and vendor bills.

- India: The Goods and Services Tax Network (GSTN) requires e-invoicing for B2B transactions, including credit memos and vendor bills.

- Poland: The KSeF platform also manages multiple transaction types, including standard invoices, credit notes and debit notes.

Strategic investment in e-invoicing technology that can handle diverse transaction types and integrate with other financial systems is essential for scaling operations and responding to market demands.

Validating transaction receipts strategically

Validation of transaction receipts is vital for ensuring transparency and reducing disputes. For example:

- Chile: The Servicio de Impuestos Internos (SII) system requires confirmation of receipts within a specific time frame.

- Poland: The KSeF system requires real-time validation by tax authorities before an invoice is legally binding.

Leaders should prioritize e-invoicing systems with robust validation and tracking capabilities to ensure that both parties have a clear understanding of transaction status. This investment enhances transparency and reduces the risk of disputes.

Ensuring compliance with government requirements

Compliance with local regulations is a strategic imperative in e-invoicing. For instance:

- European Union: Directive 2014/55/EU mandates standardized fields such as VAT identification numbers and invoice dates.

- Germany: The XRechnung format is required for B2G transactions.

- Poland: The KSeF system demands adherence to structured XML formats and specific field requirements.

Strategically, organizations must configure their e-invoicing systems to meet these compliance requirements. Investing in compliance management tools and staying updated on regulatory changes help avoid penalties and ensure smooth operations.

Implementing controls to prevent post-transmission edits

Maintaining the integrity of transmitted invoices is crucial. For example:

- Spain: The Immediate Supply of Information (SII) system locks invoices from further editing post-transmission.

- Poland: The KSeF system enforces controls to prevent unauthorized post-transmission edits, ensuring consistency and protecting against fraud.

Leaders should advocate for e-invoicing systems that include robust controls to safeguard against potential fraud and discrepancies. Effective post-transmission controls protect the integrity of financial records and maintain consistent data across systems.

The takeaway

As e-invoicing becomes a global standard, business leaders must navigate system-specific challenges with a strategic mindset. By understanding system nuances, managing errors effectively, supporting diverse transaction types, validating receipts, ensuring compliance and implementing robust controls, your organization can achieve regulatory compliance and gain a strategic edge in the digital economy.

The diverse e-invoicing requirements in Brazil, Mexico, Italy, India, Chile, Germany, Poland and Spain underscore the importance of a tailored and strategic approach. Addressing these challenges with foresight and adaptability enhances operational efficiency and positions your organization for success in an increasingly interconnected world.