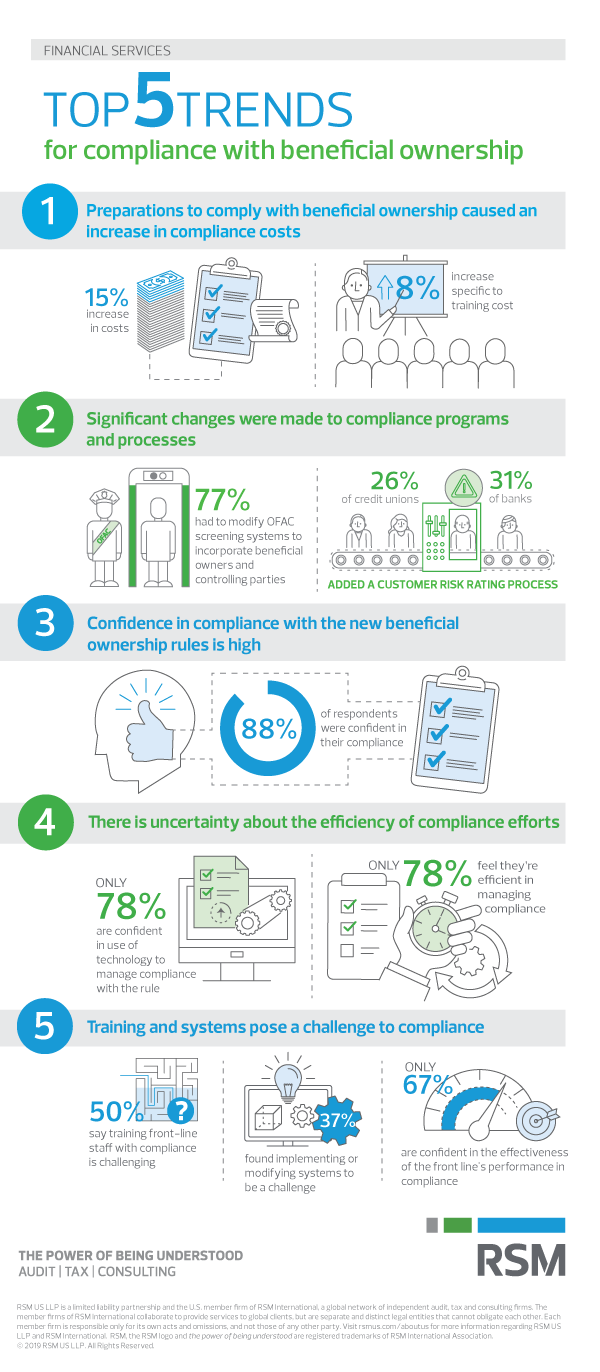

Regulatory scrutiny and enforcement are continuing to put pressure on anti-money laundering (AML) programs, with banks needing to continuously enhance their strategies to address necessary changes. The second edition of RSM’s Anti-Money Laundering Survey was developed to continue to help banks understand best practices and benchmark their AML compliance efforts against peers.

The survey provides detailed analysis of AML functional structures specifically in relation to customer due diligence and beneficial ownership compliance. The survey helps decipher the degree of change required for financial institutions to ensure compliance with the regulations in the areas of technology, training, and implementation and costs.