The first day of a new year means different things to each and every one of us. Some will begin eating healthier, starting up a gym membership (again), or spending more time with family. For many in the financial services industry, the new year represents an additional challenge regarding mortgage disclosure regulations.

More than seven years after the passage of the Dodd-Frank Wall Street Reform and Consumer Protection Act (Dodd-Frank), the updates to reporting standards under the Home Mortgage Disclosure Act (HMDA) will take effect on Jan. 1, 2018. These updates represent by far the most substantial expansion of data reporting requirements since the original passage of the regulation in 1975, and financial institutions are racing to adapt to the change.

Background

Analysis of loan application data enables regulatory agencies, economists, advocacy organizations and the public to study the availability of credit and monitor for potential disparities based upon prohibited basis factors. The data collected under HMDA enables monitoring for potential discrimination as defined under the Equal Credit Opportunity Act (ECOA), as well as broader study of the conditions within the real estate market.

Statistical analysis of loan application data serves a key role in identifying and quantifying disparities in underwriting and pricing practices along potential prohibited basis factors. HMDA data represents the primary instrument driving the Consumer Financial Protection Bureau’s (CFPB) mandate to monitor and prevent lending discrimination. Statistical analysis of this data is often the impetus of additional investigation into a financial institution’s lending practices. Therefore, reporting accurate data is critical for effective analysis.

While HMDA data attributes have facilitated study of trends in real estate lending activity and monitoring of potential disparities based upon raw outcome ratios, the file standard did not keep up with industrywide changes. These changes included the adoption of automated underwriting systems, innovations with the structure and pricing of real estate loan products, as well as broader environmental changes such as the creation of web-based lending platforms. In particular, the previous data collection requirements do not capture critical underwriting and pricing criteria such as credit score, combined loan-to-value ratios, or debt-to-income (DTI) ratios.

Changes to transactional and institutional coverage

To address new challenges and innovations, beginning with the 2018 reporting period, HMDA reporting requirements have expanded institutional and transactional coverage. For the first time, real estate secured open-end lines of credit are required to be reported if the institution meets the reporting threshold. In August 2017, the CFPB amended the HMDA Final Rule to increase the reporting threshold to 500 originations in each of the two prior years. On Jan. 1, 2020, the threshold will be reduced to the originally proposed 100 home equity line of credit (HELOC) originations.

Expansion of data reporting standards

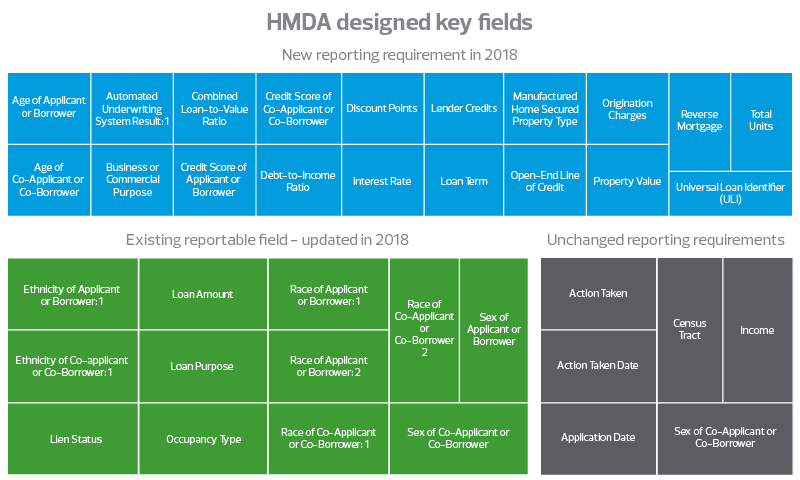

In addition, starting Jan. 1, 2018, mortgage lenders will be required to collect up to 110 reportable data fields, a significant increase from the 39 fields previously collected. The 2018 HMDA reporting standard introduces 76 fields which were not previously collected. Furthermore, 23 data fields previously included in the HMDA data specifications have been modified. The collection and reporting of the new data set represents a significant challenge for filing institutions.

The CFPB has characterized the new data fields as falling into one of the following four categories:

- Information about the applicant and underwriting process

- Property information

- Loan features

- Unique identifiers

In October 2017, the prudential regulatory agencies (Office of the Comptroller of the Currency, Federal Reserve and Federal Deposit Insurance Corporation) announced 37 key fields which will be the primary requirements corresponding with the HMDA reporting requirements scheduled to take effect on Jan. 1, 2018. These fields have been identified as most important for the execution of analysis and oversight of HMDA data.