The Securities and Exchange Commission’s (SEC) whistleblower program had a record-breaking year for tips received, claims processed and dollars awarded to tipsters in fiscal year 2020. In fact, the SEC received over 6,900 whistleblower tips, the largest number since the program’s inception 10 years ago. This represents a 31% increase from 2018, the year in which the SEC received the second-highest number of whistleblower tips, and a 130% increase since the beginning of the program. SEC directors have identified the COVID-19 pandemic and its impact on the financial markets as key drivers of the increase in whistleblower tips and award amounts paid to tipsters in 2020.

Key drivers increasing whistleblower tips

- The remote working environment puts distance between managers and their employees. As a result, individuals may feel more comfortable playing the role of whistleblower, and the privacy of their own homes allows for easier access to evidence and the ability to submit a tip remotely.

- Financial struggles brought on by the pandemic increase the possibility of financial disclosure violations and misappropriation as companies or employees attempt to make up for lackluster performance.

- Large, highly publicized payouts (over $500 million in total to date, including multiple awards paid in 2020 totaling over $50 million) increase the likelihood that whistleblowers will come forward to report bad actions.

The SEC received over 6,900 whistleblower tips in 2020, the largest number and a 130% increase since the beginning of the program ten years ago.

Using analytics to address risks

Acting Assistant Attorney General of the U.S. Department of Justice Criminal Division Nicholas McQuaid recently indicated to the Practising Law Institute that “prosecuting companies and their executives for white-collar crimes will remain a priority” and that the government will continue to require independent monitors to oversee compliance reforms. A high volume of whistleblower tips can therefore result in years of compliance distractions, lengthy and expensive investigations, and reputational harm.

Performing organizational analytics surrounding compliance, ethics and governance can help corporations conduct more efficient and accurate investigations and help with ongoing monitoring to reduce the costs of investigating fraudulent activity, policy violations and other types of misconduct.

RSM professionals frequently use leading data analytics tools to assess the effectiveness of a firm’s whistleblower program by:

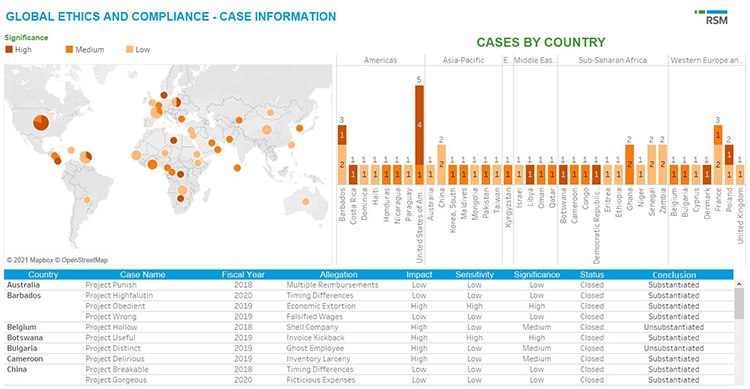

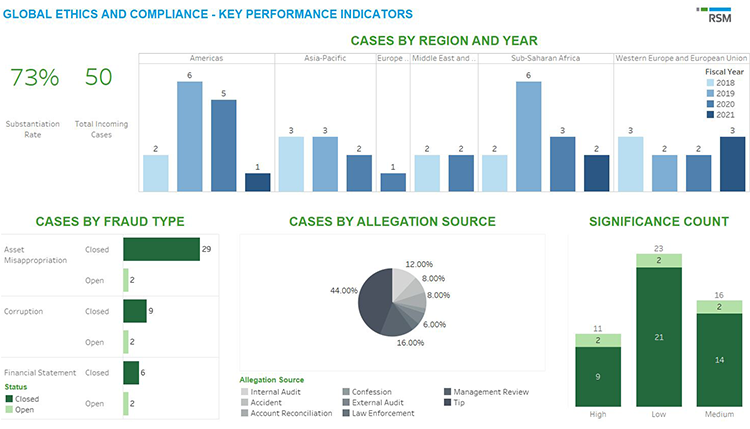

- Stratifying tips and report processes by volume, intake, geography, closure time, substantiation rate and other key indicators in a comprehensive program overview dashboard

- Performing trend analyses on available data to identify systemic issues within the whistleblower program

- Comparing trend analyses to industry benchmarks to assess the overall program effectiveness and areas of strength and vulnerability

- Providing recommendations to rectify potential fraud and compliance issues through improvements to corporate policies and procedures

Data analytics tools create an efficient method for analyzing large volumes of data associated with the investigation of whistleblower tips and help detect misconduct and policy violations. The use of such tools allows a company to point investigators in the direction of the alleged misconduct and deploy resources to the most likely areas to uncover maleficence. Furthermore, analytical monitoring tools such as case management systems enable efficient tracking of key indicators (e.g., tips per employee, time to initial response, time to resolution, substantiation rate) that can be used for guidance in designing effective whistleblower programs and processes.

For example, RSM was recently engaged by a consumer products firm to design a centralized case management system for its global ethics and compliance program. Using historical data and real-time data captured in the case management system, RSM professionals created customized, interactive dashboards that highlight key indicators, including timing of intake and data on planning, fieldwork and reporting.

Using tailored dashboards and other historical analyses, the client was able to effectively and efficiently identify regions with abnormally low reporting rates and provide personnel in the highlighted locations with additional fraud and compliance training. The implementation of this automated dashboard system has saved client personnel recurring administrative hours, allowing the team to focus on practical value-added services.

The dashboards below highlight case information commonly tracked in a whistleblower program, as well as key performance indicators that data analytics tools can capture to help organizations better assess their whistleblower and compliance programs.

Ultimately, the use of available data analytics tools can lead to a stronger and more effective whistleblower program, resulting in substantial mitigation of the corporate and regulatory risks associated with fraud and misconduct.

To learn more, please see our recent article about data analytics technologies used by today’s investigators to investigate fraud.