Key takeaways

- The COVID-19 outbreak in the United States has exacerbated many preexisting financial issues and pushed many retailers to the brink of or into bankruptcy.

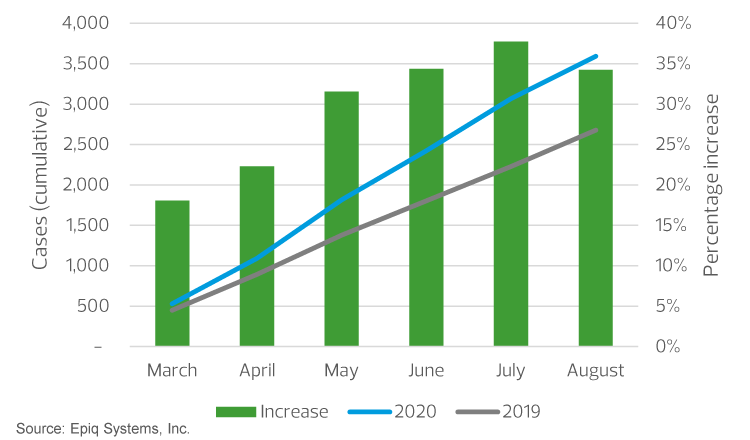

- Commercial bankruptcy filings are up, year over year, and growing steadily.

- As Paycheck Protection Program and other government support programs expire, it is possible the number of bankruptcy filings may increase.

- Consumer products companies may face significant exposure if important customers and vendors file for bankruptcy.

Many retail businesses were struggling even before the COVID-19 pandemic affected the United States. Over 9,000 bricks-and-mortar stores closed in 2019, extending a three-year record-setting trend.1 The pandemic and related nationwide economic shutdowns have exacerbated an already challenging environment. As of Aug. 21, 2020, over 7,600 store closures have been announced to date,2 with 2020 totals expected to reach 25,000,3 nearly triple the 2019 total.

A survey of retail bankruptcy filings tells a similar story. Over 35 national retailers have already filed for bankruptcy protection this year, spanning a variety of industries and including the following household names:

- Apparel: JCrew, Tailored Brands (Jos. A. Bank, Men’s Wearhouse), Brooks Brothers, Ascena Retail Group (Ann Taylor, LOFT, Lane Bryant)

- Casual dining: NPC International (the largest independent franchisee of Pizza Hut and Wendys), Dean and Deluca, Le Pan Quotidien

- Department stores: Neiman Marcus, JCPenney

- Home goods: Pier 1 Imports, Art Van, Muji and Sur la Table

- Gym, health and fitness clubs: Golds Gym, 24-hour Fitness

- Vehicle rentals: Hertz, Advantage Rent a Car

These bricks-and-mortar struggles have reverberated through the U.S. commercial real estate leasing and mall industries. Mall owners such as CBL & Associates are reportedly seeking forgiveness or deferral of debt and interest payments, receiving audit opinions that include going-concern qualifications (auditor assessments that the business may not survive 12 months after the date of the audit opinion) and/or making plans to file for bankruptcy protection.4 Equity holdings in real estate investment firms are experiencing significant declines, in some cases, greater than 50%, in the first eight months of 2020. The delinquency rate on large commercial loans tied to real estate in the United States doubled month over month, reaching 5.78% in July 2020. According to Moody’s, the retail and hospitality industries accounted for 82% of the most seriously delinquent commercial loans.5

These financial troubles and the rise in bankruptcy filings are also affecting supply chains and third-party logistic companies. As people remain at home and stores shutter, demand for products sold through in-store sales is diminishing.