Today’s tight labor market has family offices competing with other businesses for top talent.

Key takeaways

As capability needs evolve, updating role descriptions for employee recruitment is key.

Intentional skill development, career pathing and creative compensation can help retain top talent.

Strategic outsourcing and other strategies are helping family offices combat staffing challenges.

People are critical to a family office’s long-term success, as are the other pillars of operational excellence including process, technology and data. Despite the importance of top talent, many family offices feel that building a strong people pillar is one of their greatest challenges today.

Why is it such an issue? In part, dual headwinds of a talent shortage and inflation have driven up staffing costs for family offices. The UBS Global Family Office Report 2022 showed 69% of the pure costs of running a family office are dedicated to internal staff, and that 80% of U.S. family offices are expecting increased staffing costs over the next three years.

Compounding the problem, many family offices lack robust training and development plans to prepare next-generation family members and existing employees to step into key roles. Continuous development is critical to meet a family office’s evolving needs in a rapidly changing business and investment landscape. Having the right people in the right roles can unlock the value of a family office and support the family’s strategic decisions.

A proactive approach to talent

While the talent gap is hitting family offices particularly hard, they are not alone. RSM commissioned a survey of middle market business leaders across a range of industries and found that many companies are experiencing reduced productivity and profitability due to talent issues. The survey results also revealed how strongly businesses are feeling the effects of the talent gap and what potential solutions exist.

Moreover, we recently engaged in an interactive discussion with more than 460 family office executives, family members and their advisors to gain perspective on their talent challenges and the strategies they are using to overcome them. Here is what we learned:

1. Accounting and tax professionals are in high demand by family offices

The complex financial and tax needs of ultra-high net worth individuals and families require a certain level of skills and experience to navigate, and many family offices simply cannot find top-tier talent to fill critical finance and accounting roles. When asked which roles they expect to be the most challenging to fill in the coming year, 30% of our respondents said accountants, followed by tax and investment management professionals.

Part of the challenge for family offices is having to compete with countless other businesses looking to fill the same positions. To underscore the dire need for talent nationwide, RSM’s research further showed that 50% of businesses cannot find employees at any career level with the skills they need.

As a proactive approach to hiring, family offices should consider developing a clear profile for their ideal job candidate based on technical needs and cultural fit. Potential hires should be able to articulate why they want to work for a family office and their approach to collaborating with C-suite executives. It is advisable to be thoughtful about communicating the family office’s business model and goals in a way that is attractive and competitive.

2. Continuing education is essential

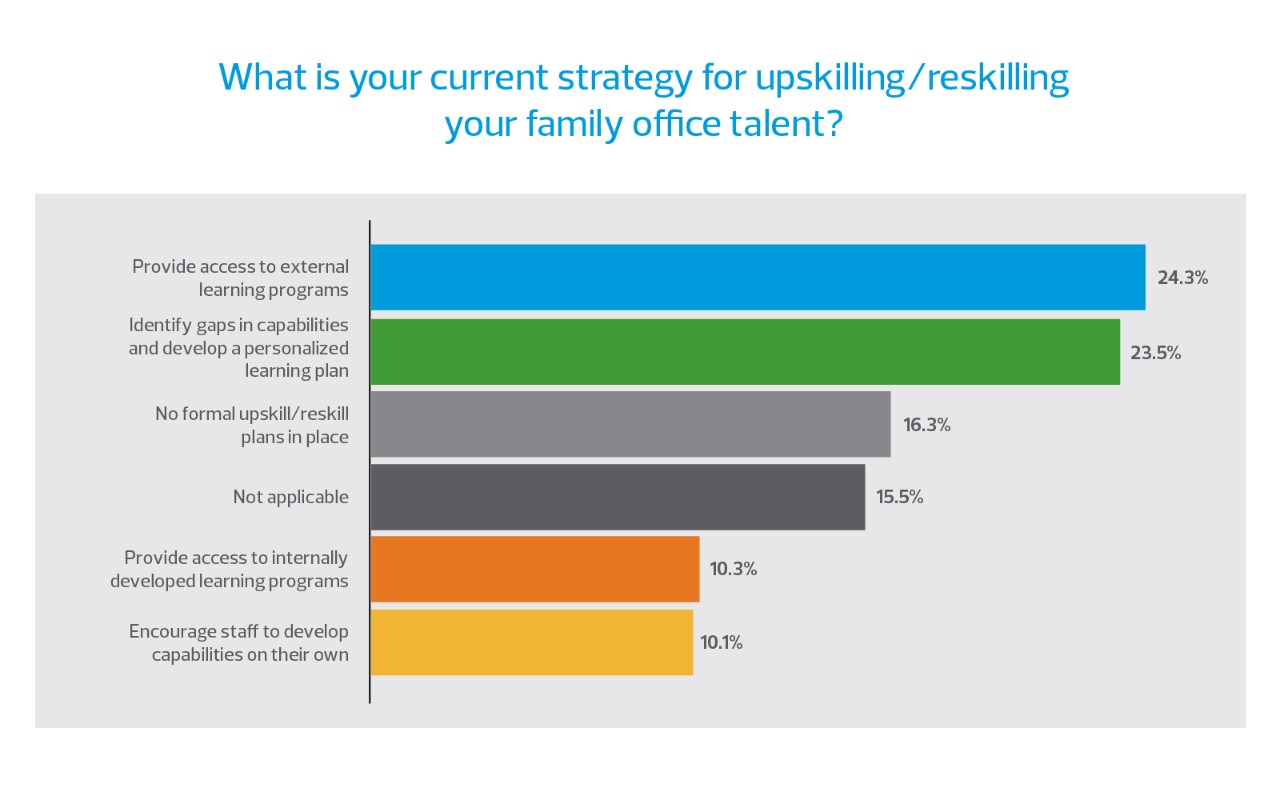

Understanding that people are their biggest asset, family offices recognize the need for staff members to keep their skills up to date. Most of our family office respondents said they plan to leverage external programs (24.6%) or develop personalized learning plans (23%). Only a small percentage (9.9%) see internal training as the sole solution.

Whether a family office focuses on upskilling employees to improve their existing skills or reskilling employees to teach them a new set of competencies, the obvious advantage of employee development is a more capable staff. However, there are other incentives for family offices to consider making an investment in training.

Providing continuous learning opportunities and other creative benefit offerings can supplement traditional forms of compensation to increase employee engagement and attract talent. It can also help with long-term succession planning by preparing family members to step into key roles.

3. More family offices are considering outsourcing

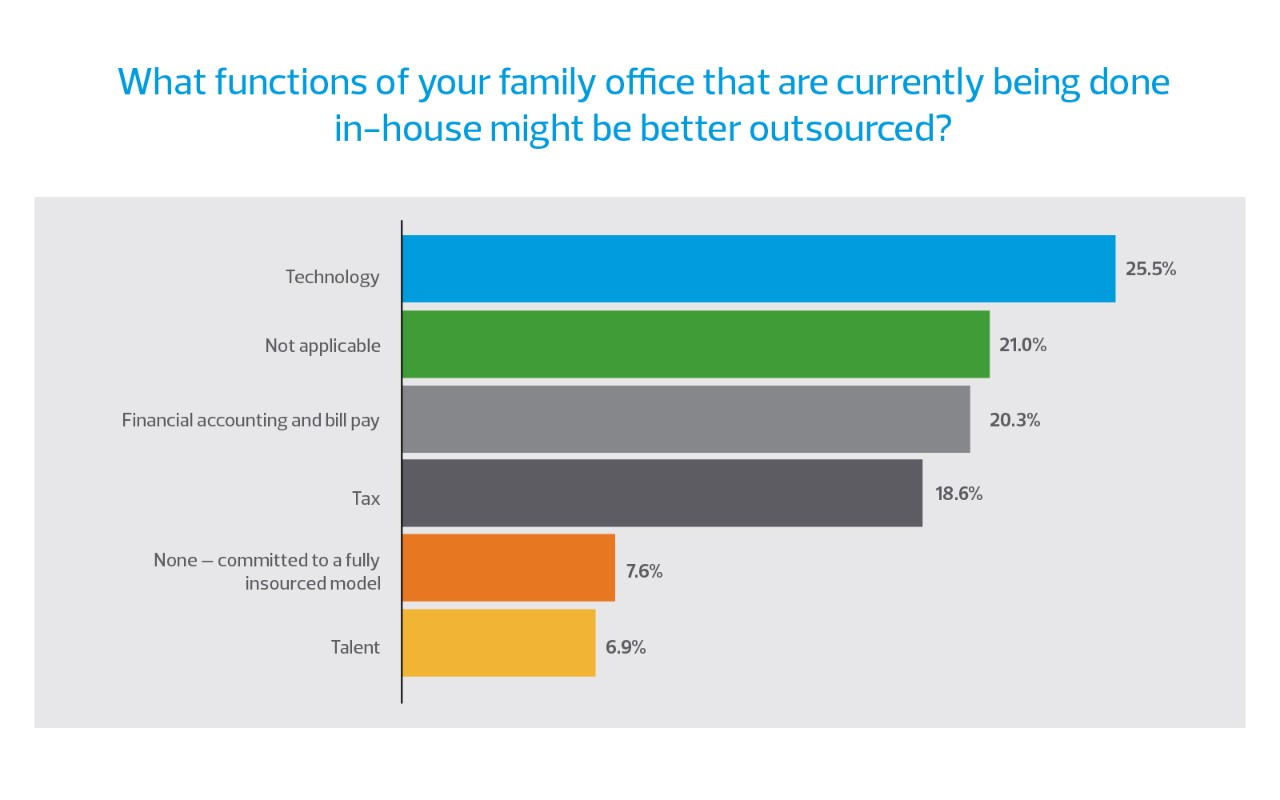

If a family office is unable to source talent with the right skill sets or feels it can unlock more value with external resources, co-sourcing and outsourcing are options worth considering.

Providers can bring in experience and tools to assess business problems, prioritize focus areas based on business goals, solve for the most immediate pain point, and then provide both scalability and extended services and guidance as a family office evolves.

Outsourcing can take the pressure off having to search for talent, build internal controls, provide ongoing education and invest in technology. Working with third-party service providers is often easier and more cost-effective for many family offices than trying to keep everything in-house. Our respondents ranked technology (24.5%) and financial accounting and bill pay (20.1%) as critical functions that might be better outsourced to address capacity and complexity challenges.

These valuable insights showed us that family offices see the importance of taking a strategic and proactive approach to talent management. While there are many options to consider, including insourcing, outsourcing and hybrid staffing models, there is a talent solution available to family offices at every point along their journey toward operational excellence.

To learn more about operational excellence in the family office, watch and share the recordings of our first three sessions and register for the remaining session today!

Session 4: Operational excellence for the family office: Streamline processes to facilitate sustainable growth

Tuesday, Nov. 14, 2023, at 1 p.m. ET