Establishing a successful family office can be likened to forming an all-star team, where the strategy is to select the right combination of A-list players to achieve goals and win big. For many high net worth families, the objective of the game is to sustain multigenerational wealth, protect their legacy, and manage their personal affairs. A family office serves to help with all of this and more.

Key considerations for creating a family office include the entity's structure, size, and complexity, which the needs of the family dictate. The most successful family offices also exhibit the following elements:

- A solid governance framework – Provides structure around decision-making, command and control of the family office

- Stability and agility – Balances the achievement of initial goals against the evolving expectations of an intergenerational family

- Top talent – Hires the most qualified employees and professional advisors who can demonstrate the level of knowledge and industry focus necessary to support and advise the family on how to achieve operational excellence

- A collaborative environment – Creates an environment that fosters group decision-making that involves every functional area of the business, including external service providers

- Effective communication – Develops consistent protocols for how, when, and with whom information is shared to promote engagement

- Family involvement – Identifies family members who are a good fit for a role in the family office, or who can help provide oversight

Above all, a successful family office is designed to meet the family's continuously changing needs. Here's how to customize a profitable and efficient enterprise that can grow and evolve over time:

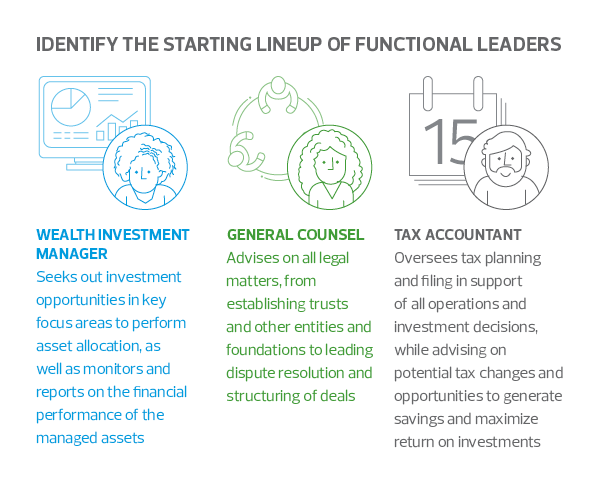

Identify the starting lineup of functional leaders

The following roles make up the elite team that oversees the family office's core capabilities. Without these three functional areas, the business cannot achieve its main mission of growing and transferring the family's wealth across generations.