Creating a new business unit - the innovation engine - is one way traditional organizations can adapt.

Key takeaways

Companies need to embrace startups’ build-measure-learn methodology to develop new products and services.

Institutions should embrace intelligent automation holistically, rather than on a case-by-case basis.

It is essential that organizations understand all the various stages of the customer journey.

The digital disruption at the heart of the fintech movement is enabling new possibilities for financial services organizations across their entire business. Understanding this disruption can seem like an unwieldy undertaking, but there are three interconnected actions institutions should take to apply these digital capabilities with intention: creating a more innovative environment, pursuing the possibilities allowed by intelligent automation, and reimagining the customer experience.

Below, we examine the implications of digital disruption across these three key points—all of which are inherently intertwined—and how more traditional financial services organizations can harness this disruption to remain competitive as fintech companies continue to transform the landscape.

Building an innovation engine

Innovation can seem like a buzzword or a catch-all term people use when referring to coming up with new ideas. But disruptive innovation only occurs in an organizational environment similar to the one startups have, says Gilvan Azevedo, a consulting partner and head of business, technology, and innovation for RSM Brazil.

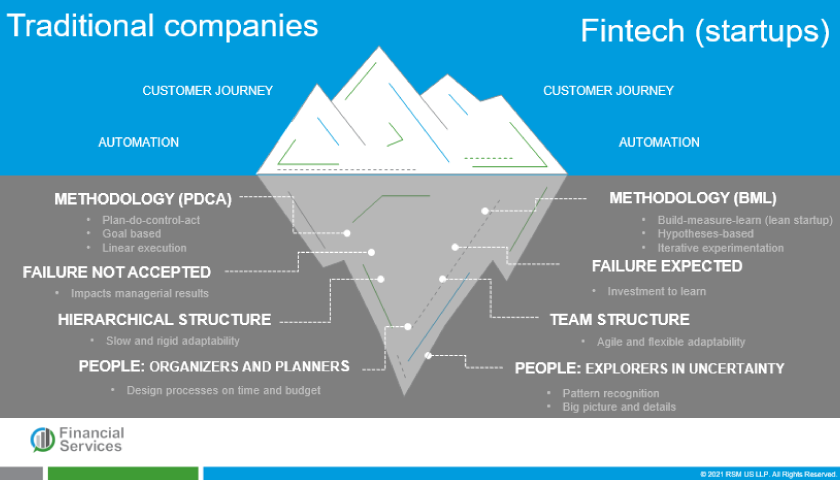

To understand this specific environment, RSM compared traditional companies with fintechs, analyzing the aspects of their business models that cannot be seen (i.e., that exist below the surface in this metaphorical iceberg). As the figure below shows, there are some organizational elements that are diametrically different between startups and traditional organizations. Those factors affect the elements we see above the surface: the level of automation and the state of the customer journey.

So, how can a new organizational environment that mimics a startup be created inside a traditional institution, considering they are diametrically different?

The answer may be to create a new separate business unit, which could be called the innovation engine, and then establish a productive and integrated relationship with the traditional business unit, which could be called the execution engine, says Azevedo.

Many large institutions are doing the work to make innovation the bedrock of their operations. But to create the foundation for an innovation engine, companies need to embrace the build–measure–learn (BML) methodology—which so many startups already use—to develop new products and services while reducing the investment risks. Organizations should use this methodology to test and validate hypotheses across four key stages of innovation:

- Identify the problem and develop a hypothesis to solve it

- Find/develop the right solution for that problem

- Identify the needs of the market and where the solution fits in the market

- Determine the potential for growth

The second organizational element that the innovation engine should have is a failure culture. Under a BML approach, companies will have to test hypotheses many times until the adequate one is found; this implies that many failures will have to occur and, therefore, an incentive system to fail will have to exist.

The final key aspect of building an innovation engine is to select people with the talent to be explorers and organize them in an agile team structure. This way, the experiential process of testing and finding the right problem, solution, market, and growth strategy can happen effectively.

Once the innovation engine has developed a new business opportunity, it can hand over this new product or service to the traditional business unit to manage the growth process. In this process of generating new disruptive innovations, two additional areas are interconnected and essential: intelligent automation and reimagining the customer journey.

Intelligent automation

Four or five years ago, when large banks began to implement intelligent automation (using emerging technologies to rapidly transform business processes), many organizations were somewhat slow to adopt these new technologies. While the velocity of digital disruption has gone from a meandering pace to warp speed since then, many large banks have still been slow to move past robotic process automation (RPA) and into other more advanced domains of intelligent automation such as machine learning and artificial intelligence.

I cannot tell you how many times companies buy RPA solutions without defining the business challenge first. From there, they are working in reverse with no clear vision—robots looking for a problem—and the entire business case becomes suboptimal.

Intelligent automation can bring vast opportunities for financial services organizations to transform their business, but a culture of innovation is a crucial factor in organizations being able to harness IA effectively. Many financial services institutions will need to undergo a mindset shift to ensure they approach IA on a holistic level, rather than on a case-by-case basis. As noted in the section above, organizations must adopt a culture that accepts failure and possess the ability to rapidly digest why an idea or solution fails, course correct and move on.

“First, you have to understand the problem statement, and then you can determine if and where to apply these emerging technologies,” says Duane Punnewaert, a business transformation leader and consulting partner at RSM US. “I cannot tell you how many times companies buy RPA solutions without clearly defining the business challenge first. From there, they are constantly working in reverse with no clear vision—robots looking for a problem—and the entire business case becomes suboptimal.”

To remedy this, organizations should consistently identify and prioritize specific use cases at the outset of various projects or as part of ongoing processes.

To foster a more rapid and efficient adoption of IA in the future as competition from fintechs continues to heat up, organizations should:

- Create a culture of innovation: While large banks tend to buy new technologies and then try to figure out how to use them, they would do well to take a lesson from fintech companies. Fintechs typically have a very clear vision as they set out to tackle a well-articulated customer problem. They then explore how technology can enable the solution—all with a mindset that it is acceptable to fail and learn from failure along the way.

- Develop new strategies to cultivate talent: Over the last decade, startups, venture capital firms, fintech companies, and Big Tech have become formidable competition for banks when it comes to hiring and retaining top-tier employees. Traditional financial services organizations need to assess what this means for their hiring strategies and understand how the most desirable skill sets have changed over the years.

- Embrace fintech solutions where applicable: Depending on the IA solution in question, companies should weigh whether it makes sense to acquire or partner with a fintech to gain access to cutting-edge technology solutions.

Other considerations in the IA landscape include understanding how automated solutions will scale, realizing cost savings, seeing the automation implications for vendors, and finally, figuring out how to work across multiple departments such as IT, human resources, security, and risk.

Customer experience: An end-to-end journey

Technology has transformed the customer journey into a truly customer-driven process, rather than a process imposed on a customer by a company. Self-service portals and tools such as chatbots can allow for a more personalized experience, for instance, and customers have become comfortable enough with the security of technology that they often prefer to get help through a smartphone app rather than talking to an agent on the phone.

You should first get a sense of what the customer experience is, and then design it in a way that incorporates technologies to support your company’s future state vision.

Such shifts are forcing financial institutions to adapt. Organizations can no longer think only internally about how to develop or improve products; they need to crowdsource ideas and connect with customers through focus groups or other touchpoints to get a clear understanding of what those customers want. Organizations that take a thoughtful approach to improving their customer journey will ultimately have better customer retention and reach a higher market share.

Before this fintech-driven disruption, customer experience was seen as a “nice to have” element of business, but now it’s a requirement, says Alex West, a strategy and management consulting manager at RSM US.

At the center of efforts to improve the customer experience, companies need to understand all the various stages of the customer journey. Implementing slick new technologies won’t be beneficial unless this fundamental understanding is in place.

“Historically, companies have wanted to throw technology at the customer experience before they understand the holistic, end-to-end experience a customer has with an organization,” says West. “You should first get a sense of what that experience is, and then design it in a way that incorporates technologies to support your company’s future state vision.”

There are several important considerations companies need to address as they reimagine their customer journeys:

- Breaking down silos—Customer experience is not owned by one single department, but shared across functions of the business.

- Getting executive-level buy-in—Companies need to have an executive board and/or shareholders that are dedicated to improving the customer experience and who will understand the time needed to make progress.

- Navigating compliance—In the constant battle to be fast to market, financial services organizations also need to understand how changes in their customer experience might be intertwined with compliance.

- Harnessing data—"Many times, organizations are data-rich and information-poor,” West said. Companies should harness the data they already have to develop granular customer personas.

The takeaway

As fintech companies continue to change the landscape, traditional financial services organizations can transform themselves by building an organizational environment that fosters digital disruption through creative strategies that use intelligent automation and new ways to reimagine the customer journey.