Over one month into a post-Brexit Europe (Jan. 1, 2021), greater clarity is starting to develop for businesses around the impact and operational realities of the new EU-UK Trade and Cooperation Agreement (TCA). The TCA provides the overarching legal framework that traders must reference and apply to best approximate the pre-Brexit tariff-free flow of goods across national borders. To these ends, Her Majesty’s Revenue and Customs (HMRC) has released specific guidance around Brexit covering various areas, providing some certainty on the associated VAT and customs implications for businesses with operations and activities in the UK and EU markets. Some of the most important aspects are considered below.

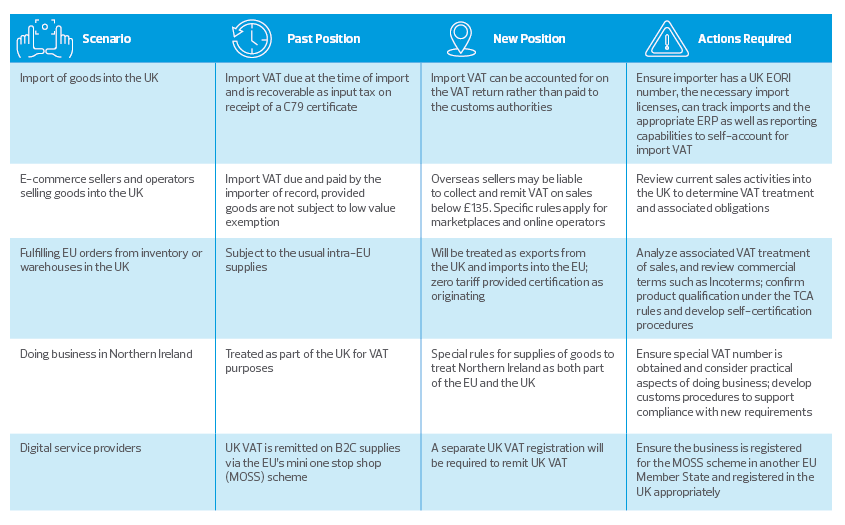

Businesses importing goods into the UK

All goods entering the UK from the EU will be treated as imports from third countries (except for most arriving from Northern Ireland). After full implementation, customs formalities will apply, declarations have to be lodged and guarantees required for potential or existing customs debts. For EU goods entering the UK between Jan. 1, 2021 and June 30, 2021, importers will be permitted up to six months to file final customs declarations and pay duties. Product flows in the opposite direction, however, will not benefit from this temporary easement.

On a positive note, goods certified as originating in the EU can enter the UK at zero tariff and zero quota, and vice versa. Further, the TCA provides for recognition of each party's Authorized Economic Operator (i.e., trusted trader) scheme, enabling streamlined procedures for registered traders using programs such as customs warehousing.

The question of UK/EU origin, to achieve zero tariff status, does however introduce some additional complexity and businesses should navigate new rules to establish if their product qualifies. The specific rules of origin for certain products are contained in the TCA’s annexes – an example of this is a value limitation rule, wherein the value non-UK or non-EU originating materials may not exceed a given percentage of the ex-works price of the product. Once a product is determined to qualify as originating, a claim for preferential access under the TCA can be supported by a “statement of origin” issued by the exporter, or via the importer’s knowledge that the good originates within the UK and/or EU.

From Jan. 1, 2021, the UK has introduced postponed accounting for import VAT on B2B transactions for UK VAT registered importers. This means that instead of a cash payment of import VAT being required in order to clear the products, businesses can just self-account for the import VAT on their VAT returns. Those businesses with full VAT recovery rights can also reclaim this amount at the same time, resulting in no import VAT cash-flow delays.

To benefit from this, the importer must include its UK VAT registration and also its ‘GB’ Economic Operators’ Registration and Identification number (EORI) on the customs declarations. In the absence of either of these, UK import VAT would be collected at the port of entry.

UK Intrastat filings will still be required for goods arriving in the UK from the EU during the course of 2021. Intrastat returns will also be required for goods moving from Northern Ireland to the EU, up until the end of the Northern Ireland protocol in 2025, subject to certain thresholds.

EU movement of goods and triangulation

Where a UK business has previously benefited from the VAT accounting simplification for triangular trade in the EU, this is no longer available. The triangulation simplification applies where the customer, seller and shipper of the goods are in three different EU countries. A good example of this would be where a UK seller of product sources the product from an EU vendor and requests that it is delivered directly to its business customer in another EU country. Pre-Brexit the UK seller would not need to charge VAT on the sale of the goods and would not need to be registered in another EU country.

Post-Brexit, for these types of transactions, the UK seller will now need to be registered for VAT in another EU country in order to meet new VAT compliance requirements.

e-Commerce sellers and marketplaces

The UK has introduced a series of VAT reforms around the e-commerce industry for the sale of physical goods to private consumers (so-called B2C supplies). These will largely mirror those implemented in the EU as part of its 2021 cross-border e-commerce changes. The key changes are as follows:

- Marketplaces will be liable to account for VAT on sales of goods sold through their platforms in certain situations.

- The UK low value import threshold of £15 has been abolished.

- Direct B2C sales of goods associated with an import into Great Britain (excluding Northern Ireland) under £135 in value are subject to VAT at the time of sale, as opposed to at the time of import. The nonresident seller, or marketplace if one is involved in the sale, would be required to charge, collect and remit VAT via a UK VAT registration. There is a nil VAT registration threshold in the UK for nonresidents.

Companies fulfilling EU orders from the UK

Shipments from the UK to EU markets are now treated as exports from the UK and imports into the EU, as opposed to intra-EU Community shipments. Non-UK originating goods entering the EU from the UK will pay the tariff applicable to the origin country, with potential relief available depending upon qualification under one of the EU’s various trade agreements.

As noted earlier, origin certification is made easier under the accord as importers can “self-certify” that the product satisfies the TCA’s rules of origin, allowing for preferential tariff treatment – that is, zero customs duties. Caution is advised here, however, as self-certification requires reliance on the exporter’s statement of origin or detailed evidence of the product’s provenance and/or value-added transformation within the international supply chain.

Consideration also should be given to issues such as the Incoterms of a transaction, Importer of Record requirements, and the associated VAT implications for both the buyer and the seller.

Businesses doing business in Northern Ireland

Uniquely, a customs and regulatory border between Northern Ireland (NI) and the UK can now be said to exist yet the agreement allows for largely unfettered trade for most goods. No UK import declarations are required, for example, for NI qualifying goods shipped to the UK. Moreover, NI-origin goods sent to the EU will be considered intra-EU supplies. In terms of VAT, NI now receives a special “dual status” for VAT purposes to help facilitate the supplies of goods from the EU. Broadly speaking, these arrangements will provide NI businesses with largely unfettered access to the UK market and free access to the EU markets.

- Supplies of goods between the EU and NI will be treated as intra-EU supplies, per the current EU VAT rules for cross-border B2B supplies of goods. Businesses established in NI will receive a special VAT ID number, pre-fixed XI, so that they can receive goods from other EU countries.

- Movements of most goods from NI to Great Britain (England, Wales, and Scotland) by NI businesses (including businesses headquartered in Great Britain with operations in NI) will not be subject to declarations, tariffs, or new regulatory/customs checks.

- Distance sales rules for B2C supplies of goods between the EU and NI will continue to apply. EU businesses making more than £70,000 of B2C sales in a year will be required to register for UK VAT, subject to the EU 2021 cross-border VAT reform rules coming into effect from July 1, 2021.

- Supplies of services between businesses in the EU and NI will be treated as supplies of services between an EU and non-EU jurisdiction.

Digital service providers

Digital service providers (i.e., those electronically supplying music, games, films, software, online training and education services etc.) making B2C supplies within the EU need to adopt one of the following approaches to be VAT compliant.

- Those businesses registered for the EU’s Mini One Stop Shop scheme in the UK need to re-register in another EU Member State, if they have not already done so, in order to continue utilizing the MOSS simplification, as well as re-registering for UK VAT purposes to remit UK VAT due.

- Those businesses registered for the MOSS scheme in another EU Member State should register for UK VAT purposes from Jan. 1, 2021, to remit UK VAT due on their supplies of digital services.

Suppliers should also consider any potential changes around “use and enjoyment” provisions given that the UK will now be treated as a non-EU jurisdiction for VAT purposes. The use and enjoyment provisions can change the country in which VAT is due based on where the service is actually used and enjoyed.