Making it work

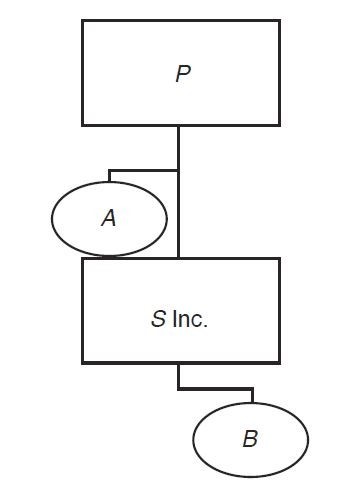

Following Step 3, the transaction appears similar to a section 332 liquidation (assuming the reorganized subsidiary is solvent at the time of the transaction), followed by a section 351 transfer of assets. However, the reincorporation step can prevent qualification under section 332 (see Rev. Rul. 76-429). In situations where section 332 liquidation treatment is desired, the IRS has required representations that any reincorporation would not exceed 30 percent of the liquidated subsidiary's assets (see, e.g., IRS Letter Ruling 201633014). Reincorporating a sufficient amount of the reorganized subsidiary's assets should render section 332 inapplicable.

If the deemed liquidation is not a section 332 liquidation, it may qualify as a reorganization under section 368(a)(1)(C) for the reasons underlying the IRS's analysis in the previously cited letter rulings. To qualify as a C reorganization, numerous requirements must be met, including the business-purpose, continuity-of-interest, continuity-of-business-enterprise, and ‘substantially all’ requirements (see Reg. section 1.368-2(g) (business purpose), Reg. section 1.368-1(e) (continuity of interest), Reg. sections 1.368-1(b) and -1(d) (continuity of business enterprise), and section 368(a)(1)(C) (substantially all)). This discussion does not address these requirements in detail.

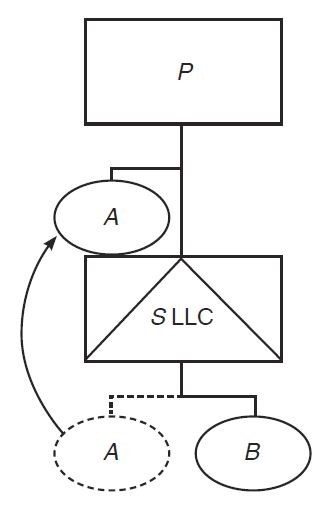

Regulations permit the parent, as the acquiring corporation in the upstream C, to contribute assets it has acquired to a subsidiary without adversely affecting the transaction's qualification as a reorganization (Reg. sections 1.368-1(d)(4) and -2(k)). Under these regulations, reincorporating the B assets can be viewed as a drop that maintains the transaction's overall qualification as a C. The regulations also generally permit further transfer of either group of assets within a corporate group and, in some cases, to partnerships (see Reg. section 1.368-2(k)).

Realization requirement

The reorganized subsidiary's deemed liquidation and reincorporation should be structured so that, when considered together, they constitute a realization event for federal income tax purposes. As explained by one IRS official during a tax conference appearance, the IRS has declined a ruling request where the only apparent difference between the subsidiary before and after the transaction was the distribution of assets during the transaction. The subsidiary, for example, neither reincorporated in a different state nor modified the legal terms governing its stock. Accordingly, the IRS would not provide the requested ruling.

By way of illustration, prior private letter rulings indicated that the following circumstances resulted in sufficient differences with respect to the reorganized subsidiary. In IRS Letter Ruling 200952032, the reorganized subsidiary changed from dual-state incorporation (State X and State Y) to single-state (State X) incorporation. In IRS Letter Ruling 201127004, the reorganized subsidiary underwent a change to the terms of its preferred stock. In IRS Letter Ruling 201224006, the reorganized subsidiary was reincorporated via a check-the-box election, and the shareholders' rights were governed by state LLC law and an LLC agreement, rather than by state corporation law and corporate articles of incorporation (or charter) as before. In IRS Letter Ruling 201424007, the reorganized subsidiary had two classes of stock before the transaction but only one class of stock afterward.

Increased IRS scrutiny

The IRS statement on Oct. 13, 2017, noted above, signals that private letter rulings on upstream C with a drop transactions have become more difficult to obtain. The statement also indicates that the IRS may make changes to the regulations governing these transactions. Results of the IRS's reconsideration of these transactions, such as changes to regulations or the ruling policy, would be of significant interest to corporate tax practitioners. Any changes generally would be expected to have prospective effect only. Companies should, in any event, be mindful of the IRS's reconsideration of the upstream C with a drop transaction and make sure their transactions have a substantial business purpose.

Reflections

Corporate groups may consider the upstream C with a drop technique to accomplish a tax-free asset distribution from a subsidiary to its parent, although favorable IRS rulings on these transactions have become more difficult to obtain. Taxpayers that wish to consider the upstream C with a drop technique should consult with their tax advisers before proceeding.

Excerpted from the April 2018 issue of The Tax Adviser. Copyright © 2018 by the American Institute of Certified Public Accountants, Inc.