On July 1, 2021, the EU’s broad e-commerce package finally came into effect. The reforms aimed to “modernize VAT for cross-border e-commerce” and will impact companies performing e-commerce sales across the EU in various ways. In particular, the reform:

- Removes the distance sales regime, and extends the One Stop Shop scheme to allow suppliers to benefit from reduced compliance obligations

- Introduces specific new rules for so-called low value B2C imports of goods into the EU

- Makes online marketplaces and platforms liable for VAT on goods sold by non-EU sellers

EU distance sales

Prior to July 1, 2021, companies making “distance sales” of goods within the EU (i.e. selling goods located in one country to a private individual in another EU Member State) were obliged to collect VAT in the destination country via a direct registration if their sales exceeded a specific distances sales threshold. This meant that e-commerce providers could be required to maintain 27 VAT registrations across the EU, and had to continually monitor sales thresholds.

From July 1, 2021, the distance sales regime has ended and been replaced by a new regime. Under the new regime, if an EU established company makes more than EUR 10,000 of distance sales across the entire EU, it will be obligated to collect and remit VAT based upon the ship-to destination, irrespective of specific sales to that particular country. There is a nil threshold for non-EU vendors.

The EU’s Mini One Stop Shop (MOSS) regime, which prior to July was only applicable to supplies of telecommunication, broadcasting, and electronically supplied services has been extended to cover cross-border supplies of goods, known as the One Stop Shop (OSS). This new regime allows vendors to register in just one EU Member State and remit VAT across all 27 EU Member States, significantly reducing the compliance burden.

Companies currently registered under the old distance sales regime should consider their current footprint, and consider whether they wish to cancel their existing distance sales registrations and replace this instead with a new OSS registration.

For EU companies operating below the EUR 10,000 threshold, VAT will only be due based upon the country from where the goods are dispatched.

The Import OSS

From July 1, 2021, the EU’s low value import threshold of EUR 22 was abolished. This threshold had previously allowed goods to be imported into the EU without customs duty or VAT.

This regime is now replaced with specific rules for “low value goods” – that is consignments with an intrinsic value of less than EUR 150. Such shipments continue to benefit from an extended customs duty exemption, but will now be subject to import VAT.

In order to simplify the clearance of these low value goods entering the EU in connection with a sale to a private individual, suppliers can register for the Import One Stop Shop (IOSS). This is an optional regime that allows the supplier to collect VAT at the point of sale from the customer, and then remit the VAT to the EU Tax Authorities via a monthly IOSS return (similar to the OSS return outlined above).

Non-EU companies that are not based in Norway, will require an intermediary (a form of a fiscal representative) in order to utilize the IOSS regime.

If a company does not register for the IOSS, low value goods will be subject to usual customs procedures, which could increase delivery times, and VAT would theoretically have to be paid by the consumer in order for the goods to be released. This may negatively impact the customer experience.

Shipments over EUR 150 will continue to be subject to the “normal” import rules.

Sales via online marketplaces

From July 1, 2021, online marketplaces facilitating sales of goods to EU private individuals from non-EU sellers are liable to collect and remit VAT as the “deemed supplier”. The non-EU seller is seen as making a zero-rated sale for VAT purposes to the marketplace, and the marketplace then making the taxable sale to the end consumer.

Importantly, these rules do not affect EU established sellers utilizing online marketplaces. Such EU suppliers continue to remain liable for the VAT due, but can benefit from the OSS scheme outlined above for cross-border supplies.

Summary

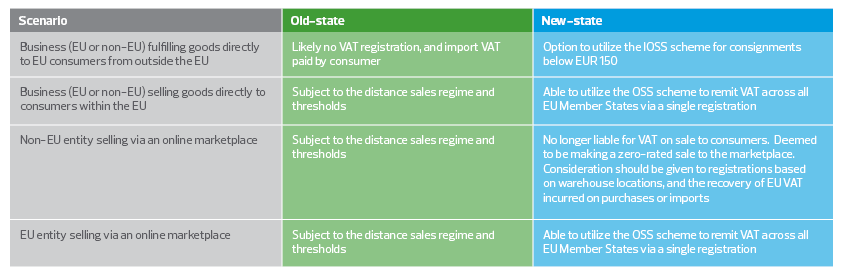

Please refer to the table below with a short summary of the changes for various business scenarios, and key considerations under the new rules.