On March 3, 2021, the UK government announced the introduction of a new temporary super-deduction to help stimulate investments in plant and machinery assets following the COVID-19 pandemic.

This announcement further incentivizes capital investment in the UK following the introduction of the Structures and Buildings Allowance (SBA) for expenditure on non-residential property as of Oct. 28, 2018.

What is the super-deduction?

The super-deduction provides an enhanced temporary first-year allowance for companies with qualifying plant and machinery asset investments. In the UK, plant and machinery assets are split into two main categories:

- Main pool plant and machinery: This category includes but is not limited to machinery, furniture, computer equipment, sanitary ware and office equipment (which previously allowed for a deduction at a rate of 18% per year); and

- Special rate pool plant & machinery: This consists of systems integral to a building such as electrical systems, lighting, heating, air conditioning and water systems (which previously allowed for a deduction at a rate of 6% per year).

The newly introduced super-deduction is available for contracts entered into after March 3, 2021, and expenditures incurred between April 1, 2021 and March 31, 2023, in relation to both newly acquired main pool and special rate pool plant and machinery assets.

The regime increased the deduction for main pool plant and machinery assets from 18% to 130% and special rate pool assets deduction increased from 6% to 50% in the first year. This essentially means that for qualifying capital investment into main pool plant and machinery assets, the year one tax savings will be approximately 25% of the investment amount, subject to having sufficient taxable profits. In contrast, prior to the introduction of the super-deduction, the year one tax saving would have been approximately 3.4%.

Exclusions

There are several exclusions to the scope of the super-deduction including:

- Expenditure on cars

- Expenditure on second hand/used assets

- Expenditure on assets acquired from a connected party

- Expenditure on assets used partly for a ring fence trade (the super-deduction is restricted to 100% for these assets)

Disposal of assets where super-deduction claimed

Where a claim is made for the super-deduction in respect of either main pool or special rate pool assets and the asset is subsequently disposed of in a chargeable period commencing before April 1, 2023, the disposal will be subject to a balancing charge.

The amount of the balancing charge will depend on the timing of the disposal, the level of qualifying super-deduction expenditure and the amount, if any, of expenditure that is allocated to a pool.

Worked example

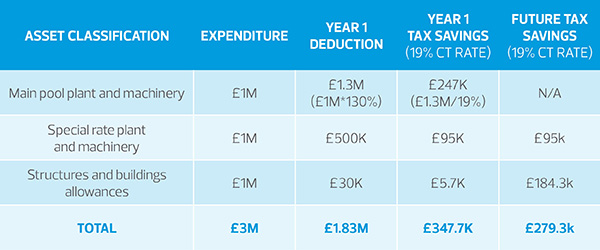

Assume that a U.S. multinational has an office in London and carries out a refit project for £3M. Of this expenditure, if £1M qualified as main pool plant & machinery, £1M as special rate plant and machinery and the remaining £1M qualified for SBAs, the year one tax saving would be as follows:

As you can see, the year one saving based on these indicative figures is more than 10% of the investment value. Furthermore, over 50% of the overall savings generated from the project is received within the first year.

In contrast to this, prior to the super-deduction, the year 1 saving would have been around £51k, without using the Annual Investment Allowance.

Considerations for U.S. multinationals

Any U.S. multinationals with UK subsidiaries in their structure should review their planned capital investment program to consider whether the timing of their expenditures should be reassessed in order to benefit from this provision. Businesses in the industrial products space, where plant and machinery or other non-residential property interests may be a large component of a company’s overall capital investment plans, should give these rules particular attention.

The potential U.S. tax implications of the UK super-deduction should also be considered. For example, for U.S. taxpayers with a UK controlled foreign corporation (CFC), the subsidiary’s fixed assets impact the calculation of global intangible low-taxed income (GILTI) inclusions by the U.S. taxpayer. For GILTI purposes, the fixed assets are accounted for using the ADS depreciation system, which is effectively a straight-line method. An increased capital investment in the UK CFC may have the double benefit of reducing the U.S. GILTI inclusion while also generating the UK tax savings.

Alternatively, to the extent U.S. taxpayers are planning to exclude GILTI inclusions from U.S. taxable income due to the GILTI high-tax exclusion, this UK super-deduction may adversely impact qualification for that exclusion. If the reduced UK tax paid decreases the effective tax rate below the 18.9% threshold required to qualify for the exclusion, then the UK tax savings achieved via the super- deduction may be offset to some extent by an increase in the U.S. tax liability.

Given the attractive benefits available to UK taxpayers with capital investment plans, and the complex nature of international taxation for global businesses, we advise businesses to work with their advisors to model the potential UK and U.S. tax implications of this incentive to achieve the most efficient results for their business.