At first glance, the Protecting Americans from Tax Hikes (PATH) Act of 2015 looks like an effort by Congress to make permanent, several temporary provisions of the federal income tax code, including shorter lives for certain types of non-residential real property and the higher section 179 deduction limits, in order to provide some certainty to taxpayers. But the PATH Act also yielded a few surprises, one of which was the application of bonus depreciation, which was extended by the Act through 2019, to a new category of assets.

The PATH Act made permanent the 15-year life assigned to qualified retail improvements, qualified restaurant property, and qualified leasehold improvement property[1]. It also introduced a new asset category, qualified improvement property (QIP), to be eligible for bonus depreciation beginning Jan. 1, 2016[2]. QIP is broadly defined as interior improvements to non-residential real property placed into service after the building is originally placed into service. The types of improvements that are eligible for QIP treatment are somewhat similar to qualified leasehold improvement property (QLI), with several exceptions:

- There is no requirement that the improvements be related or pursuant to a lease;

- The building to which the improvements are being made can be less than three years old; and

- The improvements can be made to common areas used by all of the building’s occupants.

Expenditures attributable to any elevator or escalator, the enlargement of a building, or the internal structural framework of the building are not eligible for QIP treatment. These limitations are similar to ones for QLI.

So, with the introduction of QIP, the IRS now has specific treatment for four types of improvements to non-residential real property:

- Qualified Retail Improvements [3]

- Qualified Restaurant Property (was Qualified Restaurant Improvement property until the rules were changed 1/1/2009 to allow the purchase of a restaurant building to qualify for the shorter 15 year life vs. 39 years) [4]

- QLI [5], and

- QIP

Understandably, many taxpayers struggle with differentiating between these different types of “qualified” property, determining if the costs are eligible for bonus depreciation, and applying the proper recovery period (the IRS term for tax life) to the capitalized costs.

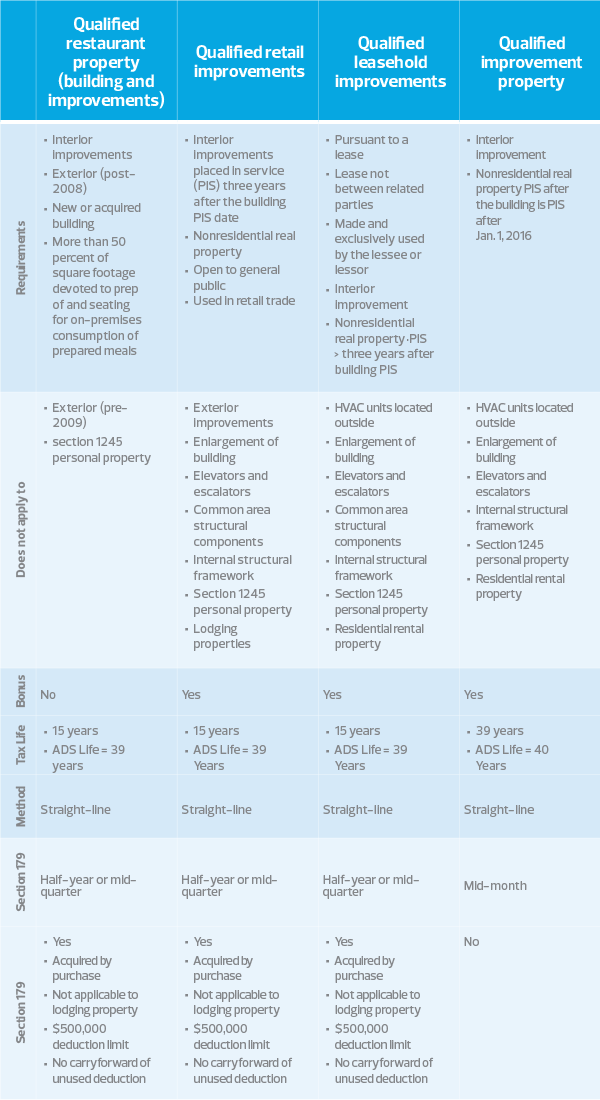

To help clear up confusion about the different types of qualified property, below is a table which can help determine what treatment to use for each type of property. Please note the following is as of Jan. 1, 2016.