During the pandemic, occupancy at senior housing facilities dropped precipitously.

Key takeaways

More fluid arrangement for home, work and school have fostered multigenerational living.

Industry participants with the ability to convert dedicated senior housing to multifamily may stand to benefit.

For the better part of the past decade, investors flocked to senior living as the baby boomer generation aged. More recently, due in large part to pandemic-related challenges, including health and safety considerations and staffing shortages, assisted living and senior facilities have lost their luster. Meanwhile, among seniors’ viable alternatives, multigenerational housing is gaining in popularity.

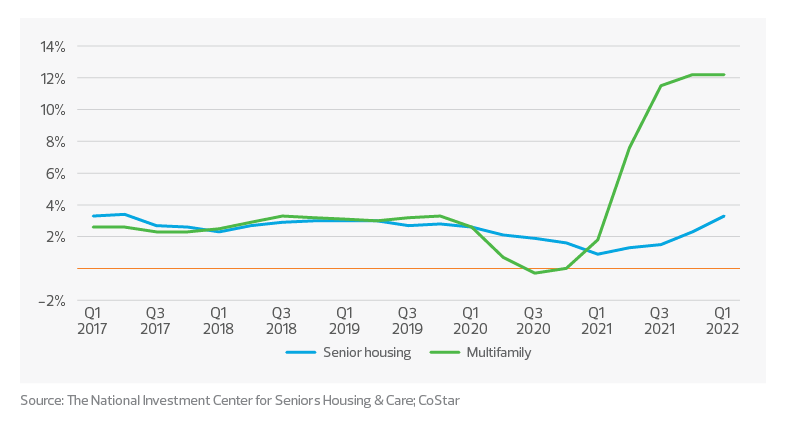

During the height of the pandemic, the occupancy rate for senior housing dropped quickly, much more so than for the multifamily market, as facilities faced high COVID-19 fatalities and a thinning labor pool. Occupancy bottomed out at 78.7% in the second quarter of 2021, down from 88% in the fourth quarter of 2019, according to the National Investment Center for Seniors Housing & Care.

Occupancy rates: Senior housing and multifamily

A host of additional factors may weigh on the sector longer term. Financial struggles related to the economic slowdown have led some boomers to put a hold on retirement, a shift helped by fast-changing workplace dynamics that have brought many senior workers new remote and hybrid work options.

The pandemic has also resulted in more fluid arrangements for school, as children move between in-person and remote learning, creating more need for in-home child care. Some grandparents are stepping up through mutually beneficial multigenerational living arrangements. And recent improvements in telehealth make it possible for more seniors to postpone moves to environments with in-person care.

Workforce participation for those over age 55 has been increasing since 2000 and is projected to continue, with the biggest rise to date in the younger over-50 set—those age 55 to 64. Most dramatically, Americans age 75 or older are expected to double their rate in the workforce to 11.7% in 2030 from 5.3% in 2020, according to the U.S. Bureau of Labor and Statistics.

In 1980, 38% of the U.S. workforce could look forward to a pension; in 2020, that figure had dropped to 15%, according to the BLS. At the same time, retirement savings such as 401(k) plans have not prepared boomers to stop working; median savings are only $202,000, according to data released in April from the Transamerica Center for Retirement Studies.

And while the rise in inflation is certainly worrisome to many seniors, the longer-standing concern over increasing medical costs speaks to the lack of financial security felt by many. With unemployment nearing pre-pandemic levels of 3.6% and the battle for labor intensifying, companies are less inclined to push retirement packages on aging employees or shun older job candidates. Often boomers are being asked to delay retirement and stay in the workplace on their own terms—and they are doing so for the long-term financial gain.

The rise in multigenerational living

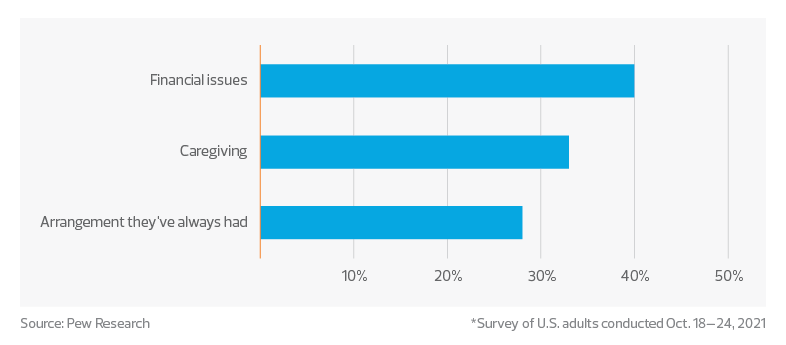

Multigenerational living had already seen exponential growth over baby boomers’ lifetimes, with the number of people residing in multigenerational housing arrangements quadrupling between 1971 and 2021 to 59.7 million, according to Pew Research. The most prominent catalysts behind this trend—financial worries and the need for caregiving—are clearly escalating.

Reasons for multigenerational living

Inflation of more than 9% year over year through June 2022 has helped drive housing prices up 20.9% in the same period, according to CoreLogic. Meanwhile, a lack of inventory of new homes, exacerbated by supply chain challenges in construction and rising interest rates, leaves many families unable to purchase a home.

Part of the reason for the inventory shortage? As boomers stay in their homes longer, the existing market supply is restricted. Even though rising home valuations provide a greater cushion to afford the amenities offered by senior housing, seniors are opting to stay in their homes longer and forgo those services.

Telehealth provides remote medical support

Often the move to senior living is prompted by a desire for access to health care, with many facilities offering higher levels of care as needs progress. Physical proximity to health care professionals was long considered critical to ensure the best care. But the pandemic changed the model, causing the medical community and regulators to re-imagine health care.

Technology innovation accelerated and telehealth visits rose, with baby boomers leading the way. According to a survey conducted by the U.S. Department of Health and Human Services from April 14 to Oct. 11 of 2021, nearly a quarter of Americans over the age of 65 indicated they had a telehealth visit in the prior month.

Benefits of multigenerational housing

The pandemic exacerbated the problems of an already stressed child care industry; according to Child Care Aware of America, approximately 16,000 centers closed permanently between December 2019 and March 2021, accounting for 9% of centers nationwide. The need for broader family support to raise children became more pressing than ever before.

Multigenerational housing can be beneficial to all age groups. Not only can baby boomers look to their adult children for help with their own care, but their children can often depend on them to help look after grandchildren.

The takeaway: Investor focus will shift

Industry participants operating and investing in existing senior housing assets with the flexibility to convert some or all their units to multifamily housing stand to benefit the most. Multifamily supply will continue to be restrained by the high cost of construction (the average price per unit is up 21.6% year over year, according to Yardi Matrix), and community aversions to new development create significant barriers for new entrants into the market.

Multifamily units that include multigenerational features such as extra bedrooms and bathrooms, in-law suites, and safety features are sure bets. While re-permitting and rezoning will present hurdles for developers, the demand for multifamily housing is simply too great to ignore.

Annual rental growth rate