Real estate deal activity slowed considerably in 2022, and financing is now feeling the slump.

Key takeaways

As the spread narrows between cap rates and interest rates, lenders and sponsors are wrestling with the risks of negative leverage and potential defaults.

Sponsors are turning to mezzanine debt or preferred equity financing to bridge the gap between senior loans and equity for upcoming debt maturities, acquisitions and new construction.

Real estate deal activity slowed considerably in 2022, and financing is now feeling the slump, as lenders join sponsors on the sidelines to close out the year. All indications suggest the industry is transitioning into a challenging period characterized by higher borrowing costs, restructured capital stacks and increased cash flow due diligence. Whether investors gear up in 2023 remains to be seen. However, the fundamentals of real estate remain strong across all sectors as the industry navigates the new normal.

Negative leverage indicates transition period

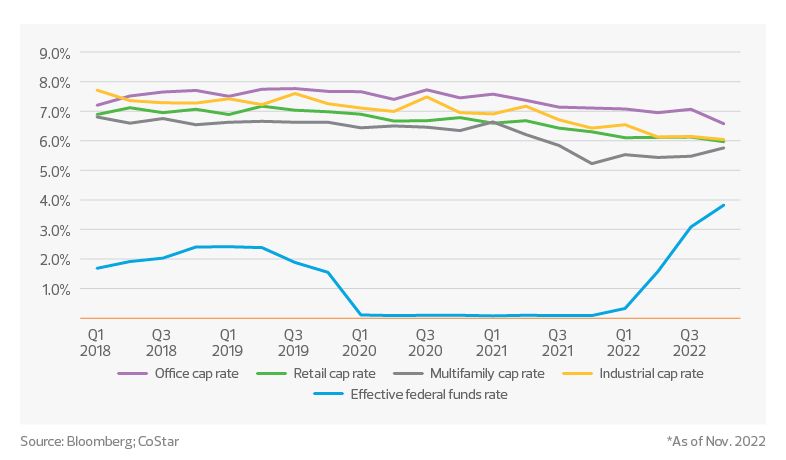

The Federal Reserve continues policy efforts to curb inflation, having raised rates four times in 2022 with further increases expected into early 2023. Although the goal is restoring price stability, rental real estate sectors have remained relatively immune to the effects of rising interest rates, with cap rates generally staying at compressed levels. Meanwhile, the current environment has created a negative leverage scenario where borrowing costs are higher than returns on real estate investments.

Approximately one-third of all commercial mortgage-backed securities loans in the third quarter of 2022 were in a position of negative leverage, according to Moody’s Analytics, with multifamily and industrial leading at 35.9% and 30.8%, respectively.

Cap rates vs. federal reserve interest rates

As the spread narrows between median national index cap rates and interest rates across all sectors, lenders and sponsors are wrestling with the risks of negative leverage and potential defaults. The immediate effect will be lower loan-to-value ratios on loan issuances, which are currently at 50%−60%, compared to 65%−75% in the recent past. But a more important shift will be the focus of sponsors and lenders toward debt service coverage ratios to monitor operating cash flow that covers higher borrowing costs, as well as the ability to exit at a levered price in line with investor returns.

As we head into 2023, Fed Chair Jerome Powell has indicated that the central bank has no intention of reducing interest rates in the next six months. Rather, we are likely to see the Fed lift and hold rates, followed by a pause. It will be up to the market to find a new equilibrium on pricing that will bring more certainty in underwriting and transition the industry to a new era.

Taking the leverage out of leverage

Many middle market sponsors are turning to flexibility in their capital structures to take advantage of any adjustment that affords a path to success in the current restrictive lending environment. Commercial and multifamily mortgage loan originations decreased by 13% in the third quarter of 2022, compared to the same period last year, according to the Mortgage Bankers Association, with the largest decrease (44%) in the office sector.

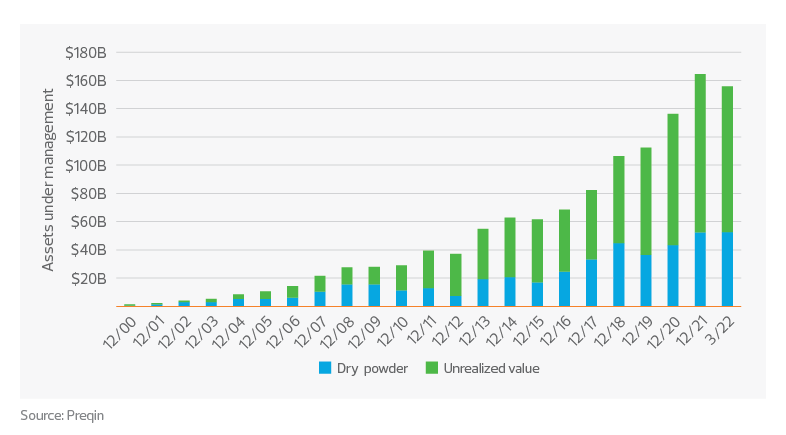

Typically, private debt issuers, which sponsors have used in times of immediate lending needs such as the current environment, offer floating rates at a premium over market rates with shorter terms. By comparison, private debt loans are less impacted during inflationary periods, as lenders are able to pass costs from higher rates directly to borrowers. Data from Preqin shows that valuations for assets under management for private debt funds have consistently grown over the past decade, a trend that includes a 46% increase from Dec. 31, 2019—just ahead of the pandemic—through the end of 2021.

Private debt funds

However, the slowdown in traditional loans is now trickling into the alternative lending space. According to Global Commercial Real Estate Services, alternative lenders accounted for 32% of loan closings in the third quarter of 2022, down from 39% a year earlier. The decline was attributed to restraints in collateralized loan obligation issuances, which fell to $3.4 billion in the third quarter of 2022 from $12.3 billion in the second quarter.

Sponsors are now turning to preferred equity to bridge the gap between senior loans and equity for upcoming debt maturities, acquisitions and new construction. As of November 2022, $258 billion of dry powder was focused on the North American real estate market, according to Preqin, with $100 billion aimed at opportunistic investment—a 40% increase from Dec. 31, 2021.

Middle market sponsors are also searching for opportunistic, value-added commercial assets with high vacancies that are not subject to long-term leases locked in at below-inflation rent bumps. They can allocate capital toward gap-lending positions, primarily needed in opportunistic investments and developments where financing has disappeared. This flexibility in capital selection enables them to take advantage of higher-yield preferred returns. Risk is hard to price right now, but defaults remain low due to the continued strength of real estate cash flows.

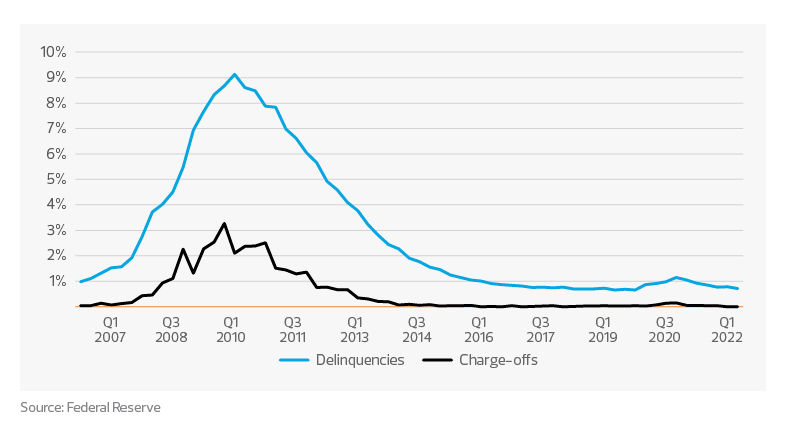

Lenders brace for a soft landing

Following the global financial crisis of 2007−09, delinquencies in commercial/multifamily real estate exceeded 9%. With major losses incurred by lenders and significant regulation that followed, lenders are bracing for a similarly bumpy impact. However, real estate portfolios are more stable than in 2008, as evidenced by commercial real estate loan delinquencies and charge-offs remaining below 1% as of the second quarter of 2022.

Commercial real estate loans

The market is still characterized by high rents and low vacancies, with no anticipated major changes in supply and demand; this indicates that the fundamentals across all sectors remain strong and sufficient to cover higher carrying costs. By the second half of 2023, lower loan delinquencies, compressed loan-to-value ratios and a pickup in deal volume should pull lenders back in the game. The Mortgage Bankers Association reported $4.9 trillion of outstanding commercial and multifamily mortgage debt at the end of the second quarter of 2022 and predicts $872 billion in total commercial real estate lending in 2023.

The takeaway

Real estate lending may look different amid the economic slowdown, but committed participants are finding creative solutions as the industry enters a new normal. Interest rates are unlikely to come down as quickly as the market expects, even with a likely recession on the horizon. Elevated rates will cause an industry previously hooked on leverage to restructure deals and look for opportunistic assets with strong and sustained cash flows to fight inflation and deliver double-digit investor returns. It remains to be seen how soon buyers and sellers can come to agreement on property valuations to solve negative leverage positions. But there is reason to be optimistic that stability in transaction pricing will bring traditional banks back into the lending mix and lead to an increase in deal volume in 2023.

TAX TREND: Real estate investment

Understanding the tax implications of loan defaults or nontraditional borrowing can inform your decisions and prevent surprises.

In the case of a loan default, a borrower might have to recognize income and pay tax despite not having the cash. In a creatively structured loan, for example, a borrower might believe they’re in a debt position, but it is deemed equity—and subject to a higher tax rate than expected.