Firms should not take the stability they have enjoyed for the past few years for granted.

Key takeaways

Productivity is key to profitability in this inflationary environment and tight labor market.

Firms are looking inward to assess how technology could help them do more with less.

Amid signs that profitability is in jeopardy, firms are focusing on productivity

The professional services industry has experienced a luxury that many others throughout the pandemic have not—stability. Amid a competitive labor market, however, inflation and increased expenses are eroding the industry’s relative shelter from public health disruptions and supply chain constraints.

As pandemic fears wane, challenges of protecting profit margins are top of mind, given how persistent inflation and resource constraints are contributing to speculation about a recession. Traditional strategies of cutting costs to protect profit margins prove to be especially difficult in times of heightened inflation, and billing rate increases have not been enough to offset the sharp increase in direct expenses driven by a tight labor market.

Instead, productivity is a priority of every professional services executive. The focus now is to invest in strategies and technology that will help drive productivity so firms can devote precious resources to high-value, billable hours.

Protecting profitability

Because the industry consists of highly skilled workers who provide professional advice, guidance and knowledge, organizations in other industries often turn to professional services providers for help adjusting their business operations or solving complex problems. In fact, from 2007 to 2021, in the professional services industry annual revenue per employee grew 22% to $165,000, according to the 2022 Professional Services Maturity Benchmark report by SPI Research.

It comes as little surprise, then, that while public health restrictions during the pandemic limited demand and contributed to soaring unemployment in industries such as retail, restaurant, and travel and leisure, some professional services subsectors even experienced impressive growth.

Looking ahead, though, protecting profitability has become a formidable challenge despite stable revenue growth.

Persistent labor shortages pushed many professional services firms to raise salaries and bonuses to attract and retain their most precious asset: staff. However, this strategy has caused direct and indirect expenses to skyrocket. Meanwhile, pervasive inflation continues to decrease the benefit of raised salaries.

Many elevated expenses, such as salary, are sticky, meaning they are not as easily cut as they are raised. This means that cutting expenses to improve profit margins this year may not be an option for many firms. Although billing rate increases have been common, this strategy will also not be effective on its own. Instead, professional services firms are looking inward to assess how technology could help them do more with less.

Revenue growth, but profitability warning signs

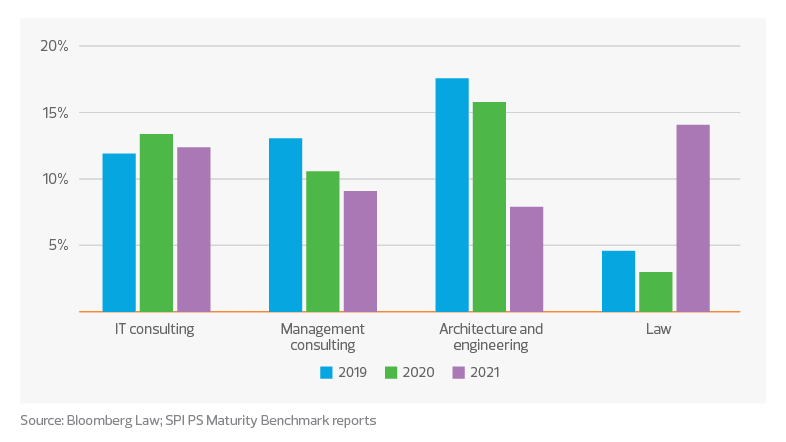

Although each of four leading professional services subsectors has had at least one year of tempered growth in demand during the pandemic, all four have continued to maintain positive revenue growth each year.

Annual revenue growth: Professional services subsectors

Despite positive annual revenue growth in all sectors, increasing direct and indirect expenses driven by inflation and a tight labor market continue to threaten profitability. In the business and professional services industries, wages in June 2022 increased 5.4% year over year, as companies battle historically low unemployment rates and a shortage of labor.

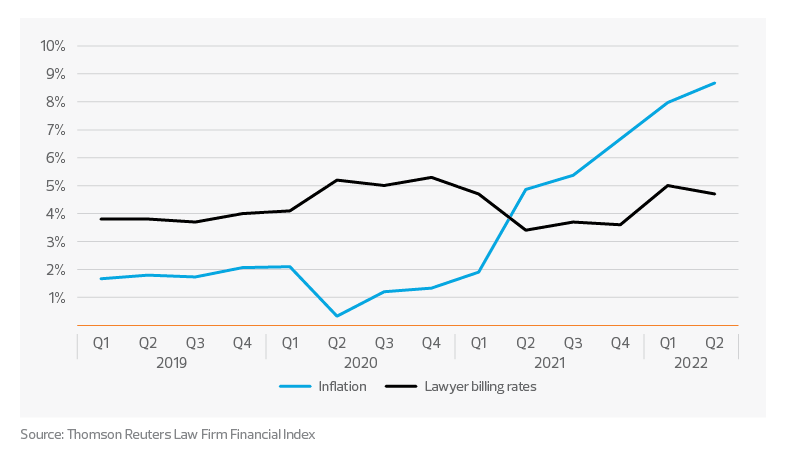

In the legal subsector, Thomson Reuters’ Law Firm Financial Index, a quarterly composite score that reflects law firm profitability, declined in the second quarter of 2022 to 36, the lowest score in the 16-year history of the index. It’s the fourth consecutive quarter in which the index has declined, a downtrend despite stable demand for law services and aggressive billing rate increases—showing that inflation has eaten into gains.

The rate of inflation has surpassed the pace of billable rate growth. From a productivity standpoint, this means law firms must focus on their input; in other words, doing more or improving productivity during billable hours to offset the effects of inflation.

Inflation vs. lawyer billing rate growth

The push to be productive

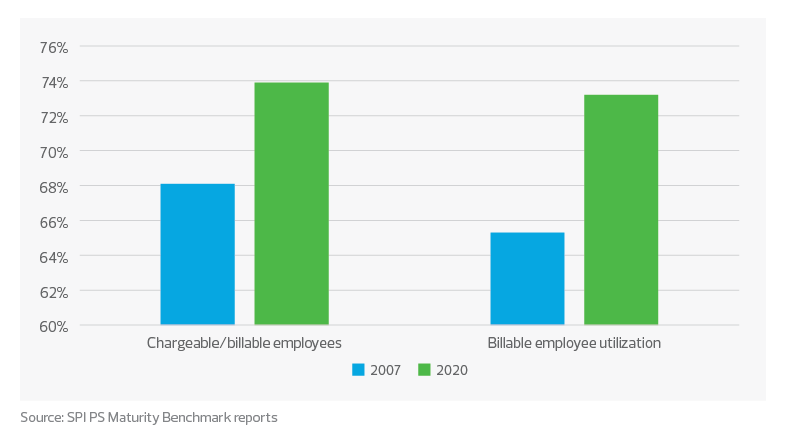

Looking back 15 years, professional services have steadily become more productive. Productivity at its core is a measurement of efficiency when creating a product or service, and key metrics for professional services firms usually center around billable hours and utilization. The percentage of billable employees at a firm rose to 74% by 2020, showing a decline in administrative, nonbillable staff.

Productivity metrics in professional services

Utilization of billable employees also has increased over the past 15 years. This shows that billable employees are able to spend more of their time on high-value, billable work and less on administrative, nonbillable tasks.

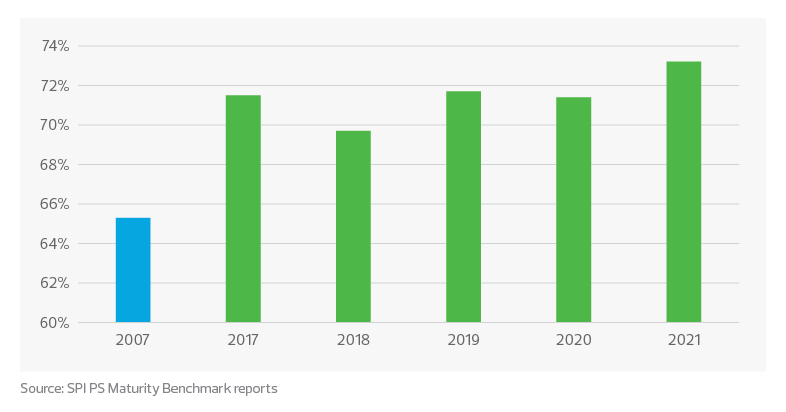

In the past five years, however, utilization growth has stagnated around 71%, according to the SPI Benchmark report—suggesting a ceiling for the number of billable hours a professional services employee can work in a year. If that is the case, firms must enable their employees to do more during those hours.

Billable employee utilization in professional services

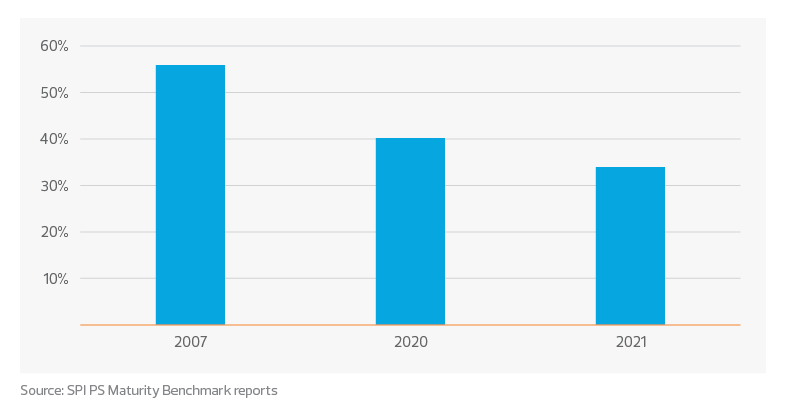

One factor that has influenced productivity gains—and was accelerated by the pandemic—is the amount of nonbillable travel time required to serve clients. From 2007 to 2020, the time spent on-site dropped by 15%. In one year during the pandemic, it dropped another staggering 6.3%, according to the SPI Benchmark report.

Percentage of time spent on-site for delivery of professional services

Although travel for on-site delivery of professional services will almost certainly never go away, we do not anticipate it increasing significantly as the world moves toward pre-pandemic work processes. Professional services providers have proven they can remain productive while off-site and are now set up with the technology to maintain that capability. Additionally, many firms are invoking environmental, social and governance policies that support global decarbonization—policies that include limitations on air travel.

Another significant way professional services firms have increased productivity is by using technology to reduce administrative tasks and to work smarter. Automation, integrated workflows and approvals, knowledge-sharing technologies, and virtual communication tools have allowed professional services personnel to multitask with several projects and clients at once.

5.4%

Year-over-year wage increase for employees of business and professional services firms in June 2022

10.5%

Percentage increase in year-over-year spending on technology by the average law firm in Q2 2022, the fastest pace in eight years, according to Thomson Reuters

22%

Decrease in time spent on-site for delivery of professional services firms from 2007 to 2021

Tech and capital expenditure trends

Investment in technology remains one of the top ways for firms in any industry to improve their productivity, especially in a competitive labor market.

The average law firm in the second quarter of 2022 increased its year-over-year spending on technology by 10.5%, the fastest pace in eight years, according to Thomson Reuters. That second-quarter surge followed an 8% annual increase in the first quarter. The acceleration reflects a subsector with its eyes on long-term success in the face of more immediate threats to profitability.

It remains a question, though, how steadfastly firms can afford to focus on that big picture.

In the architecture subsector, for example, 78% of respondents to a survey by the American Institute of Architects in May 2022 said they expect an increase over the next 12 months in the costs of technology for business purposes. Asked separately about the costs of technology for design purposes, 78% of respondents, again, said they expect an increase over the next 12 months.

In the same AIA survey, 19% of respondents said in May they planned to defer capital investments, such as technology, to cope with inflation in 2022. Contrast that with the optimistic picture painted at the beginning of the year by the Associated General Contractors of America’s national survey for its 2022 construction outlook. At that time, healthy percentages of respondents said their firms in 2022 would increase their annual investment in software for document management (33%), project management (31%) and estimating (27%).

Among professional services firms that are proceeding with investments in digital solutions, we are seeing a key trend toward single solutions that can do more under a simplified workflow with minimal integration complexities. Firms are turning to these single solutions to standardize and simplify IT architecture instead of just adding new technology to an existing suite of applications.

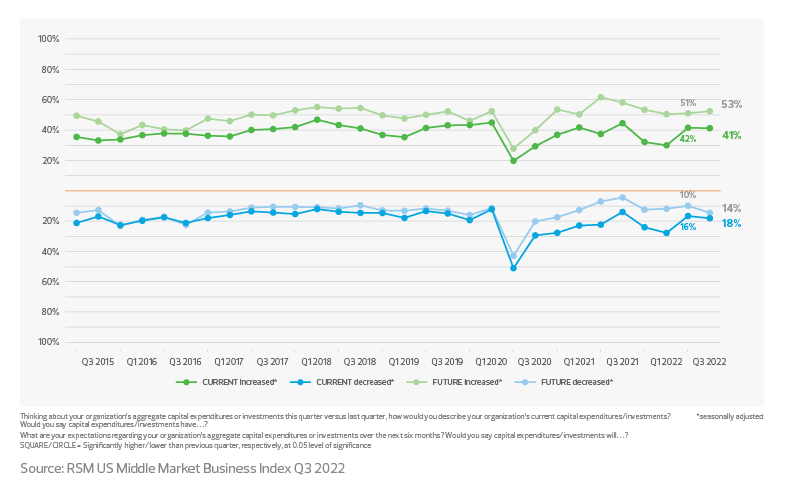

Overall, in the macro economy, RSM US’s Middle Market Business Index reported a jump in expected capital expenditures in the second quarter of 2022, up an impressive 12%, with 42% of midsize companies indicating they spent more last quarter than the quarter before (30%). That percentage of companies remained steady in the third quarter, with 41% reporting investments in the last three months. With investment levels that robust, firms that defer will do so at a risk to their competitiveness.

AGGREGATE CAPITAL EXPENDITURES/INVESTMENTS PERFORMANCE

Capital outlays eased slightly, with 41% of executives indicating their organizations made investments in Q3. The outlook remains relatively robust, with 53% indicating that they will be making capital expenditures in the next six months.

Looking ahead

As pandemic fears wane, inflation and resource constraints persist, and recession fears ramp up, professional services firms should not take the stability they have enjoyed for the past few years for granted. The warning signs are clear: Without making significant progress on improving productivity, firms in all subsectors risk a sharp decline in profits in 2022 amid the increase in direct expenses and inflation.

RSM contributors

Trending insights for professional services firms

The Real Economy

Monthly economic report

A monthly economic report for middle market business leaders.

Industry outlooks

Industry-specific quarterly insights for the middle market.