Outsourcing private equity fund administration has become an industry standard.

Key takeaways

Investor scrutiny of private equity fund administrators continues to increase.

Automation is streamlining private equity operations, from fund accounting to reporting.

Amid fluctuating market conditions, private equity (PE) fund administration must constantly evolve to meet the needs of investors, regulators and firms. The Private Funds CFO Insights Survey 2025, commissioned by PEI Group in partnership with RSM US LLP, offers a unique glimpse into how PE CFOs are responding to increasing demands. Through insights from over 120 finance leaders, the report explores key trends shaping PE operations—from outsourcing and co-sourcing strategies to ways to leverage cutting-edge technology and address talent acquisition hurdles. In this article, RSM distills essential findings and strategies for firms looking to build scalable, adaptive and resilient operational models in a rapidly changing market.

Firms are focused on scaling private equity operations

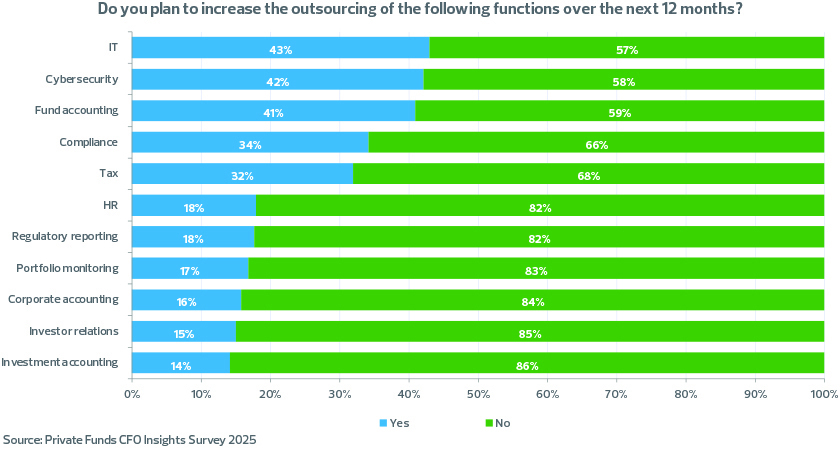

PE firms have become increasingly focused on scaling and optimizing their fund operating model. The survey results highlight a trend toward outsourcing specific functions like information technology, cybersecurity, fund accounting, compliance and tax. By relying on external partners, CFOs aim to free up internal resources, allowing back-office teams to prioritize strategic activities over administrative tasks.

Outsourcing provides firms access to deep industry knowledge, which can be crucial for maintaining compliance with regulatory demands. However, to truly benefit from this model, CFOs must select service providers capable of adapting as their funds grow. The right partner is essential to ensuring scalability without creating additional burdens, particularly as firms navigate the demands of investors and regulators.

Survey respondents were asked if they plan to increase outsourcing the following functions over the next 12 months:

How firms should approach selecting the right operating model

Selecting the best operational framework is not always a matter of insourcing or outsourcing; for many firms, it involves co-sourcing arrangements. A hybrid model enables firms to retain control over data and technology while leveraging third-party insights. The flexibility of co-sourcing appeals to firms looking to navigate shifting regulatory environments, increasing economic uncertainty and changing investor expectations.

In developing a scalable operating model, firms should assess their current state before setting a target framework. Co-sourcing offers certain advantages, such as control over proprietary data and greater agility in adapting to new requirements. However, it can be costlier than full outsourcing. As firms weigh the pros and cons of each model, ensuring scalability and adaptability remains central to building a sustainable structure.

The growing role of limited partners in outsourcing decisions

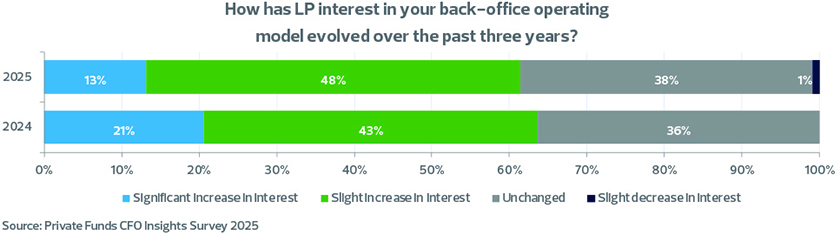

Limited partners (LPs) play an increasingly significant role in shaping outsourcing strategies, especially when dealing with new or expanding managers. According to the survey findings, LPs tend to favor managers who outsource core functions like fund administration, tax and cybersecurity. Outsourcing to reputable service providers reassures LPs that processes are handled with the rigor and sophistication necessary for effective management.

This preference also acknowledges that most middle market general partners (GPs) lack the resources to maintain a large internal team to support high standards in each area. Leveraging outsourcing enables these firms to access specialized knowledge without the prohibitive costs associated with in-house operations.

How firms are leveraging technology to better harness their data

Technology has transformed data management within PE firms, making operations more streamlined and reducing the risk of human error. Firms are increasingly integrating technology to automate tasks, link various data sources and establish a single source of truth in their data systems. This seamless flow of information supports compliance, improves decision making and enhances transparency across departments.

The concept of an infinity loop of data is gaining traction, wherein data flows continuously across finance functions—from initial entry through tax reporting and back into the overall finance structure. This approach ensures that data remains accessible and accurate for use in various tasks, such as regulatory filings and strategic planning.

Firms are also investing in robust data tagging systems that can accommodate changes in regulatory demands and LP expectations. This flexible approach allows firms to update data inputs as needed without having to reconfigure their entire back office—a crucial consideration as political, economic and compliance landscapes evolve.

Survey respondents were asked how LP interest in their back-office operating model has evolved over the past three years:

Tax technology challenges and opportunities facing firms

Tax technology presents unique challenges for PE fund managers, particularly around data transparency. Traditional tax reporting systems can be opaque, constraining firms’ ability to analyze data effectively. By implementing advanced tax technology, firms can transform tax data into actionable insights, enhancing planning and compliance. This improved visibility empowers CFOs to make more strategic, data-driven decisions.

Automation within tax processes reduces manual data handling, lowering the risk of errors and freeing staff to focus on more valuable tasks. Increasingly, firms are also looking to tax technology for real-time cash flow and tax planning, enabling them to forecast trends and the potential impacts of legislative changes. By leveraging connected data systems, firms gain a comprehensive view of financial health and can make informed projections for future performance.

Addressing talent acquisition and retention concerns

With talented employees becoming harder to find, PE firms are turning to technology to reduce the workload on existing staff. Automated processes allow skilled professionals to focus on analysis and value-added tasks rather than data entry, fostering job satisfaction and encouraging employee retention. In a competitive labor market, technology-driven efficiencies help firms attract and retain high-caliber professionals by minimizing repetitive tasks.

A major concern in outsourced operations arises, however, when the service provider undergoes a merger or acquisition. Such transitions can disrupt teams and challenge service continuity, prompting firms to carefully evaluate the stability of outsourced partners. Selecting partners that prioritize team consistency and continuity helps mitigate these risks, ensuring the outsourced model aligns closely with the firm’s values and expectations.

Private equity’s journey with artificial intelligence

Artificial intelligence is a promising but cautiously approached frontier for PE firms. While AI can enhance efficiency and provide valuable insights, many firms are taking a strategic approach, focusing on foundational data processes before fully integrating AI solutions. AI has potential applications in financial analysis, where it can streamline processes and identify trends within vast datasets. However, firms are mindful of data security and are working to strengthen their current workflows before wholeheartedly adopting AI-driven automation.

Currently, personnel typically direct AI usage, with analysts using it as a tool for enhanced decision making. Looking ahead, firms anticipate embedding AI directly into workflows, enabling automated analysis and cost savings. However, maintaining a balance between AI-driven processes and human oversight will remain essential to ensure sound, informed decision making.

Survey respondents were asked to describe their current strategy toward the use of AI within their firm:

The takeaway

As PE firms seek to future-proof their fund operations, scalability, adaptability and innovation remain top priorities. Insights from the survey reveal that CFOs are increasingly open to exploring flexible operational models, leveraging technology to streamline processes and addressing talent challenges through strategic automation. With LPs influencing operational choices and technology enabling data-driven decisions, PE firms are better positioned to navigate the complex and changing financial landscape. A commitment to scalable, sustainable solutions will allow firms to remain resilient and ready to adapt, no matter what challenges lie ahead.

A version of this article originally appeared in the Private Funds CFO Insights Survey 2025 published in December 2024.