Mid-size streaming services are increasingly seeking to acquire sports media rights.

Key takeaways

The potential to gain a new revenue source and reach a wider audience may be key right now.

Analytical tools can provide valuable insights into subscriber behavior and preferences.

The changing media consumption landscape is poised to bring further disruption to the sports industry but also presents a significant opportunity for sports leagues and streaming services to create value through expanded audiences for teams and streaming subscriber bases.

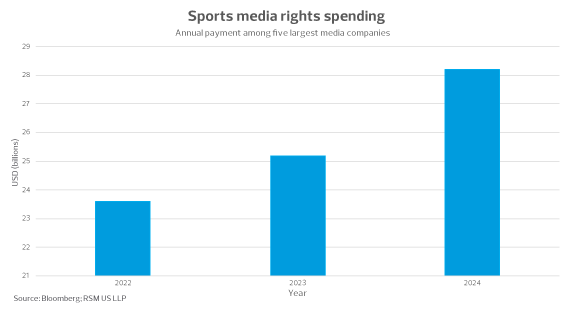

Cable TV, which has long been the primary platform for broadcasting sports teams' media rights, has seen decreased viewership for years, leading regional sports network owners to face bankruptcy and loss of those sports rights. Meanwhile, mid-size streaming services are increasingly seeking to acquire sports media rights to gain subscribers from both local and national fan bases, recognizing the value of sports content in driving viewer engagement.

For both streaming companies and sports leagues, the potential to cultivate a new revenue source and reach a wider audience may be especially crucial at a time when consumers are expected to dial back spending and economic headwinds are expected to intensify.

Media landscape

In 2023, the shift to cord-cutting continues, with significant implications for the sports industry. Pay TV providers lost nearly 5.9 million net video subscribers in 2022, according to Leichtman Research Group, an increase from the 4.7 million video subscribers who dropped cable in 2021. The trend is accelerating as users look for mobility, cheaper costs and more on-demand options that streaming provides.

Cable providers have been preparing for years in numerous ways, such as bundling content libraries into new delivery platforms. Live sports, one of the most compelling drivers of new subscriptions is reaching a critical turning point. Of the 100 most-watched U.S. broadcasts in 2022, 94 were sports, with 82 of those top broadcasts attributable to the National Football League (NFL) alone. For streaming services looking to accrue users expeditiously, exclusive sports rights come with strong, built-in fan bases and consistent content.

The success of the NFL in nationalizing its media rights demonstrates that doing so can increase fan bases, create better league parity through redistributed media revenues, and expand audiences for both national and local games.

Traditionally, sports broadcasting rights for Major League Baseball (MLB), the National Basketball Association and other leagues have been controlled by individual teams, with live broadcasts of popular professional sports becoming the cornerstones for local cable TV channels, or regional sports networks (RSNs).

If a streaming enterprise secures national rights deals with MLB, for example, as opposed to solely localized market rights, the league could potentially accrue several significant benefits, such as:

- Increased national exposure for the sport

- Increased pricing power for the media rights, as the streaming service gains a wealth of content and significant increases in engaged subscribers

- Centralized media revenues, which can be redistributed to smaller-market teams, increasing competition and improving the overall product

Netflix paid $16.84 billion on content in 2022 and has an enormous subscriber base but has not acquired sports media rights; ultimately, the company may have the view that a sports rights deal would not generate sufficient additional subscribers to be a profitable endeavor.

But other streaming services clearly disagree. Paramount agreed to pay a reported $1.5 billion to secure coverage of the Union of European Football Associations Champions League for six years. Apple TV signed a 10-year partnership with Major League Soccer for approximately $2.5 billion. And the rights to NFL Sunday Ticket garnered a whopping $14 billion.

Mid-size streaming services are increasingly seeking to acquire sports media rights to gain subscribers from local and national fan bases. Companies can use analytical tools to conduct in-depth analyses about the potential of sports content to enhance lifetime customer value.

A path to profitability?

The upcoming months will be crucial for MLB and other leagues to plan their media strategy, not just to secure the highest price for broadcasting rights but also to determine which platform may be the best fit for their sport. On the streaming services side, companies must carefully balance content spending with free cash flow needs.

To make informed decisions about the potential of sports content to retain subscribers and enhance lifetime customer value, companies can leverage a range of analytical tools, including Azure, Alteryx, Databricks and PowerBI, to conduct in-depth retention and cohort analyses. These analytical tools can provide valuable insights into subscriber behavior and preferences, helping companies optimize their sports rights investments and overall content strategy.