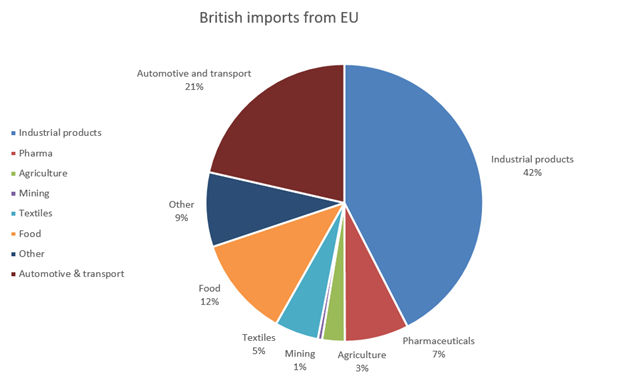

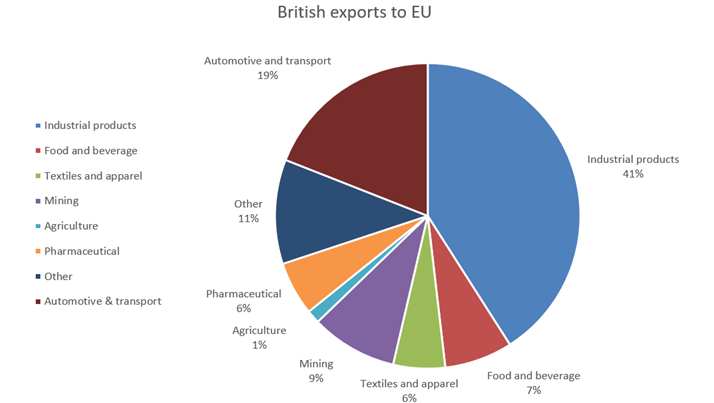

While Britain voted to leave the European Union in 2016 and companies had about four years to organize their operations for the change, there was not much clarity on what Brexit would mean for companies until Dec. 24, 2020, when the post-Brexit trade deal—the U.K.-EU Trade and Cooperation Agreement—was finalized. Plenty of questions remain about what the specific impacts of the deal will be, but some aspects—such as value-added tax and customs implications—have come into clearer focus in 2021. Manufacturing companies will need to pay particular attention to the impact of Brexit, as more than 60% of trade between the U.K. and EU pertains to industrials.

This will be important for U.S. manufacturers, as the United States is the largest investor in the U.K.; American firms—across all economic sectors—have investments of nearly $758 billion in the British market, according to the U.S. Chamber of Commerce. That’s nearly a quarter of American companies’ total investment in Europe, and more than 12% of all U.S. foreign direct investment worldwide, according to the Chamber. We expect this to further increase given the Biden government’s push for a multilateral alliance against China and the U.K. realigning itself away from the EU.

Britain has traditionally operated as a distribution hub for many U.S. companies selling into Europe, as trade between Britain and mainland Europe has benefitted from a free movement of people, goods and services—with no intervals for customs or regulatory clearances. Industrial products such as machinery and equipment, chemicals, and electronics form a significant portion of the goods traded between the two regions. Indeed, auto components cross the English Channel multiple times before finally making their way into a finished automobile.