Here’s what companies can do to prepare

Cash flow forecasting and management: The most immediate task for any middle market industrials company is to look at the organization’s cash flow and whether its cash forecasting estimates are accurate. If a company’s weekly, monthly and quarterly forecasts don’t show that revenue is expected to be higher than anticipated expenses, the business should prioritize generating more cash flow over other earnings metrics.

Companies should suspend buybacks and dividend payouts, pause nonessential projects and reevaluate capital projects for midterm relevance. It’s also important to determine which vendors are critical to supporting operations and seek out options for delaying payments to other vendors. Companies can also negotiate with landlords for applicable abatements, delayed payments or other arrangements to share the burden.

Many middle market companies generally don’t prepare 13-week cash flow reports, or have established cash forecasting processes, but using cash flow modeling tools can be critical during a crisis.

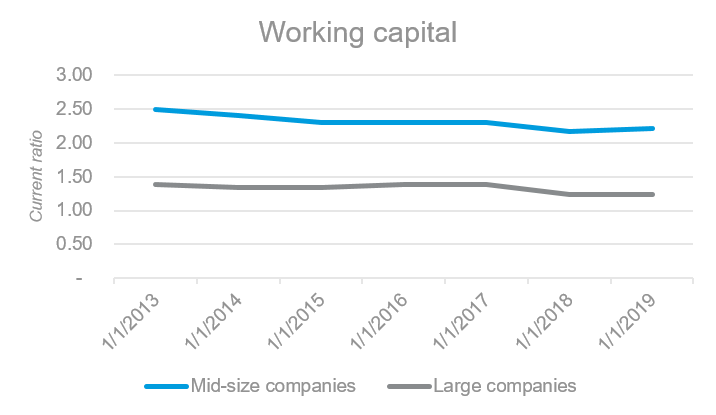

Working capital management: Companies can request longer credit terms from suppliers and at the same time explore the possibility of expediting payments from certain customers. This should be done on a case-by-case basis depending on each customer’s financial strength, industry and relationship with the company requesting the changes. Businesses could also invoice more frequently. However, it’s important to remember that customers and suppliers across the supply chain may be struggling.

Some larger companies are supporting their suppliers through advance payments or other financing options in order to strengthen their supplier base. Companies may consider approaching some of their larger customers for such potential supplier support initiatives.

If companies can manage their inventories to avoid stockpiling but instead purchase on an as-needed basis, this can provide significant liquidity relief. Of course, this needs to be supported by an adaptable inventory management system and suppliers who can deliver on time.

Flexible production schedules: In the face of declining orders, companies can consider expediting their backlogs. If companies sell to multiple end markets, they can explore the possibility of adapting their production lines to manufacture essential products or increase output for end markets that are stronger in the current environment, such as the health care and food sectors.

Federal liquidity programs: The U.S. government has introduced a number of programs to ease liquidity and tax concerns of small and medium-sized businesses dealing with the economic impacts of COVID-19. The Small Business Administration’s Paycheck Protection Program under the Coronavirus Aid, Relief and Economic Security Act (known as the CARES Act) and the recently announced Main Street Lending Program are two initiatives aimed at supporting lending to eligible small and medium-sized businesses.

Tax relief programs: Through the CARES Act, the government has introduced various tax provisions to provide relief to businesses. These relief options include changes to net operating loss rules, enhanced interest expense limitations and extended tax return filing deadlines. Current tax laws could also provide certain planning opportunities that can offer some liquidity relief. In addition, multinational companies should also explore international tax provisions that can assist in repatriating cash from overseas operations.

Many other countries have also introduced targeted tax credit and incentives, and grant and loan programs to help local businesses. Companies with operations in these countries should explore liquidity opportunities throughout their global footprint.

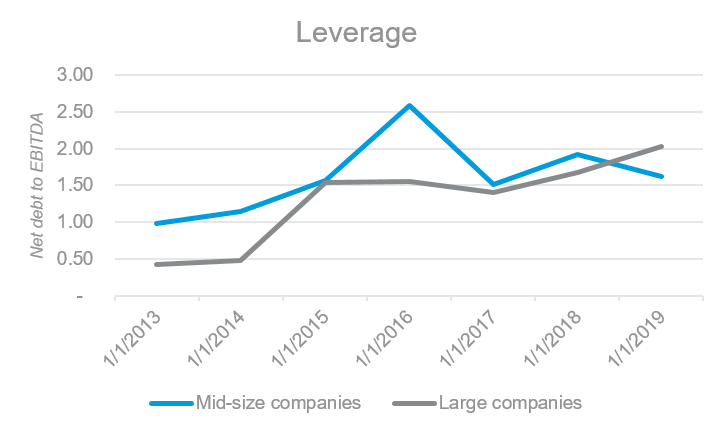

Existing lenders: Companies can explore drawing down their revolver facilities after evaluating short-term needs against prolonged uncertainty. If required, bankers could be asked to amend covenants in the interim or negotiate for better terms. Companies should carefully evaluate liquidity needs before taking on more debt.

Layoffs: Laying off employees can be very expensive given retraining and rehiring costs, and lost productivity. Companies should carefully consider long-term operations when deciding whether to implement layoffs, and also consider whether furloughs could be a more suitable option if staff levels need to change.

While the above measures can help stem the liquidity crisis in the short- to midterm, what is critical is how companies use this crisis as an opportunity to make themselves more resilient for future uncertainties. Investing in data analytics and other technology solutions will ensure companies can operate efficiently with optimized costs, be lean and adaptable, and positioned to make the best out of this crisis.