The credit incentivizes domestic manufacturing for certain renewable energy components.

Key takeaways

One area of significant opportunity is the electric vehicle market.

Companies need to understand the life span of their existing manufacturing plant capabilities.

Manufacturing executives are navigating how to maximize tax credits, grow profitability and stay on track with other priorities, and a new industry-specific tax credit adds another consideration to the mix.

The Inflation Reduction Act extended Internal Revenue Code section 48C—the manufacturers’ tax credit—to provide an additional $10 billion in tax credits. That extension included the addition of section 45X, the advanced manufacturing production credit, which provides a tax credit for eligible renewable energy components produced in the United States. Under section 45X, eligible manufacturers can receive up to 10% of project cost reimbursements to produce certain renewable energy components—such as solar panels or electric vehicle batteries—including certain renewable energy minerals produced domestically.

The opportunity

The United States accounts for just over 2.5% of energy equipment production, according to data from Statista, ranking fifth globally compared to other countries. In 2021, the United States manufactured just under 5 gigawatts of solar panels domestically out of 200 gigawatts produced globally, according to the International Energy Agency. This indicates a huge opportunity, especially given the supply chain challenges of the last few years. Boosting domestic production of key renewable energy components is one long-term solution to those challenges.

But forming new relationships and shifting supply chain models takes significant time and financial resources that executives would rather not deploy now given the current economic outlook. Enter the section 45X advanced manufacturing production credit, which incentivizes domestic manufacturing by providing those financial resources. Onshoring these energy components will ultimately reduce lead/lag timelines and uncertainties, help alleviate supply chain pressures and lessen the production cycle exposure to external factors.

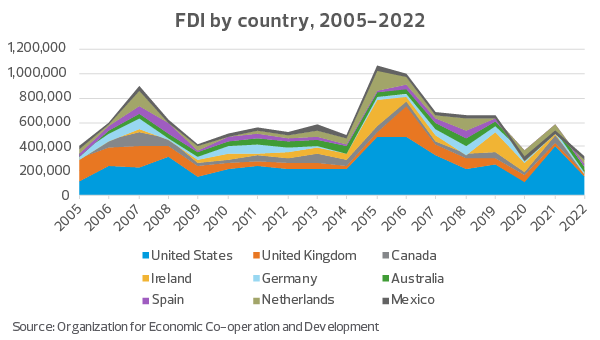

In addition to incentivizing domestic production, the extension of the tax credits makes U.S. production more appealing to foreign investors looking to expand their international presence, while also giving the United States access to broader customer networks. The United States is already the largest recipient of foreign direct investment, according to an International Monetary Fund survey from 2021, the most recent data available. FDI has many favorable outcomes for the U.S. economy, including new jobs, higher wages and increased U.S. exports. It also strengthens domestic manufacturing (approximately 40% of U.S. affiliates of foreign companies are in the manufacturing sector, according to the Global Business Alliance). FDI also provides for new research and technology and contributes to rising U.S. productivity through the availability of capital, which increases competition and helps to stabilize pricing.

Assessing resources and needs

To enhance its competitive advantage, a company must understand the criteria, implications and opportunities of the recent legislation. One area of significant opportunity is the electric vehicle market, given that many of the critical components/minerals outlined in the legislation are involved in battery manufacturing. Overall, we expect the section 45X credit—alongside other clean energy incentives—to boost the EV market’s progress toward its expansion goals.

While there is more opportunity than downside in using this credit, there may be some resistance given the upfront investments needed to take full advantage. Executives who are diligent in aligning their expansion and capital investment to take advantage of these credits will be best positioned in the long run. Companies will need to review their current capital capacity to understand the life span of their existing manufacturing plant capabilities. If capacity will be met within the next few years, investing sooner will best position companies for the financial and human capital resources needed for expansions and/or new facilities.

Data will also be central to supporting companies’ requests to receive the tax credits. This includes data about the company’s ability to monitor and reduce project lead times, as well as how the credits will boost job creation. Employing a third-party firm specializing in data analysis can help manufacturers obtain the most precise data in a timely manner, as manufacturers could start to receive tax credits immediately for sales of eligible products manufactured between Jan. 1, 2023, and Jan. 1, 2030.

For more information on tax credits under section 48C, refer to the RSM tax alert IRS releases Notice 2023-18 for credits under section 48C.