As we move through 2023, the reinsurance market is expected to undergo several notable changes.

Key takeaways

Key factors include emerging risks, technological advancements and regulatory developments.

Insurtech and data analytics will play an even more significant role in the reinsurance industry.

The reinsurance sector is grappling with a host of negative forces that have led to considerable volatility in the market. As June renewals approach, insurers are seeking ways to weather this storm and adapt to the changing landscape.

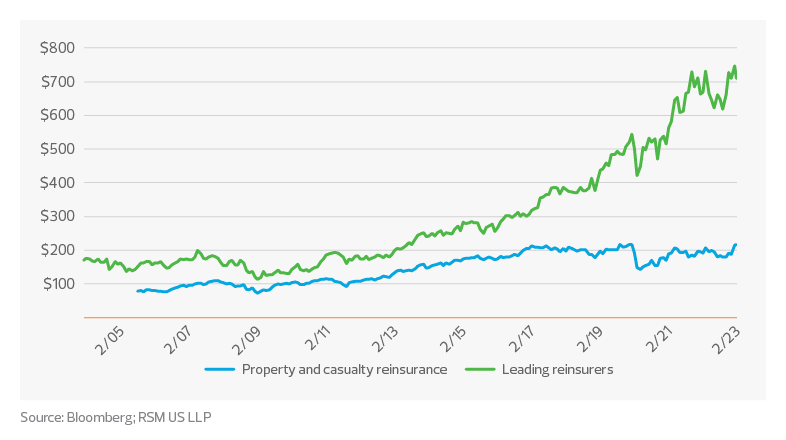

Since fall 2022, reinsurance rates have seen a significant increase, and this trend is expected to continue throughout 2023. Recent estimates reveal that property reinsurance rates surged 60% during the Jan. 1 renewals. This tightening of the reinsurance market can be attributed to a confluence of factors, including macroeconomic uncertainties, environmental challenges, consistently high natural catastrophe claims, and capacity constraints. Organizations must adapt to this pivotal moment in the industry.

Primary insurers face considerable challenges as they negotiate reinsurance contracts leading up to the June 1 renewal deadline. The industry was battered in 2022 by numerous setbacks, including losses stemming from the Russia-Ukraine conflict, ongoing inflation, mark-to-market investment losses that weakened capitalization, and another year marked by above-average natural catastrophes, such as the devastation of Hurricane Ian, as reported by S&P Global.

North America property and casualty reinsurance last price

Tightening in the reinsurance market can be attributed to macroeconomic uncertainties, environmental challenges, consistently high natural catastrophe claims, and capacity constraints. Organizations must adapt to this pivotal moment in the industry.

As we move through 2023, the reinsurance market is expected to undergo several notable changes, influenced by various factors that include emerging risks, technological advancements and regulatory developments. Here are some potential trends for the coming year:

- Continued rate increases. Reinsurance rates are expected to continue rising throughout 2023, driven by factors such as climate change, the increased frequency and severity of natural catastrophes, and elevated levels of uncertainty surrounding global economic and political situations. Insurers will need to monitor these developments closely and adjust their pricing strategies accordingly to remain competitive and profitable.

- Greater focus on ESG considerations. Environmental, social and governance factors will increasingly influence the reinsurance market. Insurers and reinsurers will likely prioritize ESG considerations in their underwriting processes and investment strategies, aligning their business models with responsible and sustainable practices.

- Technological innovations. Insurtech and data analytics will play an even more significant role in the reinsurance industry, as insurers and reinsurers seek to leverage advanced technologies to improve underwriting accuracy, streamline claims processing and enhance risk management capabilities. Machine learning, artificial intelligence and other predictive technologies will be utilized to better assess and price risks, ultimately driving greater efficiency and competitiveness.

TAX TREND: Software development

Insurance and reinsurance companies that develop internal-use software themselves or through a third party are having to comply with the unfavorable change in the required tax treatment of R&D expenses. Companies might minimize this burden by analyzing their R&D costs to carve out those that are not covered by the new requirement. And once they clarify their R&D cost data, they may find they are eligible for an R&D tax credit.

Insurers will need to enhance their understanding of evolving cyber risks, develop specialized underwriting methods, and collaborate with technology partners to design comprehensive and effective cyber insurance products.

- Cyber risk expansion. As cyberthreats become more sophisticated and prevalent, the demand for cyber reinsurance coverage will grow. Insurers will need to enhance their understanding of evolving cyber risks, develop specialized underwriting methods, and collaborate with technology partners to design comprehensive and effective cyber insurance products.

- Regulatory changes. Regulatory developments may influence the reinsurance market in 2023, as authorities worldwide seek to strengthen policyholder protection, increase transparency and promote financial stability within the industry. Insurers will need to stay abreast of these changes and adjust their compliance strategies accordingly.

- Market consolidation. As the reinsurance market continues to face mounting pressures, we may witness increased consolidation, with mergers and acquisitions becoming more prevalent. This trend could result in a more concentrated market, as companies seek to achieve economies of scale, diversify their risk portfolios and enhance their competitive positioning.

- Niche opportunities. Amid the evolving risk landscape, reinsurers may identify niche opportunities in specialized or emerging areas such as renewable energy, autonomous vehicles, and pandemic risk. These market segments may offer growth potential for reinsurers willing to develop expertise and innovative solutions to address the unique challenges associated with these risks.

Overall, the reinsurance market is poised for significant change in 2023, driven by various factors ranging from emerging risks to technological advancements. Insurers and reinsurers must remain agile and responsive to these developments, embracing innovation and adaptation to thrive in the shifting landscape.