Executive order: Buy American

President Joe Biden’s first 100 days included an executive order titled Ensuring the Future is Made in All of America by All of America’s Workers. This so-called “Buy American” executive order, issued Jan. 28, signals the administration’s intent to reshore the defense supply chain to provide greater security and transparency from a national security perspective and support American workers during and beyond the economic recovery.

Most significantly, Buy American requires the Federal Acquisitions Regulation (FAR) Council to consider eliminating the part 25 component test and replacing it with “a test under which domestic content is measured by the value that is added to the product through U.S.-based production or U.S. job supporting economic activity.” The executive order is silent, however, on how that would be measured.

With greater transparency may come greater scrutiny and difficulty relying on prior waivers and exceptions. Proposed waivers and justifications will be publicly available, inviting scrutiny from the public and competitors. Contractors should be prepared for the possibility of reshoring their supply chains or, at least, complying with documentation and reporting requirements that ensure current operations align with any updates to FAR.

Reassessing sourcing and procurement practices also will give contractors the opportunity to consider ways to align with other focus areas of the new administration, including prioritization of environmental, diversity, inclusion, and social issues. President Biden’s executive orders around these topics suggest the possibility of additional restrictions and requirements for contractors to support these initiatives and drive change nationally.

Executive order: Supply chain review

The Biden administration on Feb. 24 issued another executive order, titled America’s Supply Chains, which further emphasized the national focus on supply chain risk. This executive order requires major agencies to perform a supply chain review within 100 days of issuance of the order. The review must detail the goods, services and manufacturing associated with their supply chain, the related risks, and policy recommendations and proposals to mitigate such risks. Risk identification will be no easy feat, given the opportunity for risks associated with defense, intelligence, cyber, health, climate, environment, economics, geopolitical dynamics, human rights, forced labor and other considerations.

This executive order requires immediate review of supply chains associated with active pharmaceutical ingredients, critical minerals, semiconductors and advanced packaging, and large capacity batteries such as those used in electric vehicles. In addition, it calls for a “more in-depth, one-year review of a broader set of U.S. supply chains,” including the defense, public health and biological preparedness, information and communications technology, energy sector, transportation and agricultural commodities, and food production industrial bases.

Section 889 compliance

Those two executive orders followed the rollout of interim rule section 889(a)(1)(B) of the 2019 National Defense Authorization Act, made effective Aug. 13, 2020. This interim rule prohibits the federal government from extending or renewing contracts with an entity that “uses any equipment, system, or service that uses covered telecommunications equipment or services as a substantial or essential component of any system, or as critical technology as part of any system.” More specifically, this refers to equipment produced by certain Chinese entities deemed a threat to national security, such as Huawei Technologies Company and ZTE Corporation. Subcontractors are tasked with making a “reasonable inquiry” that their supply chains are compliant.

Contractors have scrambled to comply with the interim rule and seek additional clarification, given the heavy burden associated with full compliance and the limited window provided for industry input. Although section 889’s purpose and intent generally garner bipartisan support, the interpretation of the guidance and waiver policies are still at play.

While section 889 relates only to a specific handful of Chinese suppliers, efforts and documentation required to prove compliance can be burdensome. Additionally, section 889 sets a precedent for similar restrictions and compliance requirements for segments of the defense supply chain outside of telecommunications where national security is of particular importance.

Insights from execs

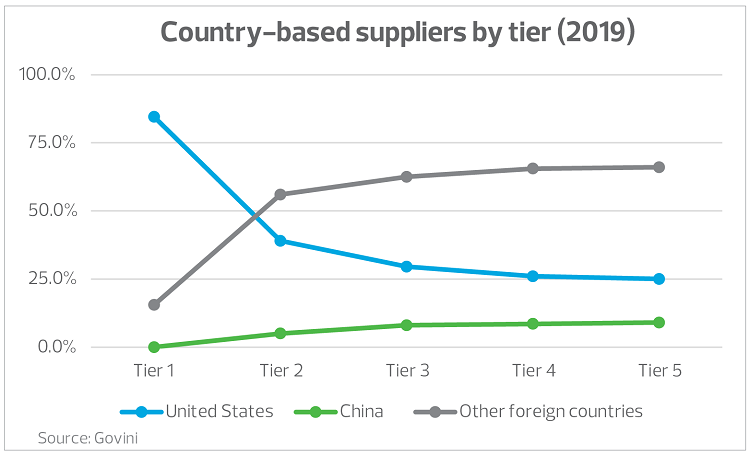

Supply chain risk and optimization was a key trend from public company earnings calls in 2020 for many defense technology contractors. Executives mentioned future trends around flight to quality suppliers, reshoring the defense supply chain and possible delayering of the defense supply chain via direct contracting with smaller, niche, highly technical contractors, bypassing some of the tier 1 contractors.

For example, Mercury Systems CEO Mark Aslett highlighted the DOD’s emphasis on domestic supply chain, noting that the department “remains focused on China’s militarization and tightened tensions in the diplomatic, technological and economic domains.” As a result, the DOD’s “number one defense technology priority” is U.S.-produced trusted microelectronics.

In addition to risk mitigation, L3Harris Technologies highlighted operational and strategic opportunities to maximize their supply chain operations going forward. Specifically, CEO William Brown noted the business is expecting “substantial activities” in 2021 relating to facility rationalization and other opportunities within their supply chain.

Overall, supply chain management remains a hot topic in the government contracting ecosystem, especially as it relates to risk mitigation and operational performance improvement.

What’s next?

Now is the time for government contractors to invest in their supply chain—not only to mitigate risk and establish required controls, but also to take advantage of operational improvements and opportunity. The low interest rate environment supports accelerating long-term investments where possible. The likelihood of increased regulation going forward paired with trends emerging under the Biden administration make this a safe bet for contractors looking to position themselves for the future of government procurement.