Opportunities for government contractors

Government contractors benefit from recession-proof revenue streams, serving the largest and most reliable customer in the world. Even during periods of economic hardship, contractors collaborate with the federal government to spur investment and recovery. Therefore, many contractors have strong cash positions and should take advantage of the current interest rate environment to position themselves strategically as critical partners to the federal government going forward.

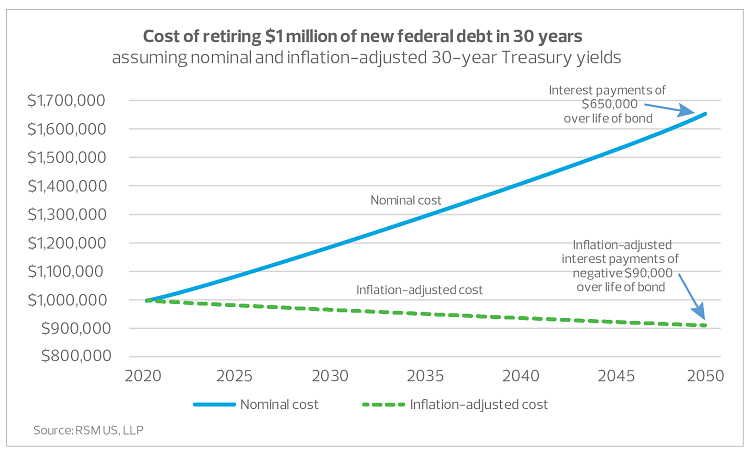

Negative inflation-adjusted interest rates make the coming year an ideal time for capital outlay on key strategic initiatives such as those outlined below.

Acquisitions and integration

- System consolidation: A roaring mergers and acquisitions market dominated the ecosystem for the last 10 years, leaving a trail of partial or failed integrations in its wake. Efficiencies abound when disparate entities come together under consolidated accounting and reporting systems, processes and procedures. There is added opportunity to enhance information technology systems by migrating to the cloud, automating repetitive processes and utilizing systems that optimize procurement and vendor management.

- Developing new capabilities: Many federal agencies, particularly the Department of Defense, are on the bleeding edge of technological advancement, whether it be artificial intelligence, machine learning, robotics, space exploration, the hypersonic regime or unmanned vehicles. Investing in the proper experts and upskilling employees to address the new frontier of the nation’s mission-critical needs positions contractors for defense of the future.

- Accessing new agencies: Winning that first contract vehicle in a previously unserved agency can require significant investment of time and talent. A changing administration and swing in Congress toward the Democratic Party could mean federal dollars flowing to agencies that weren’t prioritized by the previous administration but suddenly find themselves in vogue. Many contractors may choose to gain access to contract vehicles via mergers and acquisitions as opposed to pursuing it through means that are more organic. Either strategy requires investment.

Digital transformation

- Electronic proposal systems and data analytics: Electronic proposal systems help speed up proposal development and ensure timely and accurate calculation of rate estimates. Improved data analytics helps contractors remain competitive and identify areas for improvement in both operations and the bid process.

- Enterprise resource planning (ERP) systems: Many contractors are plagued by archaic ERP systems that require manual calculations and consolidations. ERP systems have improved significantly over the last few years with more options in the market than ever before. A comprehensive ERP system can make haphazard Excel workbooks outdated.

Cyber and supply chain risk mitigation

- Cybersecurity: The Department of Defense’s mandatory Cybersecurity Maturity Model Certification will be included in requests for proposal starting this year with full adoption achieved gradually over time. Readiness assessments, gap analyses and internal control improvements can take time and must be addressed before certification from an approved third party.

- Supply chain security: Supply chain security is of utmost importance, particularly as it relates to national security. Interim rule section 889(b) of the 2019 National Defense Authorization Act, implemented in August 2020, requires contractors to scrub their supply chains and operations of products and services sourced from Chinese companies deemed to be threats to national security. This can be a time intensive and expensive undertaking. Additionally, the Biden administration’s goal to reshore federal supply chains will also contribute to shifting procurement practices and documenting compliance.

Why invest now?

In recent years, middle market firms have lagged behind their larger industry counterparts in capital outlays, a trend documented in the RSM US Middle Market Business Index. In an encouraging sign, the December 2020 MMBI survey showed that more than half of respondents (52%) said they expect to boost investment in productivity-enhancing capital expenditures such as software, equipment and intellectual property over the next six months.

Due to the unique confluence of events that is upon us, firms will actually make money by borrowing, because we are operating at near-zero nominal interest rates that become negative when adjusted for inflation.