Over the last decade, there has been a steady increase in claim costs.

Key takeaways

Tech-enabled automotive parts will be more expensive to repair or replace.

Advanced estimating tools and technical training will become even more important.

As we move into the second half of 2024, the auto insurance industry faces a daunting challenge: the relentless rise in auto repair costs coupled with a critical shortage of skilled technicians. Even a temporary dip in auto parts prices has done little to halt the upward trajectory of repair expenses, pushed higher by inflation. Insurers need to understand the forces driving this trend if they want to develop strategies to stay ahead.

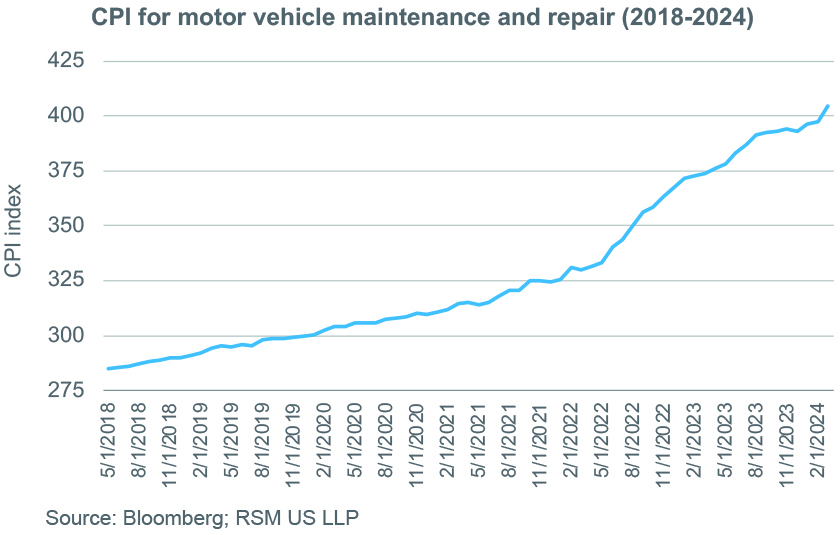

Recent data indicates a marked increase in the costs associated with auto repairs. Notably, the consumer price index (CPI) for motor vehicle maintenance and repair—accounting for both parts and labor—climbed by approximately 10% from 2023 to 2024, signaling a persistent inflationary trend.

Why the recent spike?

Inflation isn't a new risk for insurance carriers; over the last decade, there has been a steady increase in claim costs, particularly related to advances in automotive technology and the rise of extreme weather events. Supply chain constraints in the past few years led to further increases in claim costs related to parts and intermediate materials, wage pressures and increased demand for used vehicles.

A significant driver of this increase is the widespread integration of advanced driver-assistance systems (ADAS) into newer vehicles, which are packed with cutting-edge technologies. ADAS, for instance, is integrated into newer vehicles to help drivers navigate and park more safely.

In the near term, this means that tech-enabled automotive parts will be more expensive to repair or replace in the event of an insurance claim. When these vehicles need repairs, the estimates can be 50% to 100% higher than for older cars. Even routine fixes like replacing a windshield can cost over $1,000 due to the need to recalibrate embedded sensors. In 2019, the average labor rate for repairs was under $50 an hour in the U.S., according to Mitchell. At the end of 2023, it was close to $60 an hour. The significant increase in labor rates over this period reflects broader trends in the industry, including rising costs of living, higher operational expenses for repair shops and increased demand for skilled labor.

Supply chain constraints in the past few years led to further increases in claim costs related to parts and intermediate materials, wage pressures and increased demand for used vehicles.

Labor crisis continues

As we wrote in 2022, the shortage of skilled auto technicians has become an acute crisis, threatening to escalate costs and operational delays further. The U.S. Bureau of Labor Statistics forecasts a 4% reduction in auto technician roles by 2029. As vehicle complexity increases, the demand for advanced technical skills outstrips supply, leading to elongated repair times—averaging over 15 days in 2023, up from 12 days in 2019 based on industry reports. All of this inflates costs both for insurers and their customers.

How can insurers adapt?

As the auto insurance industry faces evolving challenges, it is essential for insurers to adopt forward-thinking strategies that address both current and emerging trends, including:

The proliferation of advanced estimating tools

The issue

As vehicle technologies get more sophisticated, accurate and efficient claims processing has become even more important.

How to adapt

Insurers should use tools such as photo estimating and artificial intelligence (AI)-guided estimating to enhance efficiency and integrate these technologies into mobile apps used by claims adjusters and customers alike.

The growing need for technical training

The issue

Repair technicians, claims adjusters and insurance agents all need more specialized knowledge than they used to, as vehicle technologies advance.

How to adapt

Insurers need to invest in ongoing training programs for all roles, to ensure personnel can provide top-notch service and accurate assessments.

Advocacy for policy that supports technological integration

The issue

Outdated policies can slow the adoption of innovative technologies; more groups are pushing to update those policies.

How to adapt

Insurers should advocate for changes that streamline supply chains and facilitate the rapid adoption of digital tools and AI in assessments.

Through the rest of the year and beyond, auto insurers must be proactive to manage rising repair costs and labor shortages. Effectively navigating these challenges will require embracing advanced technologies for enhanced claims processing accuracy and efficiency, investing in workforce development to ensure their auto damage appraisers and physical damage teams are trained to understand modern vehicle technologies, and advocating for industry changes to mitigate external pressures on repair costs. By strategically deploying technology and investing in talent, insurers can better control costs and improve customer satisfaction in a rapidly evolving market landscape.