For environmental services firms, opportunities abound from the Infrastructure Investment and Jobs Act.

Key takeaways

Environmental services firms and waste management companies are investing in technologies that can either replace talent they’ve lost or enhance the productivity of talent they’ve retained.

Data collection and analysis tools are producing valuable predictive insights for firms.

Environmental services and waste management firms have faced their share of hardships during the pandemic—from rising oil prices, to the stifling of construction projects, to labor and supply shortages. However, firms are seeing the light at the end of the tunnel due to several factors that are primed to give the industry the boost it needs in the near future. Now is the time for companies to take advantage of the tailwinds we see coming in the public and private sectors and invest in productivity-enhancing technologies.

New legislation lends a spark

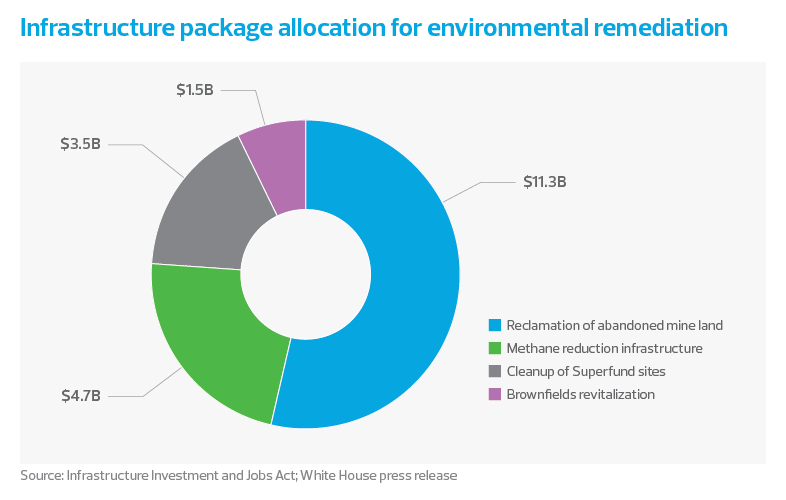

Environmental services firms are ripe to take advantage of the Infrastructure Investment and Jobs Act signed by President Joe Biden in November 2021. Of the $1.2 trillion package, $21 billion is allocated to environmental remediation, including the reclamation of abandoned coal mines, the cleanup of Superfund sites and the revitalization of brownfields. Additional funds are allocated to other environmental projects, such as the upgrade of local waste management and recycling programs.

Firms are bullish on their opportunities to take advantage of these programs. “This bill provides much-needed long-term funding certainty across our strongest markets, such as transit modernization, electrification, environmental remediation and climate resilience,” AECOM CEO Troy Rudd said on the firm’s fourth-quarter earnings call Nov. 15, 2021. “Importantly, we are positioned to benefit from nearly every line item in this bill.”

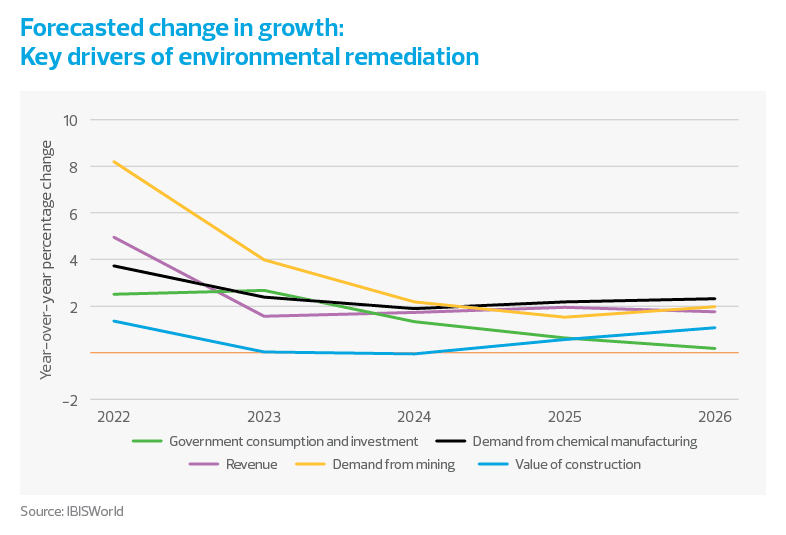

Additional demand will arise from construction projects funded through the infrastructure package. For example, the construction and refurbishment of roads, bridges and waterways will provide firms additional opportunities that include impact assessments, cleanup projects and waste removal. We can almost certainly expect significant growth in 2022 as many firms capitalize on these long-term projects. However, as these projects are long term in nature, growth in the industry is likely to level out over the next few years.

While legislation will boost the environmental services and waste management sectors in the near future, other indicators in the private sector are key drivers as well. Per IBISWorld, private sector construction, mining and manufacturing are expected to increase at an annualized rate of 1.8%, 4.2% and 2.2%, respectively. These key factors indicate an expected 2.4% annualized growth in the industry through 2026.

Firms will need to ensure they have the requisite resources and capabilities to carry out such long, complex projects. Focusing on scaling talent and necessary technologies will be keys in both the short and long terms as firms begin to bid on these projects. Of course, all environmental remediation projects are not created equal. Some may require different forms of treatment, such as biological, chemical or thermal. Having the capabilities to perform several types of remediation and waste removal will create a larger pool of projects to bid on.

Automating jobs and harnessing data

We’ve seen across the environmental services and waste management sectors that the labor shortage has put many companies in compromising situations. Many are unable to meet demand due to a lack of qualified talent. Other firms are feeling the brunt of labor inflation. In response, companies are investing in technologies that can either replace the talent they’ve lost or enhance the productivity of talent they’ve retained.

As a recent example, WM, formerly known as Waste Management, has fully automated its customer setup function. It also is upgrading and rebuilding its 45 single-stream recycling plants and has fully automated four, a process that included the implementation of optical sorters. Doing so has reduced that segment of their workforce by 35% and resulted in $1 million in labor savings per plant per quarter, President and CEO Jim Fish said on the company’s third-quarter earnings call Oct. 26, 2021.

“Strategically, we’re looking at this acute challenge as an opportunity to expedite the automation of certain jobs,” Fish added. “We said previously that we view the automation of certain high-turnover positions as both a competitive advantage and a de-risking mechanism in today’s labor market, where certain jobs simply don’t attract the interest they previously did.”

As more firms recognize how they can benefit from data, we’re seeing firms invest in data collection and analysis tools to improve productivity. In many cases, this data was already available, but using it to be more predictive and proactive is how efficiencies arise.

Casella Waste Systems, for example, is doing just that. The company has developed and implemented various management operating reports by using Microsoft Power Bl to harvest data from numerous disparate systems and move it into a centralized database.

“These reports give us predictive insights into key areas of our collection operations, down to the division level, with drill-down capability to the core data, and help us react more quickly to any deteriorating conditions,” President and Chief Operating Officer Ed Johnson said on Casella’s third-quarter earnings call Oct. 29, 2021.

As the labor shortage persists amid other ongoing pandemic-related uncertainties, the time is now to invest in productivity-enhancing technologies—an essential move to maintain a competitive advantage.

The takeaway

While environmental services and waste management firms have tackled challenges throughout the pandemic, the future appears bright. New legislation, the uptick in private sector projects, and new technologies have this sector trending in a positive direction. Firms should actively position themselves to take advantage of these opportunities to remain competitive in this growing space.

The Real Economy

Monthly economic report

A monthly economic report for middle market business leaders.

Industry outlooks

Industry-specific quarterly insights for the middle market.