RSM US LLP sponsors the Original Equipment Suppliers Association’s Automotive Supplier Barometer, a quarterly survey of the top executives of OESA’s regular member companies. The survey provides insight into the commercial issues and business environment the industry faces. Each quarter’s survey focuses on a different topic, from planning to production. The following article offers Q2 2022 insights on how auto suppliers are rethinking supply chains.

For decades, auto suppliers and manufacturers of all stripes extended their operational reach across the globe in response to multiple factors—the proliferation of the shipping container, lower labor costs overseas, and manufacturing growth in Asia being some of the most crucial.

But now, more than two years into the pandemic, more and more companies are rethinking their operational strategy as it has become clear that a deeply entrenched global supply chain presents more risk than it used to, and that a regionalized supply chain network may better mitigate the risks facing today’s customers.

Auto suppliers find themselves battling numerous high-profile headwinds, given that semiconductors and rare earth materials used for electric vehicle batteries have been in short supply, presenting both short- and long-term challenges. Businesses should continually assess the changes they need to make to lessen their exposure to the tangled supply chain.

The downside of globalized supply chains

The rise of the shipping container in the mid-1950s helped enable the globalization of trade, especially because of the intermodal nature of these containers. “Around the same time,” an article by supply chain platform company Blume Global explains, “transport manufacturers began building vehicles that could transport these containers. The invention of containerization was one of the main drivers in making global trade cheaper and more efficient.” The Toyota production system’s “just-in-time" approach to manufacturing further drove companies to remove waste in the system, resulting in more efficient, but in some cases less resilient, value chains.

Businesses started rethinking their operating models when the Trump administration implemented tariffs on steel and other goods, forcing some firms to change their sourcing or manufacturing strategies. Changes and reassessments have only become more important as the pandemic has worn on.

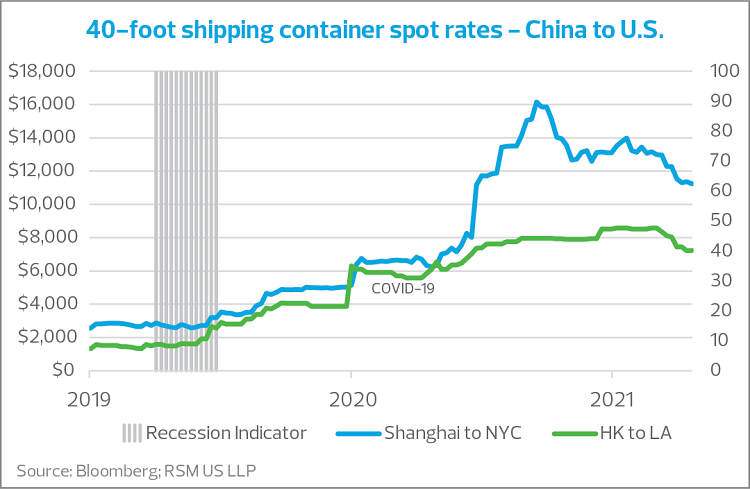

Now, with demand surging for goods from China and elsewhere, containers themselves have become such a hot commodity that their spot rates globally were “still more than quadruple pre-pandemic levels” as of early May, according to FreightWaves.

Pandemic lockdowns and resulting backlogs at ports in Asia, the United States and elsewhere have cast doubt on the viability of the “just-in-time" system and have sent businesses back to embracing some “just-in-case" approaches, keeping more inventory on hand to deal with supply delays. Businesses are also embracing regionalized supply chains to keep inventory closer to the customer.

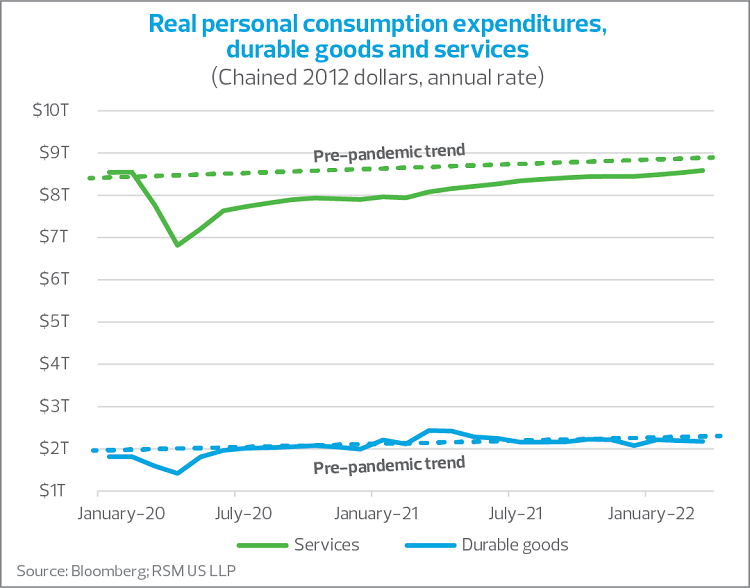

Addressing inventory issues has been especially crucial given that customers have ramped up their spending on durable goods—and away from services—during the pandemic, with more people shopping online and many restaurants and other service-driven businesses undergoing temporary closures.

The war in Ukraine and sanctions on Russia have added another element of uncertainty to the mix. While the conflict is primarily affecting global energy and food supply chains, it has also been particularly challenging for the automotive industry, which sources rare earth metals from Russia and Ukraine. Russia accounts for 45% of the global supply of palladium, for instance, which is increasingly used in catalytic converters to reduce vehicle emissions.

IHS Markit lowered its global automotive forecast by 2.6 million units for 2022-2023 due to the war. This is primarily because of less production in Russia, but other global supply challenges also play a role.

Along with the war and the pandemic, companies face inflationary pressures and labor challenges. Manufacturers are forced to rethink how they absorb prices or pass increased costs along to customers, and how they can best retain talent in a competitive labor market. Businesses have been adapting over the last two years, but continuing the move toward regionalization may help on several fronts.

The ability to pivot will remain crucial, especially considering that supply chain bottlenecks likely aren’t going away anytime soon. The RSM US Supply Chain Index rose in March but is still 2.76 standard deviations below neutral, RSM economist Tuan Nguyen wrote in early May, adding that current lockdowns in China and the geopolitical conflict in Ukraine “will most likely assure another round of supply chain snarls ahead.”

What are companies doing to become more resilient?

In regionalization, the operating model shifts in a way that aims to maximize service levels while minimizing the total landed cost of products, including customs, duties, tariffs and taxes. These are key considerations as companies determine the locations in which they want to operate.

Essentially, by creating more regional supply chain networks closer to the end customer, manufacturers hope to give their operations more of a buffer from the factors at play in global trade—essentially establishing insurance policies against some of these disruptions. This will involve evaluating new sources and suppliers, tapping regional sources, and assessing the company’s manufacturing footprint overall.

Here are some important considerations and questions for auto suppliers—especially those in the middle market—looking to regionalize:

- Understand the ways in which your customers are similar or different on a region-by-region basis. This will help prepare the company to become more customer-centric in response to significant regional differences, and potentially enable the capture of more market share.

- Understand/optimize your manufacturing and distribution footprint to minimize transportation costs, transport times, and total landed costs—including customs, duties, tariffs and taxes—while maximizing customer service levels.

- Understand the multimodal modes of transit available for the regions in which you plan to operate.

- Work with a third-party advisor to evaluate various global trade scenarios and strategies for handling them.

- Take into account how your labor practices will need to change if you are moving jobs to and from various countries.

RSM contributors

-

Bart HuthwaitePrincipal

Bart HuthwaitePrincipal -