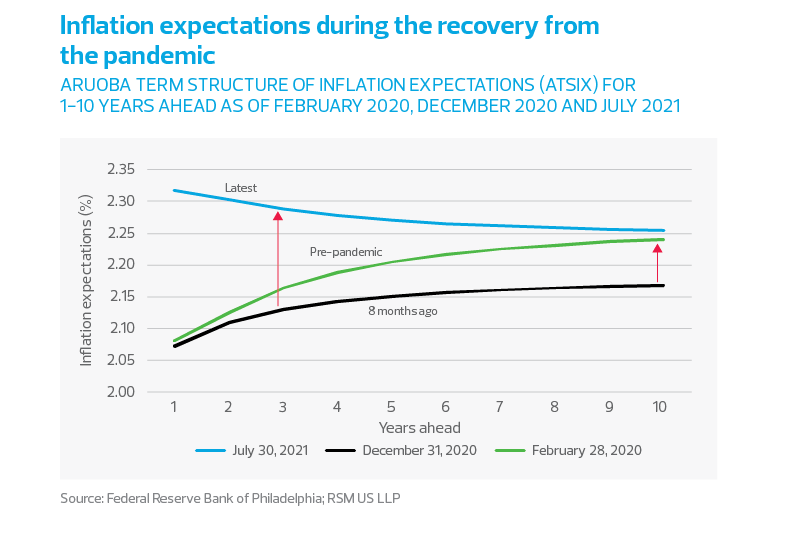

In the modern era of monetary policy and moderate growth, global authorities have shown twice in the past decade their ability to counter horrific shocks to the financial sector and economic activity. Therefore, inflation expectations remain remarkably well anchored despite the recent five-month surge in topline inflation.

Investors understand and believe that if the transitory nature of the current increase in inflation turns out to be more persistent, central banks possess the tools and the will to change policy to address those challenges. That is why expectations for moderate rates of inflation are crucial for the orderly and sustained growth of an economy.

By the end of 2020 and before the vaccination program was fully implemented, expectations were for inflation to average 2.15% over the next 10 years. At present, and because of greater price volatility due to the sudden reopening of the economy, the surge in consumer demand and subsequent supply chain issues, expectations are for the inflation rate in the next few years to move above 2.3% before settling down to roughly 2.25% over time.

Recent history

There are numerous examples in recent history where inflation has reacted to shocks, ranging from Spain and Italy—prior to going under the wing of the European Central Bank—to Argentina, where misguided monetary policies led to episodes of rampant inflation and currency devaluations. But current and forward-looking inflation expectations do not imply anything comparable happening in the domestic economy.

Just before the pandemic in February 2020, expectations for near-term inflation were pushed downward as concerns grew that the global manufacturing recession would push the U.S. economy into recession. Still, expectations were for the Federal Reserve to successfully engineer the 1.2% inflation rate toward a healthier level of 2%, and for the economy to sustain a 2.25% rate over the next 10 years.