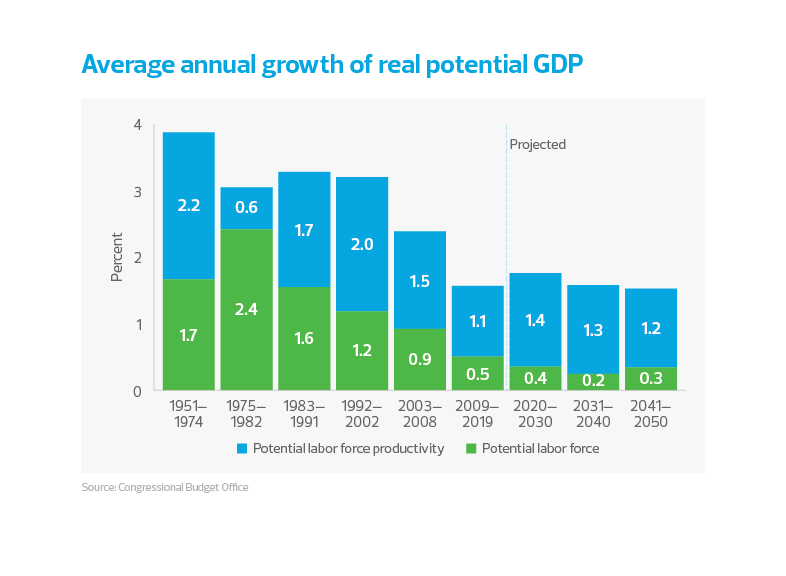

Assuming there will not be significant growth in the labor force anytime soon, the United States needs a much faster pace of growth to mitigate the permanent damage to the economy wrought by the pandemic. That can be generated only with a significant improvement in productivity. The CBO projects a long-run growth trend of only 1.8% over the next decade, and slowing to the 1.5% rate over the next 30 years. Clearly, this is not going to be sufficient to address the damage to the economy and produce fast enough growth to offset those growing deficits.

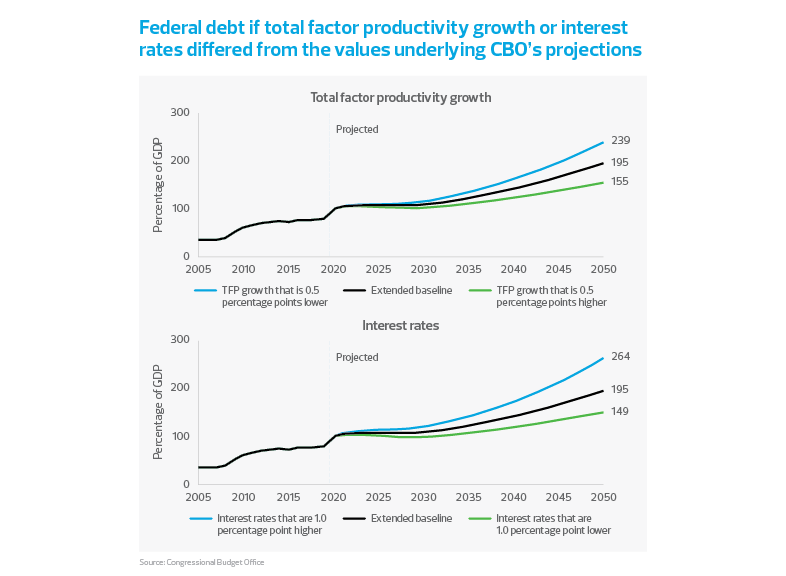

Second, take a look at the differentials in the trajectory of federal debt as a percentage of GDP based on just a 0.5% change in total factor productivity compared to the baseline projection. If total factor productivity is just 0.5 percentage points faster, that 2050 projection of 195% of GDP turns into a much more manageable 155% of GDP. Economists often state that in the short run, productivity means little, but in the long run it is everything. This data illustrates that undeniable truth.

Third, the Federal Reserve’s recent Summary of Economic Projections implied that the policy rate, or the federal funds rate, will remain at zero through 2023, the endpoint of its forecast. The move to the zero-interest-rate policy early in the pandemic caused a general shift down in the U.S. Treasury curve to the point where on most days, once one adjusts for inflation, the curve is negative out to the 30-year maturity spectrum.

The market has priced in no change in the policy rate until the end of 2025. To put this in context, the CBO projects that if interest rates are just 1% higher, the debt-to-GDP ratio would explode to 264% compared to the 195% baseline projection in 2050. If interest rates are one percentage point lower—yes, that means negative nominal interest rate policy—the baseline projection falls to 148% of GDP in 2050.

For this reason, the deficit and debt dynamics of the United States almost require the Fed to maintain its zero-interest-rate policy for the near future; this is part of the reason why the central bank recently chose to change its policy regime to a flexible average inflation-targeting one.