The United States Innovation and Competition Act of 2021, a $250 billion legislative package passed in June to facilitate the research and development of science and technology, represents a sea change in United States economic strategy and a return of government use of industrial policy.

But embracing industrial policy to solve economic and strategic problems carries with it considerable possibilities and risks.

Government-inspired industrial policy has had a mix of modest success and significant failures around the globe over the decades. The semiconductor research consortium Sematech remains a rare success for such policies in the United States. Japan, by contrast, was never able to set the global standard in the consumer electronic market in the 1990s despite considerable government support.

The embrace of industrial policy to solve economic and strategic problems carries with it considerable possibilities and risks.

Now we are on the cusp of another era of government-driven policies that involve billions of taxpayer dollars taking on economic risks.

The changing approach prompts a question: Will such a major shift in government policy result in stronger American manufacturing, technological or life sciences industries?

Business decisions are about return on investment. Government investment decisions balance goals related to jobs and markets with ethical values, all of which carry risks and rewards. Those goals accompany the flow of funds whether they are for national security, the building and nurturing of infant industries, or political considerations.

Will such a major shift in government policy result in stronger American manufacturing, technological or life sciences industries?

The Innovation and Competition Act was ostensibly passed to counter China’s economic dominance and its emerging geopolitical influence. A bipartisan group of 68 senators voted to allow the government to make economic decisions, overriding the hands-off approach that has been sacrosanct for proponents of free market enterprise.

The $52 billion put forward in the legislation to foster a domestic microchip supply chain again puts the government in the position of trying to pick winners in the manufacturing economy.

The U.S., which has captured approximately 50% of global semiconductor sales without significant intervention by the federal government, is now willing to put forward billions of dollars toward a supply chain that would support primarily the automotive sector and, to a certain extent, gaming and consumer electronics.

Those funds, though, do not carry an explicit guarantee that the supply chain will set the standard of the next generation of technology and meet demand. Billions of dollars in direct and indirect subsidies involved in this legislation could easily be lost.

Whether the legislation was framed around countering a threat to national security or securing a guaranteed supply of semiconductors, U.S. fiscal authorities have apparently sensed that the world economy is changing and requires a different approach.

What is industrial policy?

Industrial policy can be defined as government interference in the free market. It can be indirect via agriculture subsidies, tax policy, procurement practices, trade restrictions and currency manipulation, all of which have domestic beneficiaries. Or it can be direct by providing capital.

The last time we discussed whether the U.S. government should become involved in making economic decisions (and when not in the midst of a national emergency) was in the 1980s, at the height of Japan’s emergence on the world stage, and at the pinnacle of economic thought regarding corporations’ role within a market economy.

The U.S. government ultimately refrained from heavy intervention in the microstructure of the economy, while Japan eventually ceded leadership in consumer electronics and then missed the digital revolution that soon followed.

Japan’s government had used many forms of government intervention to resurrect its economy after the Second World War, from directing production to manipulating its currency. But Japan had become a wealthy ally and trading partner, and without a military it was a benign and welcome addition to the original G5 in 1973.

That was the same year that President Richard Nixon ended the dollar’s convertibility to gold. That shift was the onset of free-floating currencies among the developed economies, which among other factors would contribute to the end of Japan’s run of economic dominance.

In the 50 years since the G5, now the G7, was formed, the world has undergone a technological revolution that allowed for the creation of the global supply chain and the emergence of China and the Asian tigers as economic powers. While China’s five-year plans were not unlike Japan’s industrial policy, the entry of an authoritarian country onto the world stage and its military flexing have become a concern.

MIDDLE MARKET INSIGHT: The U.S. has gone from leaning toward a pure free market framework to subsidizing a domestic industry - but only because China has the ability to shut down the supply of key goods.

So when 68 senators voted to shift taxpayer resources to the development of the semiconductor industry, the conversation definitely changed.

The legislation shows that the U.S. has gone from leaning toward a pure free market framework to subsidizing a domestic industry—but only when the other party is a national security threat with the ability to shut down the supply of intermediate and final goods.

Public goods vs. private goods

Some goods and services are more efficiently delivered by the public sector than the private sector. The classic examples are roads, bridges, fire protection and national security.

Why not privatize fire protection, or an army? There would most likely be free riders who would benefit from a neighbor’s fire department. It’s also more efficient to have a single supplier (the local or national government) serving the entire population.

The pandemic has shown the need for government intervention in a variety of forms, especially in public health.

Let’s apply that example to the current health crisis.

Events of the past year have shown the need for government intervention in a variety of forms. There was the government support for pure research that successfully led to the development of vaccines. There was the inability to quickly produce an inventory of personal protective equipment. And there was the responsibility for management of the distribution of vaccines.

Expanding the notion of public goods

Is there any reason not to expand the notion of public goods beyond roads, bridges, fire protection and national security? Consider several recent supply chain failures, in which the market was found incapable of producing necessary goods.

One example was the failure to provide protective equipment to hospital workers during the pandemic. While Finland had stockpiled medical equipment before the pandemic, American states were competing with one another for limited supplies, to no one’s advantage.

Another example was the energy shortage during the winter storm that hit energy-rich Texas. Electricity supply and delivery is treated as a mere commodity rather than a regulated public utility in Texas, but isn’t there a limit to allowing people to suffer in the name of free enterprise? Someone needs to check that equipment can withstand a crisis and that backups are available.

MIDDLE MARKET INSIGHT: A lack of semiconductors contributed to a shortage of automobiles, with the subsequent increase in demand for used vehicles contributing to higher inflation.

A third example is the shortage of semiconductors, which came about because of the halt in production during the pandemic and the shutdown of the global supply chain. Along with backlogs in shipping of other goods supplied by our Asian trading partners, the lack of semiconductors contributed to a shortage of automobiles, with the subsequent increase in demand for used vehicles accounting for one-third of the recent spikes in inflation. So consumers are picking up the bill.

But is it right to put medical masks, electricity and semiconductors all in the same category of public goods? Should government intervention be allowed to go beyond public health and into economic development?

The special case of semiconductors

China is the principal reason that industrial policy for semiconductors is here to stay. Both President Biden and top Republican policymakers have asserted that the purpose of the 2021 legislation is to combat China’s growing influence in several key areas of technology such as artificial intelligence and quantum computing, with special interest given to semiconductor production.

Semiconductor devices are the silicon chips etched with microscopic transistors that are the brains in nearly all modern technology, from toaster ovens to fighter jets. The production of the most advanced semiconductors is a critical economic and supply chain issue as well as a national security concern.

MIDDLE MARKET INSIGHT: The U.S. auto industry, both automakers and their vast network of suppliers, was hit hard by the shortage of semiconductors.

The production of semiconductors requires a lot of capital, and the development of competitive semiconductor factories, called foundries, often costs tens of billions of dollars, forming a significant barrier to entry in the market.

For this reason, the industry has experienced tremendous consolidation, and only three companies are capable of producing the most advanced semiconductors—Intel, Samsung and the Taiwan Semiconductor Manufacturing Company (TSMC). Of these three companies, TSMC is the clear leader, in both market share and innovation.

In effect, the entire world relies on TSMC semiconductors, and any disruption to TSMC’s production or supply chain could result in serious problems on a global scale. This happened during the pandemic, when quarantines and employees working from home spurred increased demand for personal electronics and a resulting semiconductor shortage.

The U.S. auto industry, so dependent on these semiconductors, was hit hard. Parking lots full of finished cars sat idle outside plants in Detroit, waiting for Taiwanese chips. This event was a wake-up call for both the U.S. and China, whose manufacturing economy was also shocked by the shortage.

Arguments for and against industrial policy

This is not the first time that the government has intervened in U.S. economic activity.

Going back to the 1930s, the recovery during the first phase of the Great Depression was driven by government employment, antipoverty programs and infrastructure investment. The initial recovery from the Depression quickly ended, however, when policy turned contractionary. That sent the economy into a deeper recession that lasted until military spending and the war effort brought it back to life.

Development of the American social safety net would not have been possible without the shock of the Great Depression, which serves as a lesson for today’s policymakers. The upending of American hierarchy during the Depression and the war were pivotal in the creation of the middle class and the economic success that followed. It is clear that policymakers in both parties look at the shocks unleashed by the pandemic as a similar opportunity to remake the domestic economy.

The U.S. postwar recovery during the 1950s and 1960s was a remarkable exercise in free enterprise and consumerism. But the economy had little in the way of competition from war-torn Europe or Asia, and was aided by the Eisenhower interstate highway program and the GI Bill that sent Americans to college. Even so, the American dominance of the world economy didn’t last forever.

Japan’s economic postwar recovery began under state control and an antiquated hierarchy. It nevertheless managed to advance from making cheap toys and cars to supplying the world with efficient automobiles and consumer products. But industrial policy errors made sure that didn’t last either.

Next up were China and the Asian tigers.

When China began to open up its economy and enter the international market in the late 1970s and early 1980s, it sat at the bottom of the value chain. China could specialize only in low-value-added goods such as textiles, textile inputs and toys.

Since the 1980s, however, China has caught up in many industries, and now Beijing has pledged to invest the equivalent of more than a trillion U.S. dollars in national objectives relating to industry, including a $200 billion semiconductor foundry.

Japan and China offer examples of state control of industry, one within a developing liberal democracy and one under authoritarian rule. Are there lessons for the U.S. from these episodes?

Yes, Japan’s industrial policy made poor decisions, losing out to technologies and production in Taiwan and South Korea. But there were other factors, such as an aging population and a lack of immigration, that stifled growth. And there was the emergence of China.

As for China, it’s hard to argue that the seeds of losing its economic dominance have been planted by inefficient competition among its provinces and overcapacity. China has natural resources for the digital economy and a nimble labor force. And it has begun to invest in the world’s economic infrastructure.

MIDDLE MARKET INSIGHT: The dominance of the idea that corporations and society are best served by optimizing shareholder profits appears to be ending.

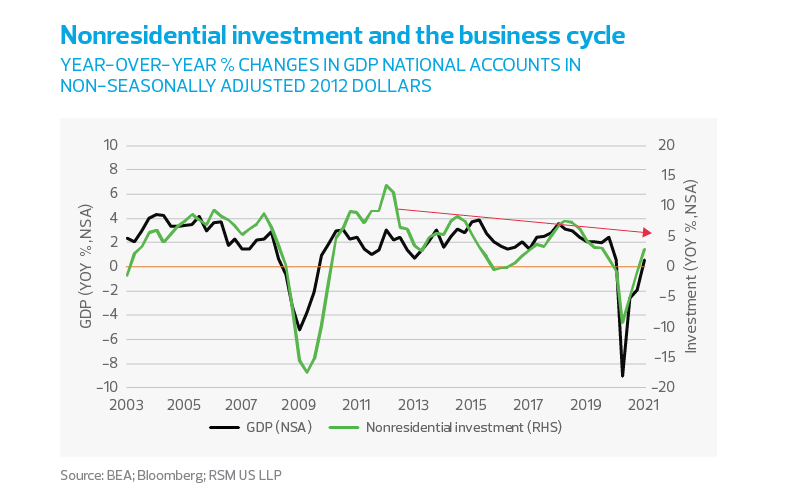

As for U.S. economic policy, the dominance of the idea that corporations - and society - are best served by optimizing shareholder profits appears to be ending after a 40-year run. There can be no argument that U.S. nonresidential investment has been in decline. Corporations rightfully took the opportunity of the recession after the global financial crisis to move production overseas to low-cost centers.

But the concept that the marketplace is infallible—or that corporations are responsible only to their shareholders—seems as fashionable as Def Leppard or 1980s padded shoulders.

Though we cannot expect corporations to act irrationally and neglect to maximize profits, neither can we expect the government to ignore the best interests of its labor force and taxpayers. Are there alternatives to strictly adhering to ideological precepts?

We suggest these compromises to orthodoxy:

- Expand the concept of public goods to matters of public health and beyond

- Invest in a shortened supply chain for those public goods

- Fund research and development of essential industries

- Invest in the new model of American growth