We have entered a period of persistent supply shocks, higher inflation, higher interest rates and slow growth.

Key takeaways

The pandemic and the economic forces that were unleashed have resulted in a structural shift that is transforming globalization, growth and liquidity.

That regime change in those three areas of economic and commercial life will result in a higher cost of issuing debt to finance economic expansion and meet social obligations.

The American economy is in the midst of a long-lasting structural change following the severe shocks unleashed by the pandemic.

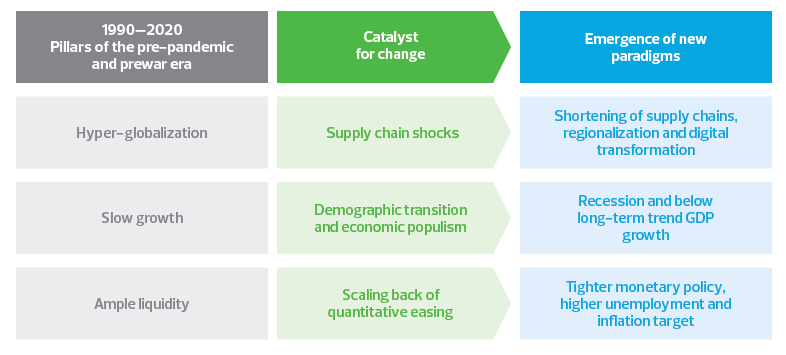

The hyper-globalization that has dominated the global economy over the past 30 years is giving way to an era of regionalization that is radically altering the flow of trade, investment and technology.

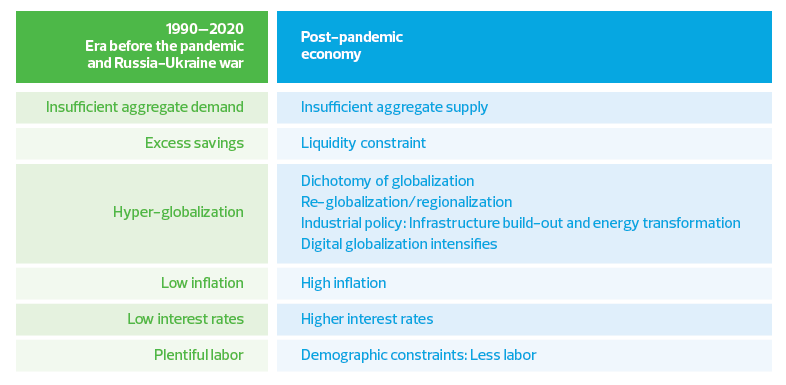

Rapidly fading is an era defined by insufficient aggregate demand, when consumers enjoyed low-cost goods produced in low-wage regions and delivered in tight-knit supply networks. In its place will be a period defined by insufficient aggregate supply, supply shocks and persistent geopolitical tensions.

Globalization, as we have known it, is ending.

Identifying such a shift is always difficult, and it’s even harder during periods of crisis and disquiet, as we are in now. But the changes taking place in geopolitical alignment, globalization, growth and liquidity are too significant to ignore.

Big-picture changes in the U.S. economy

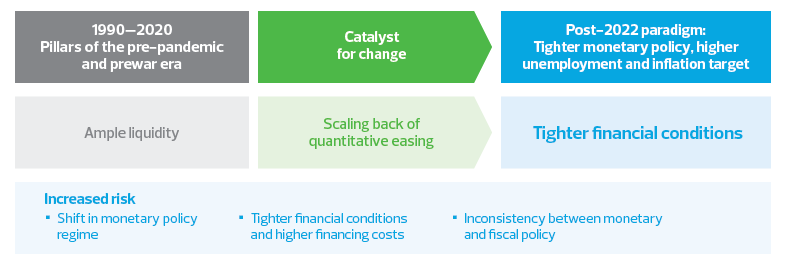

Moving from pre-pandemic financial and real eocnomy conditions to "what comes next"

At the center of this transformation is the decoupling of the American, European and Japanese economies from China. This shift is altering the flow of trade and investment across the global economy.

In the early phases of this decoupling, as the global economy is in now, the redirected flow of goods will initially lead to a period of economic stagnation and diminished liquidity. Policymakers will have narrower fiscal and monetary space in which to respond to these shocks.

Whatever policies are adopted will require a bias toward price stability and higher interest rates as the economy emerges from pandemic-era disruptions.

A break from the past

Globalization, growth and liquidity to significantly change

Consumers, businesses and investors will understandably feel uncertainty. While trends like digital transformation that characterized the global economy over the past three decades will endure, many other dynamics that shape growth, like trade and investment, will be different.

The changes in those conditions will require different managerial and technological skills to navigate.

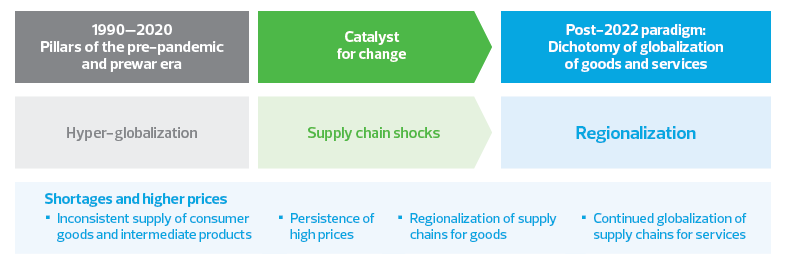

From hyper-globalization to regionalization

Adapting to the increased risk of breakdowns of supply chains for goods

How regionalization plays out

The decoupling of the American, European and Japanese economies from China is resulting in bifurcation of trade relations into two tracks: the goods economy and the services economy, with technology at the center of it all.

The goods track: On the first track—goods—trade, capital and technology flows are being heavily influenced by security concerns among G-7 nations as they embrace the return of industrial policy.

Consider the recent restrictions on transfers of technology, including sophisticated microchips, placed by the United States on China. A primary goal of these restrictions is to nurture nationally important industries and to protect a manufacturing labor base.

Some businesses will come out as winners in this new landscape. But for consumers, these policies will result in generally higher prices as firms shift from low-cost manufacturing centers in China.

This, in plain English, is what Treasury Secretary Janet Yellen means when she says American firms and their major trading partners should consider “friendshoring,” or relocating production to countries that fall within the U.S. economic sphere of influence.

Such a shift will almost certainly result in more North American investment by foreign firms that want access to wealthy U.S. consumers. It will also result in more investment in places like India and Vietnam for American firms that want access to the dynamic Asian economic region.

Apple’s recent announcement that it would begin sourcing sophisticated chips from North America is the signal that many global firms have been waiting for to begin reducing their exposure to China.

The services track: On the second track—services— policymakers are taking a different approach. For the most part, the service sector will continue with fewer trade restrictions, just as it has over the past three decades. If anything, that approach will accelerate.

Scott Lincicome at the Cato Institute finds that even as the global trade of goods peaked before the financial crisis, the digitization of services has enabled increased global trade of services.

Digital globalization offers tremendous potential for rural communities, health care, small businesses, manufacturing and especially entertainment, all of which benefit from greater access to international markets as broadband proliferates.

It is natural for economies to help push this along as they move from providing basic goods to meeting the increased demand for services that results when incomes rise and consumer choice expands.

In short, it is natural that firms and households will want to move up the value chain as the global digital transformation of commerce advances.

This trend is happening in advanced economies all over the world, wherever internet access is commonplace. Expect it to become the norm in developing economies as well. In the meantime, we are nowhere near the end of identifying all the implications of digital trade or managing its governance.

The competition for geopolitical security for the most part will not alter the digital transformation of the service sector. The ideas behind that evolution are fungible, easily transferable and not amenable to trade restrictions.

It is far easier to put constraints on the transfer of existing or older technology, as well as physical goods, than it is to stop the movement of ideas. Recall how quickly the American nuclear monopoly melted after 1945.

But there will be constraints outside of those economies that remain on good terms with Washington, Brussels, London and Tokyo. For this reason, the flow of capital is also going to be constrained.

Stagnating growth

When an economy experiences a series of shocks, it often ends up with less capacity to produce as firms exit existing patterns of production and investment shifts to more profitable and/or less risky areas of the economy.

The post-pandemic era will be no different, and we expect stagnant growth over the next 24 to 36 months.

Growth in the U.S. economy is a function of productivity and labor force expansion. During the past decade, annual economic growth overall was generally 2%, driven by growth of roughly 1.5% in productivity and 0.5% in the size of the labor force.

The American labor force grew by an average of 1% annually during the postwar period. That increase was as reliable as the sun rising in the morning and setting in the evening. Today that is not the case, and labor force growth has settled in below the recent 0.5% trend.

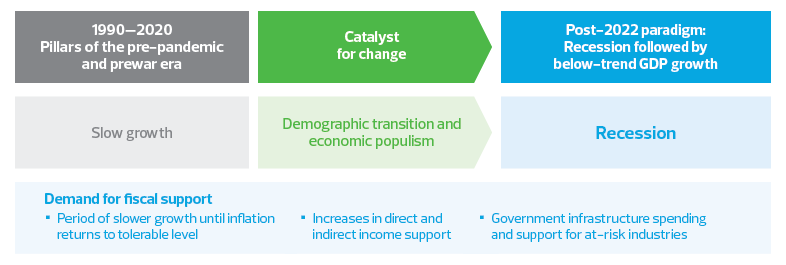

From slow growth to picking winners and losers

Adapting to the increased risk of just getting by

Now, when rising costs driven by the shift of production away from China are added to this slowing productivity and labor force growth, the result will be a slower overall pace of growth.

Today, the growth of the labor supply is not sufficient to meet demand. Baby boomers are retiring, immigration has slowed and the pandemic is still taking a toll on labor force participation. For this reason, trend growth is likely to decline to between 1% and 1.5% in the near term, following what we expect to be a recession during the second half of next year.

In addition, as inflation continues to act as a dead weight on real income growth, there will be calls for government assistance during the coming economic downturn.

That is just one factor that will lead to greater competition for scarce capital, which will in turn drive interest rates higher and restrain growth.

The end of easy money

Contributing to this stagnating growth will be the end of historically low interest rates. The era of ultra-accommodative policy on the part of the major central banks, except for Japan, will result in a net reduction of liquidity within the American and global economies.

Rising policy rates and the reduced size of balance sheets will cause interest rates to rise along the longer end of the investment curve.

This will result in an increase in the cost of issuing debt for public and private actors. The cost of financing economic expansion—be it for a large, publicly held firm, for a private midsize firm or through government-issued debt—will become more expensive.

From monetary accommodation to increased financial risk

Adapting to growing unwillingness to borrow or to lend

As those interest rates rise and tighter financial conditions ensue, firms that have lived off nominal zero-interest rates and negative real rates will face substantial rollover risk.

Risks around the commercial real estate sector will grow, and firms that inhabit slower-growing portions of the economy or have exposure to higher material costs will face greater challenges over the next several years.

While that will provide opportunity for the private equity and merger-and-acquisition communities, it will nevertheless entail substantial transition costs in terms of servicing debt, loss of employment and a slower overall pace of growth.

It is useful to remember what drives rates higher over the medium term. Interest rates are determined by expectations for inflation, the response to that inflation by monetary authorities and the risk of holding a security until maturity.

Interest rates tend to move lower during periods of disinflation and higher during periods of inflation as the central bank pushes the overnight policy rate higher.

Another component, known as the term premium, includes the risk of inflation moving higher or lower than expectations. For instance, if inflation were to exceed expectations, then the Fed would be required to push short-term rates higher, causing a bond market sell-off that would reduce the value of holding that security.

As the nature and composition of globalization change and as growth slows, a shift in structure is occurring within the real economy and the financial markets.

We anticipate that economic growth will slip into a recession next year because of the monetary tightening, ongoing geopolitical tensions in Europe and Asia, and households reducing their spending.

Once the economy emerges from recession, we expect it to be characterized by stagnation, with annual growth ranging between 1% and 1.5%, a notch below the pre-pandemic rate of 1.8%.

Why are we focused on the long-term growth trend within the context of an increasing liquidity constraint?

Recall that short-term bond yields are directly affected by monetary policy, with two-year bond yields representing the present value of expectations for short-term money market rates over the course of two years.

But yields on long-term bonds—while still affected by changes in the policy rate, as we’ve seen lately—are more likely to include perceptions of economic growth and the real return on investment.

As those growth expectations reset lower, firms will be tempted to hold back on critical productivity-enhancing investments, which feeds back into the post-globalization transition and its rising cost structure.

Because of economic uncertainty, the risk premium for issuing government and corporate debt is rising. At present, lenders are requiring increased compensation from borrowers to cover the risk of recession and diminished demand, with the yield spread between investment-grade corporate debt rising above two percentage points. Riskier high-yield debt is now requiring four to five additional percentage points of compensation.

As both the American and global economies adjust to higher input costs and risk around purchasing debt as inflation remains elevated, both the policy rate set by central banks and longer-term interest rates determined by the private sector will reset higher.

In the end, the result is a higher cost of doing business for all firms.

The takeaway

Starting with the collapse of the Long-Term Capital Management hedge fund in 1998, through 9/11, the 2007—09 financial crisis, and into the pandemic, the primary policy response to those shocks has been ever-lower interest rates. At the time, that monetary policy was seen as unorthodox and sought to stimulate growth in the context of insufficient aggregate demand.

That era has likely ended. We have entered a period of insufficient aggregate supply, persistent supply shocks, higher inflation, higher interest rates and slow growth.

The onset of the pandemic and the economic forces that were unleashed have resulted in a structural shift that is transforming globalization, growth and liquidity.

That regime change in those three areas of economic and commercial life will result in a higher cost of issuing debt to finance economic expansion and meet social obligations.

Perhaps the geopolitical tensions between China and the developed economies led by the United States will abate, and the conditions that characterized the hyper-globalization of 1990 to 2020 will return.

I am not holding my breath.