The $1.2 trillion Infrastructure Investment and Jobs Act signed into law by President Biden will increase productivity, reduce business costs, cut carbon emissions, improve living standards and have the potential to lift economic growth above the current long-run rate of 1.8%.

Once one accounts for spending at the state and local level, infrastructure spending will reach nearly $3 trillion over the next eight years. This represents the most significant modernization of the nation’s infrastructure since the middle of the 20th century.

There are near-term macroeconomic benefits to infrastructure investment—the multiplier effect with real interest rates being negative is likely larger than the 1.25 per dollar spent on traditional hard infrastructure. But the most encouraging benefit of the initiatives will take place over the long run as they bring a payoff to both productivity and growth that will be greater than our estimate suggests.

While most ignore productivity in the near term, in the long run, it is everything. The dynamism and vitality of the domestic economy depend upon it.

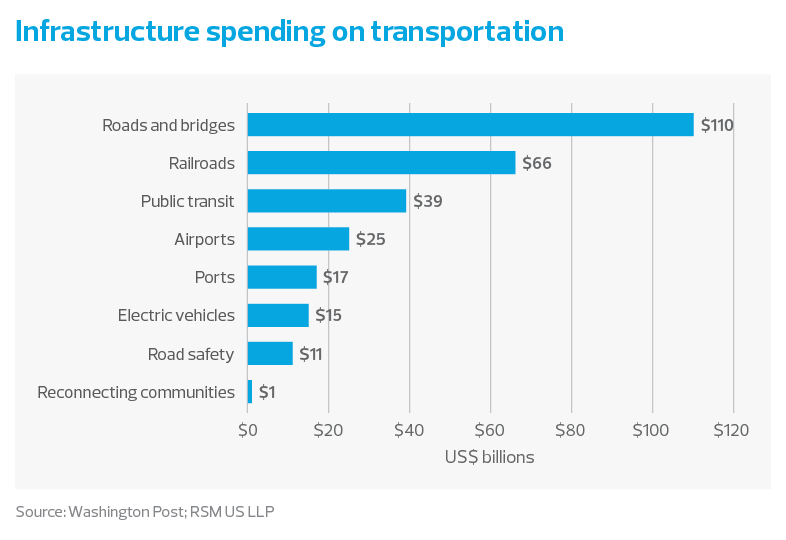

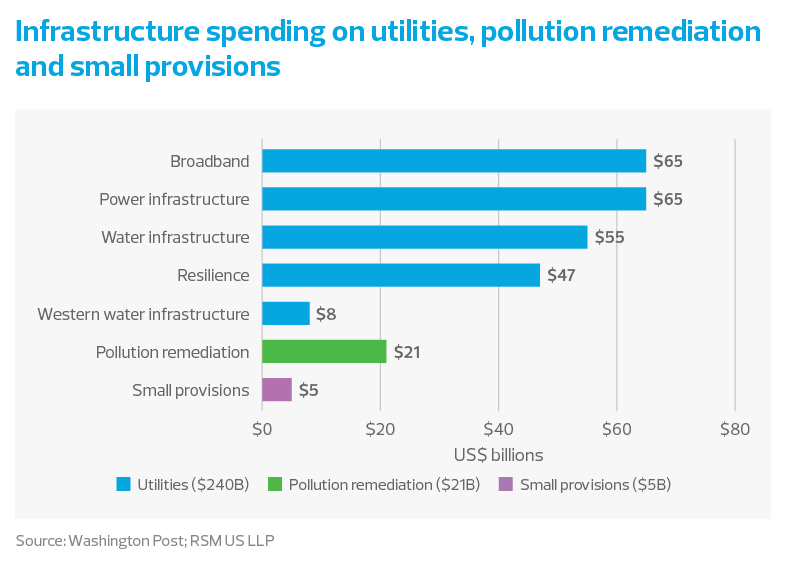

The long-run benefits make this infrastructure package distinct from almost all other fiscal policies in recent years. Spending on broadband, roads, bridges, power and water systems, and public transit will receive the largest boost.