TOP CONCERNS AND BENEFITS

The issues and policy actions that generated the most concern over the past 12 months included:

- Lack of skilled workers (55%)

- Tariffs on imported goods (40%)

- Retaliatory tariffs on exported goods (26%)

The policy actions that benefited their businesses the most over the past 12 months included:

- The 2017 Tax Cuts and Jobs Act (44%)

- Federal regulatory changes (22%)

While the impact of the federal tax cuts in 2017 received similar ratings among both larger and smaller middle market organizations, larger companies were more likely than smaller ones to report that they benefited from other policy actions. For example, 32% of companies with annual revenues between $50 million to $1 billion reported gains from the easing of federal regulations, while that rate was 14% in companies with annual revenues from $10 million to $50 million. When the questions focused on the next 12 months, the survey reported similar sentiment.

GREATEST OPPORTUNITIES

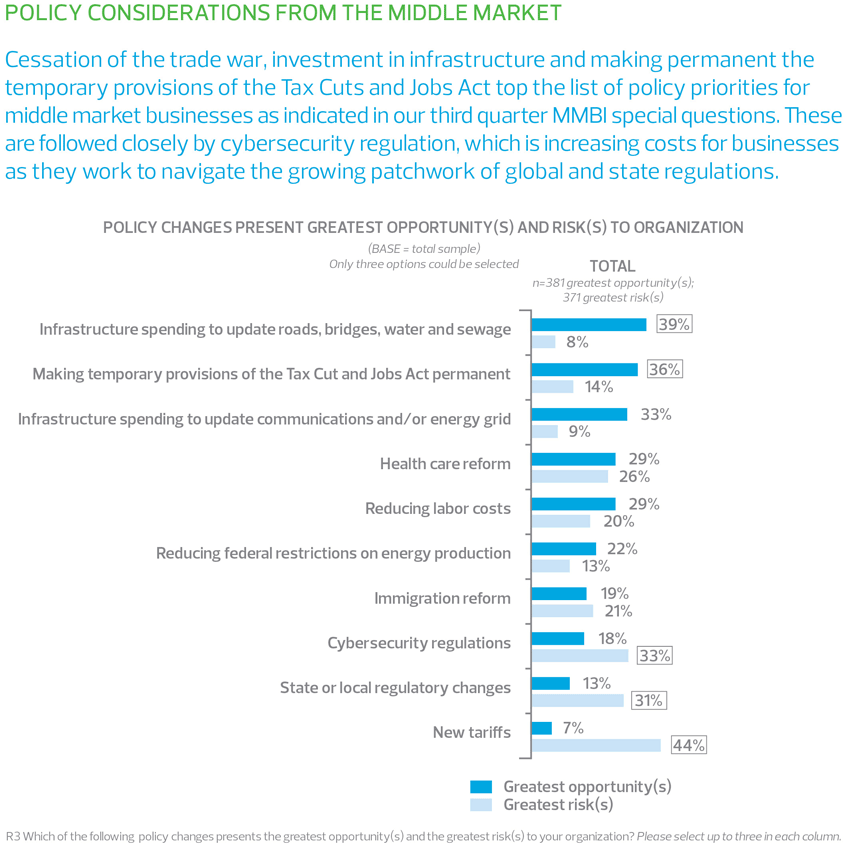

The survey found a range of opinions when executives were asked what they saw as the areas of greatest opportunity:

- Infrastructure spending to update roads, bridges, water and sewage systems (39%)

- Infrastructure spending to update communications and the energy grid (33%)

- Making the 2017 Tax Cuts and Jobs Act permanent (33%)

“While middle market leaders have many areas of concern, there are a few bright spots,” said Sara Webber Laczo, principal and corporate communications leader for RSM. “Infrastructure has been a top policy consideration for the middle market since January 2017. Businesses not only see opportunities to increase the efficiency of their operations through infrastructure improvements, but also want to participate in rebuilding our country.”

There was a similar range of opinions when asked about threats to their business:

- New tariffs (44%)

- State or local regulatory changes (31%)

- Cybersecurity regulations (33%)

- Health care reform (26%)

- Immigration reform (21%)

Perhaps because of these concerns, 38% of middle market executives reported an increase in the level of interaction they have had with state policymakers or political representatives over the past 12 months. And about a third reported an increase in their level of interaction with local and federal government representatives (34% and 29%, respectively).

Overall, sentiment about the economy eased in the third quarter, as the Middle Market Business Index declined, to 129.4, down from 132.3 in the third quarter, and below the recent peak of 136.7 in the first quarter of 2018. The decline is in line directional declines in the expected growth of revenues, capital investments and hiring.