U.S. middle market firms continue to signal growing confidence in the relaunch of the American economy, according to the May survey of the RSM US Middle Market Business Index.

The proprietary survey of senior executives at middle market businesses pointed to an acceleration of economic activity over the next six months as firms, buoyed by rising net earnings and revenues, are poised to increase hiring and compensation even as concerns about rising prices grow.

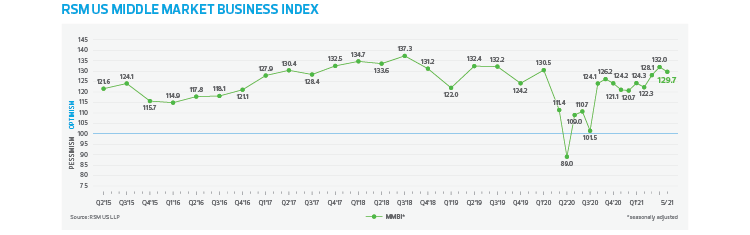

While the index eased to 129.7 in May from 132 in April and is off its peak of 137.3 in 2018, it remains quite strong despite the ebb and flow of the economy’s gradual reopening.

For the first time since the onset of the pandemic, a majority, or 52%, of the senior executives of middle market businesses told RSM that the economy is improving, and 67% anticipate it will do so for the rest of the year.

The brightened view comes as the economy nears a complete reopening. According to Moody’s back-to-normal index produced in association with CNN, roughly 91% of the economy has reopened. We expect that the second quarter of this year will mark the point at which the economic recovery turns to expansion, and the forward-looking readings in the RSM index underscore that outlook.

Although only 47% and 45% of participants noted an improvement in gross revenues and net earnings, respectively, 72% and 63% of respondents signaled that they expect a surge in both over the next six months. This reading, which has been broadly consistent in recent months, underscores our outlook that the economy will continue to boom throughout the year—RSM US forecasts 7.5% growth for 2021—and supports the optimistic outlook on hiring and compensation implied by the survey.

That forward-looking data indicates that 69% of executives intend to increase compensation to support hiring and retention, as well as the 61% who are signaling an acceleration in hiring over the next six months.

Just as important, those revenues and earnings will support an expansion of capital expenditures that are key to increasing productivity and will be paramount for middle market businesses in the hypercompetitive post-pandemic economy.

Our data implies that 53% of executives intend to increase capital expenditures over the next six months, down from 62% in April. Given that the pandemic average on the current reading stands at 33%, there is almost surely going to be a significant release of pent-up demand in investment around software, equipment and intellectual property that will bolster competitiveness.

The risks around the middle market business outlook, like those of the broader American economy, are linked to supply chain constraints that have sent the prices of goods used at earlier stages of production, intermediate goods, software and personnel higher as demand has outpaced supply.

At this point, rising prices are largely confined to a segmented cluster of the economy that lay primarily within the manufacturing and residential investment ecosystems. There is modest spillover into the remainder of the economy as prices have bounced off pandemic lows. But as demand for services rebounds, it will certainly outstrip supply temporarily, and that will most likely cause service prices to jump.

Roughly 80% of executives indicated that they paid higher prices during the month and 82% expect to do so over the next six months. But only 47% implied that they passed along those higher prices in May, which is up modestly from the 44% who reported they did so in April.

Those readings are in line with those of recent years when inflation remained below 2%, so there is not yet a clear and convincing signal that the recent bout of price volatility will turn into sustained inflation.

Still, 72% say they intend to charge higher prices over the next six months; so without a doubt, this is going to be the risk around the middle market and American economic outlook this year and next. Stay tuned, because price volatility is almost surely going to get worse before it gets better.

Finally, middle market firms continue to manage their inventories carefully, with 32% of respondents reporting an improvement in May, which is slightly below the three-month average of 34%, and 49% expecting an improvement over the next six months.

If middle market firms are truly concerned about a sustained issue with inflation, one would expect large jumps in inventory procurement to avoid the type of price volatility that has been in view within the residential investment ecosystem over the past few months.